Nishank Goyal's company, Masters India Private Ltd, did business in aluminium products. But, the Delhi-based entrepreneur realised a while ago that there would be huge potential in the implementation of Goods and Services Tax in July. So he rolled out the technology portfolio of his company to target the new GST wave. And, his company was picked as one of the 34 GST Suvidha Providers shortlisted by the Goods and Service Tax Network (GSTN).

GST Suvidha Providers help tax payers and businesses to transform smoothly towards a GST regime. “There was a technical evaluation, and we eventually got selected. Our technology arm has a team of 25 developers, tax experts and chartered accountants who helped us achieve this,” said Goyal.

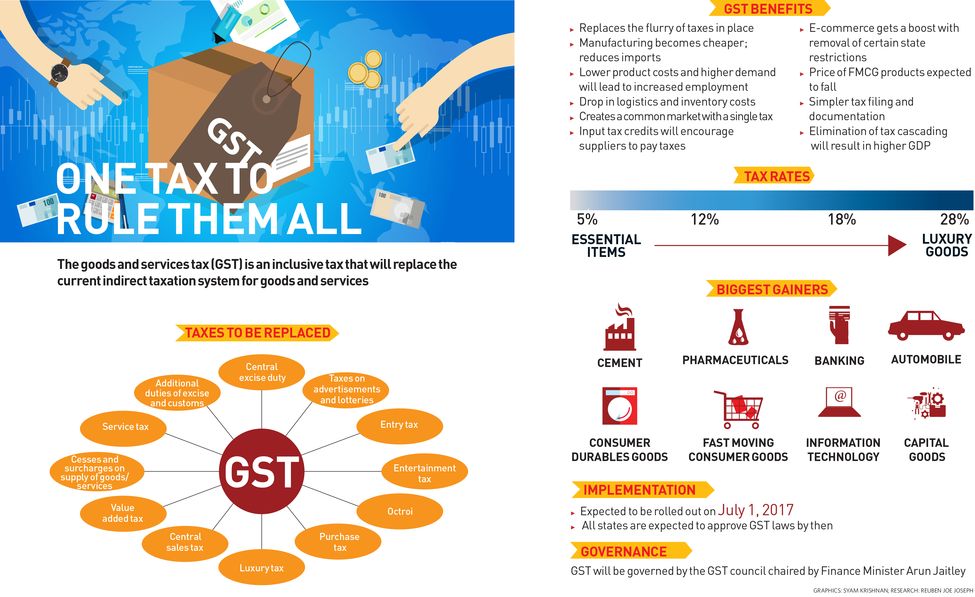

Apparently, everyone stands to benefit from GST. Businesses and consumers had been burdened in the current taxation regime with double taxation, complicated rules, and uncompetitive tax rates and structures. “Central and state governments have been unable to control leakages from the system, and the public has been troubled with higher prices on goods and services due to all this,” said Goyal.

GST is expected to set the economy on course for good growth. But, businesses need to be prepared to cope with the transition. “A robust solution will be required to manage GST compliance as the GST regime necessitates a high level of synchronisation between tax payer’s system, i.e. an ERP (Enterprise Resource Planning), an accounting or an invoicing software, and the GST system. Without automation it would be a difficult task,” said Goyal.

It is a demanding task, and lapses would upset the entire process. “If anything is amiss, business’s compliance rating will take a hit, and it will act as an indicator for buyers, lenders and insurers,” said Goyal. “Timely tax compliance will be critical for business success.”

Awareness will play a key role in the success of GST. Goyal's company has been publishing articles on everything related to GST, conducting weekly webinars, running campaigns, and creating online courses in multiple languages for small businesses, aspiring accountants and CAs. By virtue of being a GST Suvidha Provider (GSP), the company is providing GST APIs (application programming interfaces) so that businesses and application service providers (ASPs) can connect to GSTN servers and exchange tax information. The company has also created a self-registration portal, which has a sandbox (a virtual space in which untested software can be run securely) for testing GST APIs, a log of API calls for debugging and billing purposes, comprehensive support documentation to get started and support request panel.

Goyal's company also has a product called AutoTax, which makes GST compliance effortless. This system can integrate with a business’s existing ERPs and allow seamless flow of data between them and the government servers to enable up-to-date view of business tax status. The product will facilitate tax planning through analytics and will help tax planners to make decisions with data.

Many established players have also been upgrading their offerings to meet the GST requirements. Bengaluru-based Tally Solutions, for instance, has been enhancing its popular product Tally ERP 9 to provide GST compliance for all its customers and businesses. “This will involve the ability to record and maintain accurate GST invoices as required by law. We will also have a GSTN integrated capability which will allow users to upload their transactions as we are a GST Suvidha Provider,” said Tejas Goenka, executive director, Tally Solutions.

Tally is trying to design its product in such a way that it will enable businesses to manage the change in tax structure better. “In a normal day of work, business people need to deal with a situation where some invoices have been uploaded, some are pending for various reasons and need to be acted on. They would be able to see all their compliance work on a single screen that will not only give them a view, but also allow them to take necessary actions,” said Goenka.

GSTN will deal with tax payers in asynchronous manners. “This means that for every upload, the business will not get a confirmation right away, but a token of acknowledgment that the invoice return has been received and will be processed. Businesses would prefer to be posted on what happened to the upload rather than spending time on repeatedly checking the status of the upload,” he said.

An undesired outcome of GST would be small businesses getting pushed out. Goenka said the GST law stated that input tax credit would be available to a buyer only if the supplier had paid due tax to the government. This linkage will be detrimental to small businesses in the chain because if, for some reason (even if not intentional), the supplier is unable to pay the tax on time, the buyer will be treated as non-compliant and input tax credit will be denied to him. “Small businesses that operate on wafer-thin margins will be seriously impacted and, despite having paid tax on time, they will have to bear the brunt of their supplier’s non-compliance. This, along with the provision for a compliance rating, which will be made public, will slowly drive small businesses to closure.”

Goenka wanted the government and policymakers to take note of this issue and bring in necessary changes to the law so that GST can be implemented effectively and prove useful for all. “This is one major challenge which stands between us and a smooth transition to GST for all,” he said.

Financial startups are all set to play an important role in the transition to a GST regime. Clear Tax, a Bengaluru-based startup, for instance, has been helping companies understand the transition rules and get registered. It has launched a GST training module, which is followed by a certification and can be used to learn about GST by both CAs and staff of companies. “Our GST product can be used to complete all types of GST return filing. We also have filing features. The system stays on top of mismatches and creates reports for action, which can be assigned to teams. It also has capability to allow communication with the vendor from within the software. Our solution will be available on both web and mobile,” said Archit Gupta, CEO and founder of Clear Tax.

Mustafa Nadeem

Mustafa Nadeem

Clear Tax is using intelligent reporting and analysis to identify mismatches in time to help businesses make sure capital is not locked up. “Small traders may be facing heat due to non-usage of technology in bookkeeping and supply-chain management. We are trying to ensure through our solutions that such businesses migrate to a simple solution which can meet their basic invoicing and accounting need. Our solution is simple for accountants to use and follow. We also provide training for users and have an offering that helps small businesses evaluate if they should register and how they can migrate to a tech-based platform. Besides, we help businesses clear their doubts about how to manage closing stock, semi-finished goods, goods in transit at the time of transition to the new regime,” said Gupta.

The big fish have big plans for the big occasion. German software giant SAP is all set to make the best use of the opportunity. “India’s GST implementation is expected to bring the unorganised sector under a uniform tax base and improve growth opportunities for the organised sector,” Neeraj Athalye, head of GST adoption drive, SAP India.

He expects GST to unburden not only the common man but also the SMEs in the long run. “Implementation of GST will lead to 3-5 billion invoice uploads every month. SAP estimates that at least 40 per cent of these will pass through a SAP-enabled system. This gives our company a huge responsibility to not just help businesses get compliant with the new law, but also ensure that businesses benefit from the GST vision,” he said.

SAP has set up GST Solution Centres that engage with medium and small enterprises and showcase SAP’s solution portfolio for GST. It has 30 such centres in 13 cities and 10 partners to support six different industries. The company has also launched ‘GST in a Box’, a solution portfolio, to help organisations of all sizes and across industry verticals to become GST compliant.

Neeraj Athalye

Neeraj Athalye

The company has been running a drive across cities to evaluate and educate organisations that are preparing for their transition to the GST regime. Along with ASSOCHAM, SAP has also launched a knowledge sharing resource centre to educate organisations to manage changes in their business processes and information systems. It has also signed an MoU with Reliance Corporate IT Park to launch ‘SARAL GST’ solution for taxpayers. It has been organising webinars and customer forums to analyse customers’ current digital infrastructure and chart out a roadmap to transition to GST compliant IT systems.

“GST is not just a financial reform, but is also a catalyst for digital transformation of the nation,” said Athalye. “To help realise the true potential of this change, we are directing all our efforts towards strengthening the grassroots. Companies will require a strong technology backbone to sustain and succeed in the GST regime. We want to ensure that businesses, including SMEs, gain maximum benefits from this wave of digitisation.”

All these companies are trying to simplify the highly complicated GST process. “GST returns, specifically the GSTR 1 and GSTR 2, have very complex forms containing around 14 to 17 sections, including amendment to each section. In these returns multiple categories like B2B, Overall B2C transactions, including some 2.5 lakh inter-state, exports, debit or credit note details are to be populated in multiple separate sections. If anyone decides to upload the GST return data separately for each section, there are chances of errors as it involves huge manual intervention. We have digitised this process,” said Niraj Hutheesing, managing director of Cygnet Infotech, a service provider.

Tejas Goneka

Tejas Goneka

Despite these new offerings, overhauling or transforming an organisation for GST incurs a cost. And, it may take months to benefit from it. “From accounting systems to supply chain management, they all will certainly take time, and during this period of transition the organisations will try to ascertain the benefit that can be passed on,” said Mustafa Nadeem, CEO of Epic Research. “So, not in coming days, but, yes, may be in next six months, we may start seeing some benefits to be passed on in terms of pricing, which may further increase competition.”

Nadeem pointed out that GST would lead to influence of new pricing regime across markets and any competition in that would benefit end users. “End consumers are the ones who will have benefit of the same in the long run, maybe a year from now,” he said. “Traders are certainly going to benefit as they have to maintain various records that would service to state as well as Central government, increasing their cost and burden. Further simplification of the GST will enable them to furnish all documents at a lesser cost and lead to less burden. There will also be transitional challenges for businesses as they will have to revamp their accounting standards, supply chain management, finance, IT and logistics for GST. It will be a one-time cost for small businesses and traders, and we may start seeing the benefit to be passed on to the consumers in terms of better pricing and services.”