Remember that old saying—you can’t avoid death and taxes? It still rings true about death, but not so much about taxes. Investigative journalists are revealing how multinational companies have avoided paying billions in taxes in Europe. This is relevant to us because of India’s Rs 14,200 crore tax demand from Vodafone. The heart of the raging European controversy is, unlike tax evasion, tax avoidance is legal. But it is unethical. It is the injustice of employees paying 20 per cent in taxes while some MNCs pay 2 per cent. It is the immorality of cash-strapped governments imposing austerity and slashing public spending because companies and individuals legally avoid taxes by dumping an estimated $21 trillion in profits in tax havens. Tax crusaders say if these firms are immoral to take advantage of tax loopholes, then politicians are surely immoral for creating the loopholes in the first place.

Governments don’t call them loopholes; they call them tax incentives. That is fine when you want to attract investment in a difficult sector or region, especially in the start-up phase. But in mature industries in mature markets, this is unnecessary and usually the reward for lobbying. Confederation of British Industry’s John Cridland says: “Where transactions are designed for no commercial purpose at all, other than to avoid tax, then we cannot condone it, even if it is legal.”

Google's Eric Schmidt disagrees. “It’s called capitalism,” he says. No, it is not. “It’s unlawful state aid,” says the European Commission, which gave this verdict in the infamous Luxembourg sweetheart tax deals.

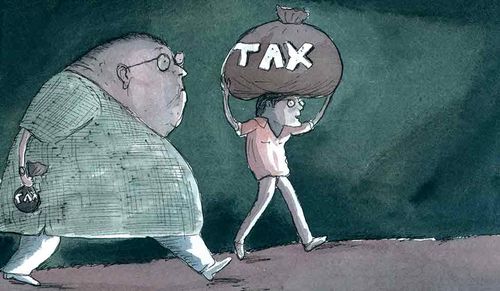

Reducing tax liabilities to boost profits is a fine example of shareholder capitalism. But companies, too, are part of the ecosystem with societal obligations to create wealth, jobs and revenue to fund public investments in infrastructure, health and education. Tax havens and low taxes for MNCs violate the concept of level playing field, an intrinsic ethic in true capitalism, which, in fact, thrives on the success of small and medium enterprises. British opposition leader Jeremy Corbyn asked, “Why is there one rule for big multinationals and another for small businesses and self-employed workers?”

Illustration: Bhaskaran

Illustration: Bhaskaran

Britain is the shore hit by this “tsunami of scandalous cases of MNCs failing to pay taxes”, as tax activist Tove Ryding calls it. Google reportedly avoided paying £2 billion in global taxes last year by parking £30 billion profits in British-territory Bermuda, which has zero corporate taxes. Its recent deal to pay £130 million in taxes to the UK government has been attacked as opaque and secretive. “It's pocket change for Google,” laments whistleblower and former Google employee Barney Jones.

GE, Boeing, DuPont all pay very low or no taxes in the US, thus contributing to America’s massive $1.1 trillion budget deficit. French economist Thomas Piketty reveals America had a 91 per cent tax rate for those earning more than $1 million during 1940-1960. These astronomical taxes did not undermine America’s strong post-war economic growth. But since the Reagan era, raising corporate taxes is taboo due to the power of the lobbies. Voters are fed up with “rigged capitalism” and this explains “socialist” Bernie Sanders’s unexpected popularity.

It’s easy to demonise corporates and politicians, but there are heroes to lionise in this unfolding saga. There is Jones who prioritised his conscience over his paymaster. There is EU’s Competition Commissioner Margrethe Vestager, who took on American Google, Russian Gazprom and her own Danish telecoms. Her actions are rooted in “fairness”, an ideal inherited from her parents, both of whom are Lutheran priests. She is a deadly combination of acid wit, fearless determination and steely nerve. Warns European Finance Commissioner Pierre Moscovici, “The days are numbered for companies that avoid paying tax at the expense of others.” Thanks to these heroes, that old saying about death and taxes just may continue to ring true.