When seasoned banker Uday Kotak choses to publicly mention the weak underbelly of the banking system, it means the issue is too big to be quietly dealt with.

Executive vice chairman and managing director of Kotak Mahindra Bank Ltd, Kotak wrote to his shareholders: "The weak underbelly of Indian banking, something which I have been consistently pointing out through the years, has resurfaced strongly. Both public and some private sector banks have revealed stress on their balance sheets. The story is not over yet, and we can expect to see more bad news on this front."

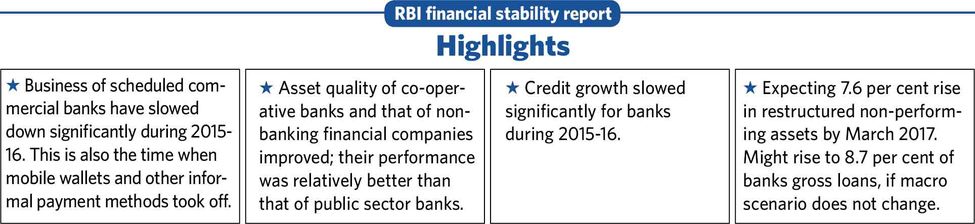

The risks faced by India's banking system are large and looming right on the horizon. A massive firefighting exercise is under way and banks are saving every rupee to hedge against future losses from non-performing assets (NPAs).

"We have complied with whatever was required from us by RBI,” said Bharat Dangar, director, Bank of Baroda. “Right now we are going a bit slow with all lending, be it for consumer purchases or corporate loans. The idea is to first create adequate provisions. It is an exercise that will take a few months more and after that business will pick up.”

Bank of Baroda has listed likely bad loans (gross NPAs) of Rs 40,521 crore and had written off Rs 19,521 crore as confirmed bad loans (net NPA). Interestingly, most of the defaulters are big borrowers. But, now, dispersal of consumer borrowings for durables, housing and education, too, have been hit by corporate defaulters.

“Loans to medium and small businesses have petered out since the RBI had directed banks to take stock of their NPAs. Bank branches with whom we had conducted business for years are refusing loans," said Anil Kumar Aggarwal, senior vice president, Federation of Indian Small and Medium Enterprise (FISME). “We are out with a begging bowl for funds to buy raw materials and meet our orders and commitments. Sometimes we have to approach two to three banks for separate, smaller loans. Many people are also opting for unsecured loans on higher interest.”

Kotak's statement also takes note of those affected by the fallout of over-lending by banks. “Banks were nationalised 47 years ago,” he wrote. “One of the reasons for this was that private banks were lending disproportionately to big businesses. Access to funds from banks was not easy for the common man. Nationalisation was supposed to change this. Today's irony is that the biggest losses booked by banks... are on account of lending to big businesses. Effectively, public policy actions supposedly done 'in public interest', are instead going 'against public interest'.”

NPA loans for all banks stood at a massive Rs 13 lakh crore as of March. Almost 11 per cent of the total borrowing through Indian banks are already bad loans. The International Monetary Fund's global financial stability report said 37 per cent of total debts in India are at risk. If all these loans results in zero recovery, the banks can absorb only seven per cent of the shock, IMF said.

A full-fledged overhaul of the banking system is on the cards. Pavan Vijay, founder, Corporate Professionals and a former director of IFCI, said, “In the current system of loan disbursal, hardly any attention is given to the future prospects of a business. Instead they look at age old numbers like profit and equity ratios, which hold no significance in today’s age of innovative business practices.”

The Banks Board Bureau, chaired by former comptroller and auditor general Vinod Rai, is charting the future course of the sector. “We expect the bureau to frame the broad guidelines for the banking industry reforms in the coming month or so,” said Shaktikanta Das, economic affairs secretary, at a recent briefing.

The Banks Board Bureau is likely to start with revamping the system for disbursal of large loans. It might also look at the way in which banks attach properties by using the bank securitisation act. “The act needs simplification and some attention to the fact that attachment of a property does not result in closure of the business,” said Dharmakirti Joshi, chief economist, CRISIL.

Another concern for banks is the low level of capital available. A recent review by the Reserve Bank Of India showed that private and public banks had witnessed a steady decline in the capital adequacy ratio in the last year.

“If reserves with banks fall below a certain level or the minimum floor as set by RBI, then banks can face severe consequences. I am sure that all banks are taking adequate measures to ensure that it does not happen,” said Das.

The consolidation of public sector banks are also likely to make another hole in the government's pocket. The State Bank of India has received regulatory and government permission to acquire seven group banks.

This year, while Rs 8,000 crore was allotted in the union budget for infusing fresh capital for loss-making PSU banks, many from the sector believe that Finance Minister Arun Jaitley would have to make additional provisions of another Rs 3,000 crore to settle claims of employees and to remove the disparity in pay structure among group banks.

“Consolidation is not the only answer to resolve this crisis. [Banks should] think innovatively and adopt modern technology like analytics,” said Alok Prasad, CEO, Micro finance Institutions Network. Interestingly, the smaller cousin of the larger banking system had fared better and reported better recoveries. The sector scored by paying attention to individual needs and by forming business binds between lenders.

Public sector banks have been slow in upgrading to technologies like mobile wallets. State Bank of India has just tied-up with Reliance Jio for forming a payments bank. Experts see it as a desperate bid to catch up with Chinese giants reigning the space in India.

“In a market where the shortage of change has fuelled the growth of mobile wallet-driven instant payments, the universal payments interface suggested by RBI is still not fully up and running,” said Vijay. Though private banks are better armed, experts feel there is scope for much more innovation.

Recently, the RBI floated a structured stress asset restructuring scheme to help banks get rid of bad loans. There are rumours about the formation of a 'bad bank' with a fund of $3 billion. The money will come from multiple sources. Such banks usually buy NPAs form other banks.

RBI Governor Raghuram Rajan has not been for the 'bad bank' as he feels it will encourage banks to lend recklessly, confident that they will be bailed out by the system.