For a long time, Dhanada Devdhar’s savings had mostly been bank deposits. Averse to any kind of financial adventures, the 56-year-old from Nashik refused to consider suggestions from friends to try other investment avenues. That was until she learnt how easily she could invest in mutual funds via systematic investment plans. It spared her the headache of following the equity markets regularly, but gave the benefit of the market’s rapid growth.

Million of Indians seem to have had a change of mind like Devdhar did, and, as a result, the mutual fund industry in India is having a dream run. In the past two financial years, mutual funds saw total inflows of around Rs 1,40,000 crore. While their penetration in India still remains low, compared with many developed markets, it is no longer a big city phenomenon.

It was in September 2012 that the Securities and Exchange Board of India initiated steps to increase the penetration of mutual funds and energise the distribution network. After a series of meetings by SEBI officials with industry stakeholders, the market regulator announced several measures, which included an additional total expense ratio (TER) of 0.30 per cent on daily net assets of a scheme if new inflows from beyond top 15 (B15) cities constituted at least 30 per cent of the gross new inflows or 15 per cent of the average assets under management of the scheme. This meant fund houses could pay higher fees to distributors on inflows coming from small towns, which gave a higher incentive for agents to sell mutual funds in small towns.

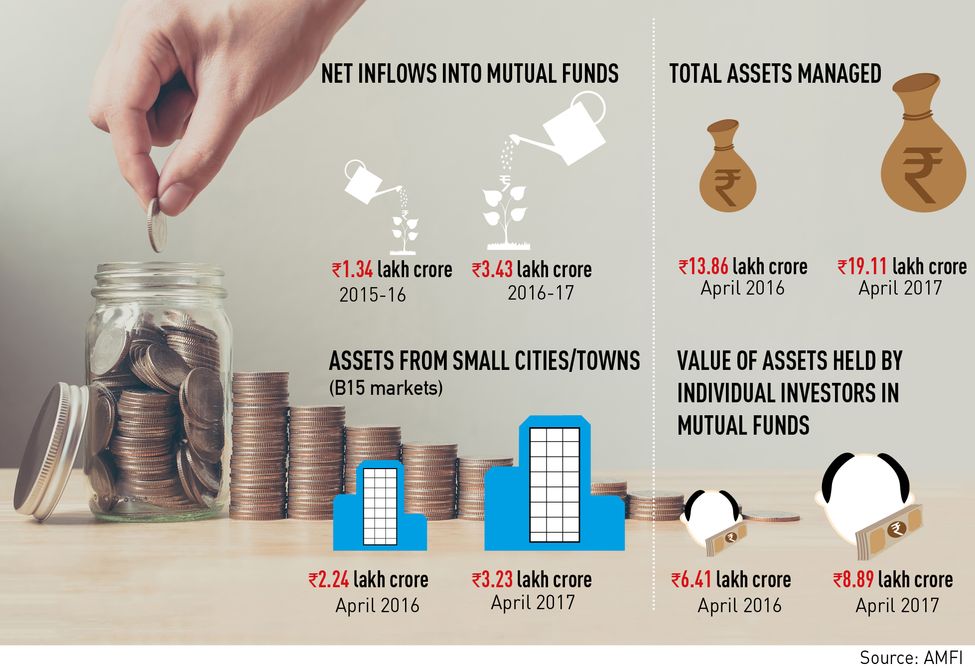

Despite this, however, many considered it a Herculean task, given that most people in these towns had limited or no knowledge about investing in equity markets or mutual funds and were generally risk averse. In 2012, the top 15 (T15) cities accounted for about 90 per cent of the total mutual fund industry assets under management, with the metro cities alone accounting for almost 75 per cent. Last financial year, 17 per cent of the assets of the mutual fund industry came from B15 locations. As of April 2017, assets from B15 markets rose to Rs 3.23 lakh crore, from Rs 2.24 lakh crore a year ago. The total assets from B15 markets surged 44 per cent during the period, as against the industry growth rate of 38 per cent.

Helped by the strong growth, total assets under management of the mutual fund industry topped Rs 19.11 lakh crore for the year ended on March 31, 2017. Net inflows more than doubled year-on-year to Rs 3.43 lakh crore from Rs 1.34 lakh crore in the previous fiscal. More than 67 lakh new mutual fund folios were added last year, taking the total tally to around 5.44 crore at the end of February. It was 4.77 crore at the end of March 2016.

Dhanada Devdhar, 56, refused to consider suggestions from friends to try investment avenues other than bank deposits. That was until she learnt how easily she could invest in mutual funds.

Dhanada Devdhar, 56, refused to consider suggestions from friends to try investment avenues other than bank deposits. That was until she learnt how easily she could invest in mutual funds.

“SEBI’s efforts in terms of increased payouts to distributors for investments from B15 towns, as well as investor awareness programmes by mutual fund houses have driven sustained organic growth for fund houses from the small towns,” said Srikanth Meenakshi, co-founder and COO of Fundsindia.com, a mutual funds investment platform. A strong bull run witnessed by equity markets over the past 18 months and the falling interest rates on bank deposits and small saving instruments have also contributed, he added.

Till January 2000, investors were paid 12 per cent interest on their public provident fund (PPF) investments. Since then, however, interest rates have been reduced and for the current financial year, it has been set at 7.9 per cent. Bank fixed deposits, too, have come down from around 10 per cent a few years ago to around 6.5-7.5 per cent. Kisan Vikas Patra’s interest rate currently stands at 7.6 per cent.

In comparison, large equity funds have been giving average returns of 15 per cent over the past three years. For the risk-averse and those investing in equity markets for the first time, fund offerings like monthly income plans, where only a small portion of about 20 per cent is invested in equity and the rest is in debt funds, returns have been around 11 per cent last year. “There has been this huge shift in interest rates. Even tax-free bonds are now at 6-6.5 per cent only. This has made mutual funds attractive,” said Aashish Somaiyaa, managing director and CEO of Motilal Oswal Asset Management Company.

The rise in mutual fund investments should also be looked at in the light of the lacklustre returns from other asset classes. Gold prices have been flat over the last one year. India’s gold imports declined 24 per cent between April 2016 and February 2017, thanks to the reduced appetite of investors.

Also, according to some fund managers, after the demonetisation of Rs 500 and 1,000 currency notes, the shift towards financial instruments from physical investments has only sped up.

The Association of Mutual Funds of India has been taking initiatives to boost mutual fund penetration. In 2013, AMFI launched the District Adoption Programme (DAP), under which fund houses were asked to adopt districts across the country where they would push mutual funds through financial literacy and investor education programmes. Thirty of the 44 mutual fund houses in the country have adopted some 200 districts under the DAP so far, and thousands of investor awareness and education programmes are being conducted by mutual fund houses each year.

“On an average, we are conducting 1,200 events each year,” said said A. Balasubramanian, CEO, Birla Sun Life AMC and chairman of AMFI. “We tie up with local media in these markets, while also looking to connect with youngsters through university tie-ups.”

Fund houses are expanding not only their branch networks, but also the reach and focus of their branches to cover more towns. “There is a lack of penetration in small towns, and so fund houses are trying to reach out aggressively. These investors typically invested in bank deposits and with interest rates falling, there is a rising interest to invest in fixed income funds. Also, our growth across equity fund assets under management in B15 markets is ahead of the T15 markets,” said Balasubramanian.

Motilal Oswal’s growth in the smaller markets is also ahead of that in the top cities, said Somaiyaa. B15 markets now contribute around 25 per cent of its total assets under management.