When the Indian Government demonetised currencies of denominations Rs 500 and Rs 1,000 last year, not everyone was aware of the vision Prime Minister Narendra Modi had for the country. Now it is clear and evident that the government intends to revolutionise the payments system, a critical requirement for India to maintain its healthy GDP growth rate while weeding out accumulation of wealth disproportionate to known sources of income or black money. The latest initiative—BHIM-Aadhaar Pay app—is being hailed by every section of society and the international community, as no other developing country is ushering in digital payments as rapidly and efficiently as India.

The Digital payment system was long overdue in India, as circulation of black money was a big impediment for the economy. Prior to demonetisation, India was overwhelmingly a cash heavy economy, with 90 per cent of all commercial and personal transactions taking place in cash. With demonetisation wiping out 86 per cent of India’s cash overnight, people are gradually switching over to digital payments systems, such as, mobile wallets, online payments and by using Points of Sales (PoS) etc.

However, people from the backward and rural areas, and those below the poverty line (BPL) found it difficult to adopt digital payment methods, primarily because of the lack of knowledge, absence of support infrastructure and lack of access to the internet through a smartphone or a computer. As their plight became an issue for the political parties, the government was quick to simplify the process by leveraging necessary technology.

For the past few months, the government has been laying the foundation for digital payments infrastructure on a war-footing. One of the biggest interventions is the Aadhaar Pay, which does not require the payee to use a device for any monetary transaction through their bank accounts. All that the payee must do is quote the Aadhaar number and scan his or her thumb impression with the merchant to complete the transaction.

This initiative was a follow-up to incentivisation schemes on digital payments for merchants, imposing a ban on cash transactions above Rs 3 lakhs, launching the Unified Payment Interface (UPI); and Bharat Net, a high-speed digital highway to connect all 250,000 Gram Panchayats of the country through the Internet.

The government also proposed tax sops in the form of customs/excise duty exemptions on miniaturised PoS card readers, fingerprint readers/scanners, and iris scanners. Tax exemption for specific components of such devices has also proposed to encourage domestic manufacturing of these devices.

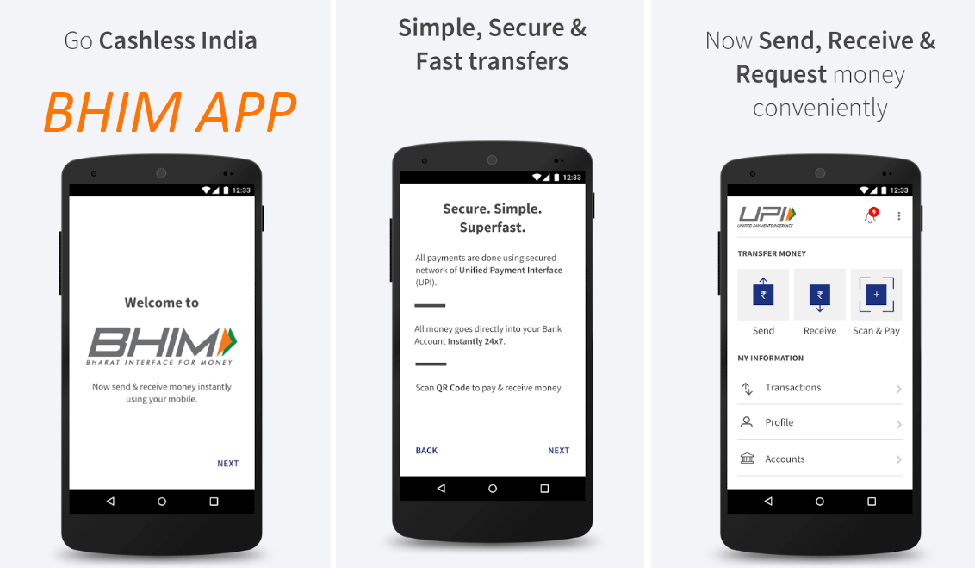

The launch of the Bharat Interface for Money (BHIM) app also came at the right time and the government made a smart move by linking it to Aadhaar to reduce the complexities of payments. According to government estimates, approximately 1.13 billion citizens (against population of 1.25 billion) are on Aadhaar. It means that the biometric data of 1.13 billion citizens is available for developing payments infrastructure. Not many countries have been able to achieve this scale, especially among the developing nations.

By strongly leveraging this Aadhaar identity system, the BHIM-Aadhaar Pay app enables consumers to pay through their biometric data, linked to their Aadhaar. It means that Aadhaar Pay mechanism will take place without the need for a debit card/credit card/mobile wallet. The biometric-based payment system facilitates real-time money transfers between bank accounts of consumers and merchants without a phone, at no additional cost.

Benefits of a biometric payments system

There are multiple benefits to all stakeholders concerned, including consumers, from Aadhaar Pay. It is imperative for a customer to link the bank account to his/her Aadhaar number. While conducting a transaction with any merchant or any shop, the consumer must select the bank’s name and enter the Aadhaar number while his/her fingerprint will serve as the password to authenticate the transaction. The system offers immense relief to people, who are not familiar with using smartphones, mobile devices, debit or credit cards. It also eliminates the need for remembering debit / credit card PINs, MPINs and passwords.

In fact, the charges for conducting Aadhaar pay transactions are nil for consumers whereas it will involve a one-time investment for merchants. Hence, the government is offering them incentives to adopt Aadhaar Pay system in a big way.

Adoption of biometrically-linked payment system is a critical step towards ushering in a digital transformation of India. Digitisation of payments infrastructure is essential to elevate India to be a digitally empowered society through good governance by synchronising public accountability, e-governance programmes and services enabled by IT.

Ashu Kajekar is an internet visionary, founder and CEO of 7EDGE

Disclaimer: The views expressed in this article are solely those of the author and do not necessarily represent the views of the publication.