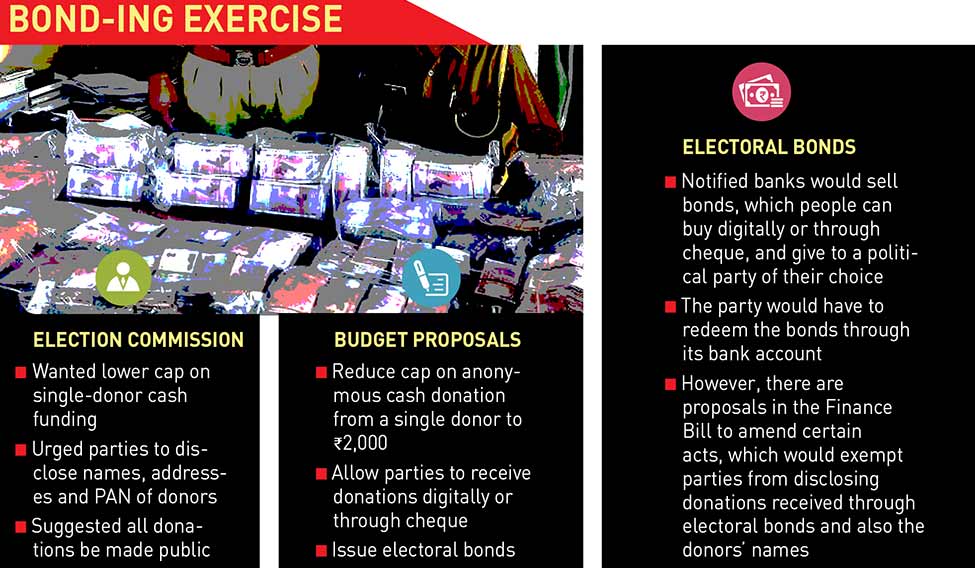

Last December, the Election Commission of India suggested greater transparency in donations to political parties. It said the cap on donation in cash by a single donor be reduced from 120,000; that parties be required to disclose the names, addresses and PAN of donors, and that all donations be made public.

On February 1, after Finance Minister Arun Jaitley finished his budget speech, BJP leaders were ecstatic. Their party had flagged an issue—anonymous donations in political funding—which no political party could do without felling the tree on which it was sitting.

“Prime Minister Narendra Modi has kept his 2014 promise of ending the menace of black money in political funding,” said BJP president Amit Shah. “The limit on cash donation to political parties is the beginning of a new era.”

After the initial euphoria, however, there was apprehension that, far from making the process transparent, Jaitley had made cash donations over Rs 2,000 altogether opaque the minute he proposed electoral bonds. His proposals had three elements. First, reduce anonymous cash donations from Rs 20,000 to Rs 2,000 per person. Second, allow political parties to receive donations digitally or by cheque. Third, issue electoral bonds.

The devil, however, lies in the detail. Once the government and the Reserve Bank of India thrash out the details, and the electoral bonds are on sale in the notified banks, anyone would be able to buy these digitally or through a cheque. They can then give the bonds to the political party of their choice. The party would have to redeem the bonds through its bank account.

However, while the funding will come through the banking channel, it would not be transparent. Clause 134 of the Finance Bill, 2017 proposes to amend the RBI Act 1934 in order to issue the electoral bonds and assign specified banks to sell them. By the same clause, it proposes to amend the Income Tax Act, 1961, to exclude donations received by the political parties through electoral bonds from being reported to the income tax department every year in order for them to avail of the tax exemption. And by Clause 136, the Finance Bill proposes to amend the Representation of the People Act, 1951, so that political parties will not be required to disclose the identity of individuals and companies who make donations through electoral bonds.

The Congress, said spokesperson Randeep Surjewala, would support any step that brings transparency to political funding. “But as of now, they have a long way to go,” he said. “These proposals, and the manner in which they have been raised will come up for discussion in Parliament. And there are three crucial acts that have to be amended.”

There are apprehensions that political parties would also sweet talk those who are likely to make big donations into opting for electoral bonds.

Jagdeep Chhokar, founder of Association for Democratic Reforms, inferred from Jaitley’s speech and his later interactions that the electoral bonds would be in the character of bearer bonds. “They will keep the identity of the donors anonymous,” he said. “It is known that more than 70 per cent of the funding comes from unknown sources. This will lead to creation of one more unknown source of funding.”

Jaitley, however, elaborated: “These bonds will be brought through cheque payments and will be encashed through banks. It will be clean money and transparent, as the buyer is known.”

Mainstream political parties have yet to react to this in detail, possibly because they, too, would like to let their large donors remain out of public viewing.

Associated Chambers of Commerce and Industry of India called electoral bonds an out-of-the-box idea, but conceded it did not make for transparency. “There is merit in the government contention about protecting the identity of the donors as their identification could lead to bigger problems,” said ASSOCHAM secretary general D.S. Rawat. “No industrial house would like to be identified for its donations to one political party or the other. This way, business houses could be trapped in political rivalry.”

Calling the electoral bond the “most regressive” idea of reform, Yogendra Yadav of the Swaraj Abhiyan remarked: “Arun Jaitley knows the art of political spin, that how you announce a scheme and get the media to respond in the first 24 hours is all that matters. Normally, these things should come as part of bill that can be debated and voted on in both the Lok Sabha and the Rajya Sabha. But now, it’s been brought through the back door [the Finance Bill is not voted on in the Rajya Sabha]. It reduces the scope of debating. Last year, they did it in the case of foreign funding.”

Said RTI activist Venkatesh Nayak: “The definition of the money bill is provided in the Constitution and is very clear. The amendments proposed to the RBI Act, the IT Act and the RP Act do not fall within this criterion. So, once again, the government is trying to bulldoze amendments to other laws through the Finance Bill.”

Former chief election commissioner T.S. Krishnamurthy told THE WEEK that, at best, the changes proposed in budget could have “a marginal impact and does not substantially make for transparency”. “Personally, I favour a national election fund with donors getting tax exemption, and state funding,” he said.

Many people do not see the cap on anonymous cash donation to 12,000 as a noteworthy reform. A senior chartered accountant who was part of a company that worked for the second United Progressive Alliance government remarked: “It is a no brainer that parties will only have to print more receipts, write out more names, trash them, and keep counterfoils.” That is, in fact, the general view on the subject.