It was a financial emergency at home that made Vivek Sharma look for a short-term loan. Soon he realised it was not as easy as he thought it would be, with all the paperwork and some confusion over interest rate. Then he bumped into Shubh Loans, a fintech company which offered a smart credit model.

Shubh Loans, which is based in Bengaluru, helps salaried people get loans up to Rs 3 lakh for tenures up to three years. Its underwriting process is accepted across the banking industry, and it has tie-ups with nine lenders. The entire process is done through the Shubh Loans app, which is available in English, Kannada and Tamil. Hindi, Telugu and Marathi versions will soon be there. The company is aiming to bring 10 lakh people into the formal banking fold by 2020.

“The current credit system in India is keeping away millions of loan seekers from getting their applications approved. What is worse is that a large number of Indians are approaching loan sharks and end up paying interest rates as high as 50 per cent. Shubh Loans, through its Android application, is helping applicants understand their credit standing holistically and access fair and transparent credit for their personal needs,” said Monish Anand, founder and CEO of Datasigns Technologies, which operates Shubh Loans.

Shubh Loans is just one example of the new-age fintech companies in India that are trying to cash in on the huge potential that the Indian market offers. Gurugram-based Policybazaar.com, for instance, aims for a seamless customer experience through a single platform for all insurance-related requirements. The company has developed end-to-end solutions for different types of insurance policies, which help customers compare various insurance policies and choose a product.

“We have recently brought out an innovation, PBee, which is an artificial intelligence-driven chatbot that allows users to get our customer support without going on a call. We have seen that almost half of our customers buy policies without getting into even a single call. We have also come up with a self-inspection video service for lapsed motor insurance policies. This feature allows consumers to overcome the hassle of physical inspection for lapsed motor insurance policies and makes renewal of such policies possible within a short time. The feature is available on our mobile app for both Android and iOS users. This service has reduced a three-day process into 30 minutes,” said Ashish Gupta, chief technology officer of Policybazaar.com.

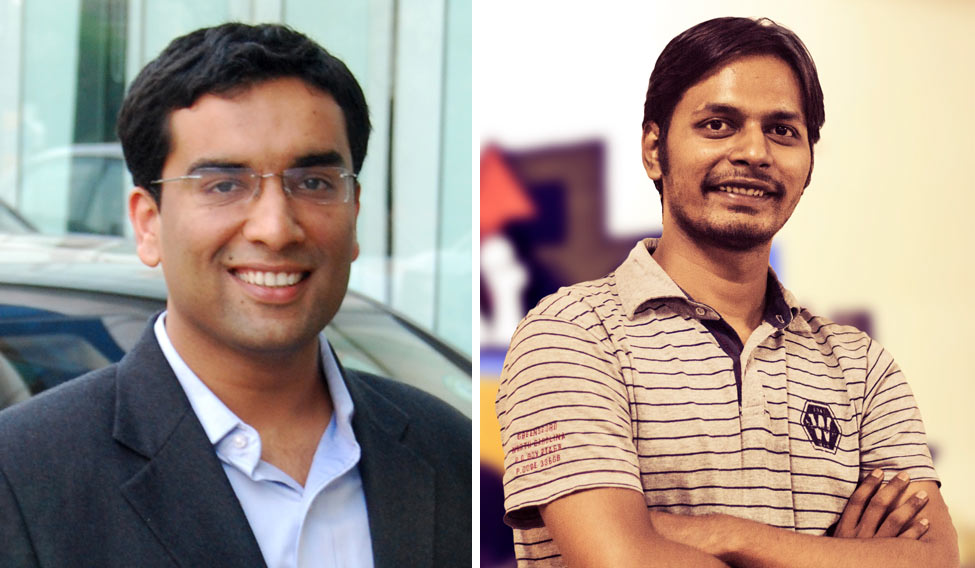

Ramki Gaddipati and Bhavik Vasa

Ramki Gaddipati and Bhavik Vasa

The new-age fintech companies are trying to not only make things easier for customers but also iron out many glitches in the system. For instance, because of the lack of a common repository, documentation and medical clearance process required for issuance of a policy has been a big challenge. “We are currently working on a lot of projects, such as auto detection of documents using AI to make these processes automated,” said Gupta. “We are also working on something called Health Xchange programme, which is a reverse auction platform to make health insurance accessible to many more people, especially unhealthy profiles, and help improve insurance penetration levels. We have created a disruptive platform to match the requirements of higher risk profiles with insurers willing to underwrite them simultaneously and in one shot.”

Mumbai-based Bankbazaar.com is a multi-brand paperless platform for instant, online approval for various personal finance products. It offers products from 85 financial institutions, including public and private sector banks, NBFCs and insurance companies. “Our approach has been to simplify the entire user experience of consuming financial products through the online medium without compromising on security or speed. The whole idea is to provide a platform where the customers enjoy end-to-end services for instant, customised offers with less hassle, fewer clicks, less paperwork and more security,” said Adhil Shetty, CEO and co-founder Bankbazaar.com. “Our partners enjoy the aspects that remove redundancy, on-ground team and cumbersome paper-based verification with features like auto-submission of applications, and OTP-based e-KYC document verification, which reduces the cost of selling financial products and makes it simpler.”

Another Gurugram-based fintech company, Paisabazaar.com, is aiming to tap the huge potential in the loan sector. Launched in early 2014, it disburses more than 0300 crore every month in some 250 cities and towns. “Ever since our inception we have focused on strengthening our product suite to meet the personal finance needs of our customers, whether it is lending, investment or saving. We also keep on broadening our distribution scale to cater to different customer segments by bringing on partners from across the financial landscape that includes established and new-age banks to small and big NBFCs to modern digital lenders to fellow fintech companies. We are currently working with more than 75 financial institutions. We also keep innovating consistently,” said Naveen Kukreja, CEO and cofounder of Paisabazaar.com

Naveen Kukreja and Sachin Jaiswal

Naveen Kukreja and Sachin Jaiswal

The company gives a free credit report with monthly updates to customers. “This offering is digital and instant. It helps them be aware of their creditworthiness and make informed credit decisions. The monthly updates enable them to track and build their score through responsible credit behaviour,” said Kukreja. Paisabazaar.com has launched a facility called Smart Match on its platform that helps borrowers connect with the most suited lender. “On the basis of customers’ eligibility and need, we provide different loan options with a smart match score to help each customer find the right product from the right lender at the right price. This not only ensures that customers apply for loans with the right lender, but also helps lenders increase their operational efficiency, as we direct only relevant and eligible customers to them,” said Kukreja.

Bengaluru-based fintech company Zeta offers employee benefits for tax saving on one platform. Its Optima brand gives fully digital tax optimisation and reimbursement solutions, digital meal vouchers, fuel and travel card, communications card, medical reimbursements, gadget card and gift card. The grants are electronically distributed to employees located anywhere. The Zeta dashboard serves as the command centre for all employee benefits and can be customised to preset usage rules for every benefit. The entire verification process is outsourced to Zeta’s experts. This saves time, resources and costs for corporates to manage these benefits.

Founded by Bhavin Turakhia in 2015, the company has more than 350 employees in 11 cities and tie-ups with many corporates. “The Indian Income Tax Act lists 52 benefits and prerequisites that organisations can offer to employees. Some of these benefits and perquisites help reduce the employee’s tax burden. However, several organisations choose not to offer them. This is primarily due to the insurmountable hassles involved in the process. From collecting and verifying claims, to storage of each bill for IT audits, to the hassles of physically distributing paper-based meal vouchers to employees, across locations, offering tax-saving employee benefits has been a daunting logistical and financial challenge. These tax-saving benefits in the current non-digital form are hardly employee favourites either. Most employees do not opt for the benefits offered to them as they are cumbersome to avail and generally require extensive paperwork and are associated with a long drawn-out process,” said Ramki Gaddipati, chief technology officer of Zeta.

Bala Parthasarathy and Monish Anand

Bala Parthasarathy and Monish Anand

As the world is being taken over by the artificial intelligence storm, Indian fintech companies are not falling behind. Bengaluru-based Niki.ai uses chat to help users make digital transactions. Founded in 2015 by IIT Kharagpur alumni Sachin Jaiswal, Nitin Babel, Shishir Modi and Keshav Prawasi, this platform has an AI bot that converses with customers and helps them buy products and services. The company has been focusing on the personal finance space and will soon offer peer-to-peer money transfer, an AI-based insurance bot, and an automated personalised stockbroker. “With these service offerings, we aim to make the tedious process involved in personal finance management more personalised, hassle-free and fast. This will also eliminate the requirement for middlemen, such as insurance agents and salespeople, making the process more transparent, consistent and reliable,” said Jaiswal, CEO of Niki.ai.

Similarly, Bengaluru-based MoneyTap offers chatbot technology in regional languages to solve the problems of consumer credit. MoneyTap also provides machine learning algorithms and data science to evaluate credit for lower middle income customers in less than five minutes on mobile phones. “We are one of the first app-based credit lines for consumers and have crossed the 1,00,000 user install base. MoneyTap enables instant credit by the means of a credit-line, which is a new concept in India. It means that the bank will issue a limit of up to Rs 5 lakh, without any collateral or charging any interest. Against this limit, by using the MoneyTap app, consumers can borrow as little as 03,000 and as much as Rs 5 lakh, and repay it as EMIs from 2 months to 3 years. Our app is available on Android Playstore to all salaried employees and self-employed professionals. We have also recently launched ZeroPaper technology, which enables 100 per cent paperless processing of the customer applications,” said Bala Parthasarathy, cofounder and CEO of MoneyTap.

These apps thrive on fast-growing consumer borrowing in India. “As per the consolidated data from the Reserve Bank of India, personal loans extended by banks grew at 28.7 per cent in 2015 and credit cards grew at 23.6 per cent. But if we look at the actual numbers, there are just 24 million credit cards for a country of 1.2 billion. Middle income customers making Rs 25,000 per month or more, facing frequent cash crunch for regular needs like education, medical, birth or death are not serviced by financial institutions today without putting up collateral such as gold. We are trying to address this issue with our app,” he said.

Adhil Shetty and Ashish Gupta

Adhil Shetty and Ashish Gupta

EbixCash is among the oldest fintech companies in India. “For over a decade, we have been in the digitisation of cash across India,” said Bhavik Vasa, chief growth officer of the company. “With an omni-channel strategy that encompasses a distribution network of over two lakh physical touch-points, we believe in creating a financial exchange where a customer’s financial needs are fulfilled—be it through physical or a digital channel. At EbixCash, we call ourselves PHYGITAL, aiming at last-mile connect and combining the physical reach of tens of thousands of distribution outlets across the country with end-to-end technology and processes.”

These fintech companies are trying to mitigate many challenges in the Indian personal finance market. Lack of education about personal finance management is probably the biggest among them. “Today’s millennial is more concerned about ‘making’ money than thinking of 'managing' it. This is probably because the personal investments or savings one makes is more of a long term result-yielding practice with minimal, fixed, short-term benefits. Also, traditional methods have always been cumbersome and inaccessible for some portion of the population,” said Jaiswal.

Said Anand of Datasigns Technologies, “Lack of financial knowledge is stopping many people from embracing digital economy. Financial education is the need of the hour and companies must take the initiative to provide the tools and means for people to understand financial services better.”

And, there are many infrastructure challenges. Shailendra Naidu Somarouthu, CEO of OBOPAY, said the ecosystem around merchants and financial products was not fully digital yet. “Personal finance is still largely the domain of banks in terms of consumer trust,” he said. Also, the Indian personal finance landscape is constantly being shaped by shifts in market conditions, regulatory amendments and changes in customer demands and behaviour.

Despite the good going, these companies need to work towards gaining the trust of the consumers. “Customer inertia, I feel, would be the biggest challenge that new-age players and fintechs face,” said Kukreja. “While there’s an increasingly big size of the population that is discovering the massive benefits of doing personal finance transactions through fintechs, there’s another segment that has remained unmoved by the value fintechs have added to the personal finance space, and continue to use traditional and offline modes despite being inconvenient. Similarly, from a regulatory perspective, marketplaces and lenders are still restricted in providing a completely digitised and frictionless experience due to the mandatory requirement of physical documentation and signatures from customers. This, I am hopeful, will change through e-KYC verification and digital signatures.”