As he prepares to present the Union budget on February 1, Finance Minister Arun Jaitley finds himself in a spot similar to the one President Pranab Mukherjee was in in 2009. As finance minister in the UPA government, Mukherjee had to prop up an economy battered by global recession. The Lok Sabha elections were three months away and, if the Congress had to win, there was a lot of image building to be done. Mukherjee, through a fiscal stimulus package to revive the economy, did just that. Jaitley, who needs to assuage a country reeling under demonetisation, need look no further than the 2009 budget for inspiration.

Demonetisation has not only inconvenienced the public, but also brought India’s informal economy to a standstill. “More than the middle class, it has affected people at the bottom of the pyramid,” said Ashvin Parekh, founder of Ashvin Parekh Advisory Services. “Scarcity of cash has meant that small farmers, labourers and construction workers are not getting their payouts. They have also lost jobs. Only about 5 per cent people in India transact digitally and less than half the population uses the banking system for monetary transactions. In a demonetised world, these people have been left high and dry.”

Recently, former prime minister Manmohan Singh said: “Employment will fall, growth in agriculture, industry and services will fall. Production, especially in the informal sector, which accounts for 45 per cent of national income, will fall.”

Spending, which constitutes about 56 per cent of India’s gross domestic product, has been severely affected. As there has been a slowdown in demand, factories are reducing production cycles and even shutting down production in some cases.

Jaitley will have to revive this demand with a slew of pro-poor measures in the budget. “This is going to be more of a political budget than an economic one,” said Pronab Sen, former chief statistician of the Union government. “The finance minister has to give an impression that he is concerned about the effects of demonetisation.”

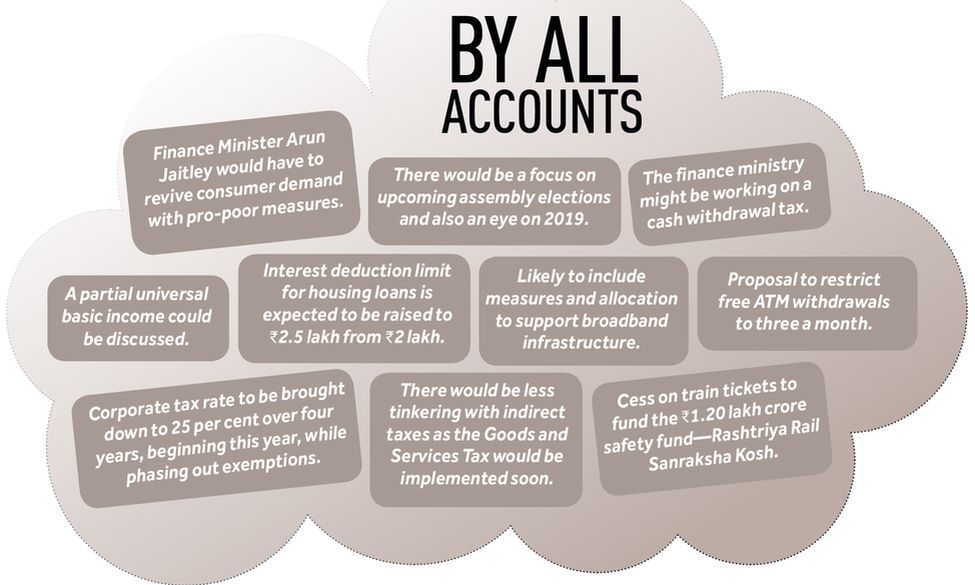

Universal basic income (UBI) could be one such move, said experts. It is essentially a monthly fixed amount that would be transferred to every individual’s bank account. “They can probably think of doing a limited version of UBI,” said Sen. “The government does not have the resources to implement this scheme universally. Whatever it is, UBI is surely going to be discussed in the economic survey this year.”

Economist Sunil Sinha, from India Ratings, said the government might already be running a UBI, even if in a limited way. “Take, for example, the LPG subsidy or the kerosene subsidy, which gets transferred directly to beneficiaries,” he said. “Or the latest move to transfer 06,000 to the accounts of pregnant women.”

Sinha said spending on social sector schemes would assuage the pains of demonetisation, and Prime Minister Narendra Modi, during his New Year’s speech, had announced some schemes targeted at rural and low-income population, and micro, small and medium enterprises. Moreover, it is expected that the government might increase the interest deduction limit from Rs 2 lakh to Rs 2.5 lakh in housing loans. Making home loans attractive will also give a fillip to the bleeding realty sector.

The budget is also significant vis-a-vis information regarding the gains of demonetisation, including how much black money was unearthed, who are the tax evaders, how many new taxpayers have been brought into the system, and what the government is going to do with this new revenue.

Apart from demonetisation, the budget would also focus on the upcoming assembly elections. If the BJP wins in Uttar Pradesh, it would sell the victory as a thumbs up to Modi’s governance. A win there would mean more Rajya Sabha seats and more leeway for the NDA government to rule the way it wants, legislatively speaking.

Though the model code of conduct bars the government from doling out freebies in the budget to election-bound states, some goodies could be slipped through as part of a generic demonetisation antidote.

Jaitley’s budget would also have an eye on the 2019 Lok Sabha elections. As the impact of a lot of projects, especially in the infrastructure sector, is visible only after a while, it might be the right time to announce some of these projects.

There would also be less tinkering with indirect taxes as the Goods and Services Tax would be implemented from July 1, as Jaitley has said. “Whatever changes they [finance ministry officials] bring are going to be short-lived because of GST,” said Rajat Mohan, director, indirect tax at Nangia & Co. “We think there might be an increase in the service tax rates as they would like to bring it to 18 per cent. They might also do away with some exemptions and give some tax incentives for digital transactions.”

Relaxation in personal income tax rates is widely expected, as leaving more money in the hands of taxpayers would revive consumer spending.

“Tax slabs were last changed in financial year 2014-15, almost three years back,” said Sonu Iyer, partner, tax and regulatory services at Ernst & Young. “With an eye on elections, this might be the right time to bring down income tax rates. It is expected that income up to Rs 4 lakh might be made tax-free. The 10 per cent slab could apply on income between Rs 4 lakh and Rs 10 lakh and so on.” Recently, Jaitley had himself said that a lower level of taxation was key to building a globally competitive economy.

Said Rahul Jain, partner, direct tax at Nangia & Co: “The finance minister might increase the limit of deduction under Section 80C of the Income-Tax Act, 1961 from Rs 1.5 lakh to Rs 3 lakh. This will give an impetus to household savings and divert it into growth avenues such as insurance, equity and retirement funds. It will help in deficit financing in the long term.”

The budget is also expected to include regulations about cashless transactions, which the government has been promoting. The information technology ministry, the finance ministry and NITI Aayog have been working to promote digital payments under the Digi Dhan Vyapar Yojana. According to latest Reserve Bank of India data, the volume of credit/debit card usage went up from 20.5 crore in November to 31.1 crore in December. The corresponding increase in value was from Rs 35,240 crore to Rs 52,220 crore.

One of the major hindrances to Modi’s cashless dream is the lack of broadband infrastructure, and the budget is likely to include measures and allocation to support this.

The other problem with digital payments is transaction charges. “When people were dealing in cash, the cost of printing and transporting it was being borne by the government,” said a member who is on the finance ministry’s committee on digital payments. “So, the issue is why the merchant should pay now. The government will have to subsidise the transaction charges by either creating a corpus or announcing tax relief for the merchants.”

Also, to discourage the use of cash, the finance ministry might be working on a cash withdrawal tax, said a banker who attended the pre-budget consultations. This means that cash withdrawals beyond a certain threshold limit would be taxed. There is also a proposal to restrict free ATM withdrawals to three a month.

The government has also announced the roadmap to bring down corporate tax rate to 25 per cent over four years, beginning this year, while phasing out exemptions.

The big question mark on all these measures, however, is the amount of resources Jaitley has to implement these schemes. Experts said there was not a lot of fiscal bandwidth for the finance minister to announce heavy-duty spending. This year’s fiscal deficit target of 3.5 per cent will be met because of additional tax resources from the income disclosure scheme and black money seizures. What is worrying is next year’s target. “They will not be able to carry out the envisaged spending unless they relax next year’s target,” said Sinha. “We have revised GDP growth target downwards from 7.8 per cent to 6.8 per cent for this year. Slowdown in growth will also reflect in tax collections. On the other hand, expenditure will go up because the government will have to spend to soften the demonetisation blow.”

This year, for the first time, the rail budget will be presented along with the Union budget. Usually, populism trumps performance in the rail budget. This time, however, it could be different. Passenger fares are likely to go up as the railway ministry is thinking about imposing a cess on train tickets to fund the Rs 1.20 lakh crore safety fund—Rashtriya Rail Sanraksha Kosh.

At the halfway mark of his tenure, Modi seems to be focusing on welfare measures and has a lot of goodies for everyone. But, has he delivered the “achche din”? The fine print of this budget might provide some clues.