Vishal Sikka looked tired when he addressed the media persons assembled at Infosys headquarters in Bengaluru through a video call from Palo Alto in California on August 18. Abruptly, the first non-founder chief executive of India’s second largest IT company said he was quitting. “I had left India as a teenager and got an opportunity to come back many decades later through Infosys. It is a very sad day,” he said.

Sikka had been unhappy about the persistent criticism of his style of functioning by N.R. Narayana Murthy, co-founder and first CEO of Infosys. The director board of Infosys placed the blame squarely on Murthy and seemed to be set for a battle with him. The bigger challenge before the board, however, would be finding a successor to Sikka and safeguarding investors’ interests. The day Sikka resigned, around Rs 23,000 crore of investor wealth was wiped out as Infosys stock plummeted 9.6 per cent.

A major allegation Murthy kept on making was that corporate governance was compromised by the Infosys board when the company acquired the Israeli firm Panaya. Infosys paid $200 million for the company while the latest valuation was $150 million. He also questioned the high severance package (Rs 18 crore) given to the former chief financial officer Rajiv Bansal.

Sidhant Rastogi, partner at Zinnov Management Consulting, said there was no merit in the argument that corporate governance was compromised in the Panaya deal. “A deal of this magnitude does not happen lightly and there was a full process and that was followed by Infosys. A third party agency, which in this case is reported to be Deutsche Bank, was involved in the valuation and the whole process of approval did take place at the board level,” he said.

Panaya’s solutions are expected to help Infosys free up its workforce for higher skill processes. “Panaya’s valuation at $200 million is negligible in comparison with the $30 billion valuation of Infosys. Such small acquisitions require clearance only from the board, not from shareholders. It is said that the Securities and Exchange Board of India has looked into the acquisition. A problem will arise only if the acquisition was facilitated to satisfy the personal agenda of Sikka, which looks impossible,” said Aditya Mohan Jadhav, professor (economics and finance) at T.A. Pai Management Institute, Manipal.

It is said that Bansal had to go because Sikka did not get along well with him. The severance package was decided in October 2015 after negotiations with the Infosys management, board representatives, Bansal and his legal team from AZB and Partners. “Severance is paid during involuntary separation of an employee. There is no law governing severance pay at senior levels. Typically, at the executive level, there are always clauses and restrictions around employment post the current role. I feel that a two-year severance package (which had been offered to Bansal) for a senior executive is well within the globally accepted standards,” said Rastogi. After paying Bansal about Rs 5 crore, Infosys suspended the payment. He has invoked the arbitration clause in the severance contract asking for the rest of the money.

While no one is doubting Murthy’s right to question the board and the chief executive, experts say he should have been discreet. Every shareholder had a right to question a company, said Subramanyam S., CEO of Ascent Consulting, but the forum he used—the media and open letters—appeared to be a sticky issue between Murthy and the board. “Given his role in making Infosys what it is, Murthy rises above the board when it comes to questioning practices of management or governance, which is a new standard by itself,” he said.

The road ahead for Infosys is expected to be bumpy, and finding a new CEO in the current muddled environment and governance structure would be a big challenge. “The board and the founders, especially Murthy, would have to agree upon and jointly publish a credible and clear working mechanism between them and the executive team,” said Rastogi. “Once the house is set in some semblance of order, there may be hope to get a good external candidate. My opinion is, an external CEO is not an imperative to Infosys’s long-term growth,” said Rastogi.

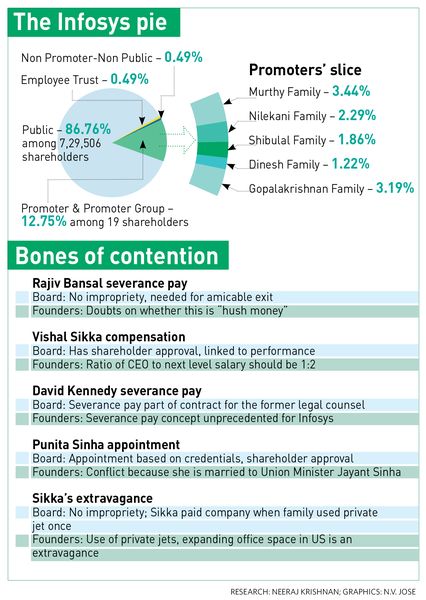

The founders still hold significant stake in Infosys, and these holdings make much of their wealth. Murthy and his family, for instance, hold 3.44 per cent stake in the company. It was worth about Rs 8,068 crore a day before Sikka’s exit, and it declined to Rs 7,040 crore when the stock crashed after his resignation. These holdings must be a reason the founders are reluctant to completely give up the control. However, many experts say it would be difficult for the board to find an outsider CEO who will step in and be able to perform under the glare of the founders. “Interestingly, this has put some founders on the back foot. If they decide to join back, it will be assumed that they forced Sikka out to get back into the company. If any of the founders’ children join the company, it will be viewed as nepotism,” said Jadhav.

While the bitter battle has definitely dented the image of brand Infosys, it is unlikely to be a lasting one. “Boardroom battles, as long as they are resolved with resoluteness and speed, do not hurt client-end relationships. Yes, they remain a talking point, but they don’t hurt business that is ongoing, or new business that is being considered. To that extent, the brand takes a temporary scar, and quickly the scar is erased and it is business as usual,” said brand expert Harish Bijoor.

The disturbances at the top level are unlikely to hit the functioning at the ground level. “Most IT companies have excellent processes to manage customer satisfaction,” said Rastogi. “At the same time, if the current instability and infighting persists over a few more months, then there will be an impact on the win rate of new, especially large, competitive deals that need top management attention.”

The internal dissension would be the biggest challenge before the new CEO. But the lofty standards that the company had set for itself from the beginning would guide him to overcome this. “Infosys is not just a large company, it is an institution,” said Alok Shende, director, Ascentius Consulting. “The institutional gravity offers a tailwind that helps new CEOs sail easier. Along with the new CEO, Infosys should also recast its board and get a new set directors who are in greater sync with the exacting values that Infosys has espoused through the course of its history. In the long term, the recent events will be a small blip on Infosys’s historical map.”