It can now be said that mutual funds have become a sound investment option for retail investors in India. This transition has been in the making for the last three years. With domestic institutional investor holdings as a percentage of foreign institutional investor holdings reaching a record high, investor confidence in mutual funds has been on the upswing.

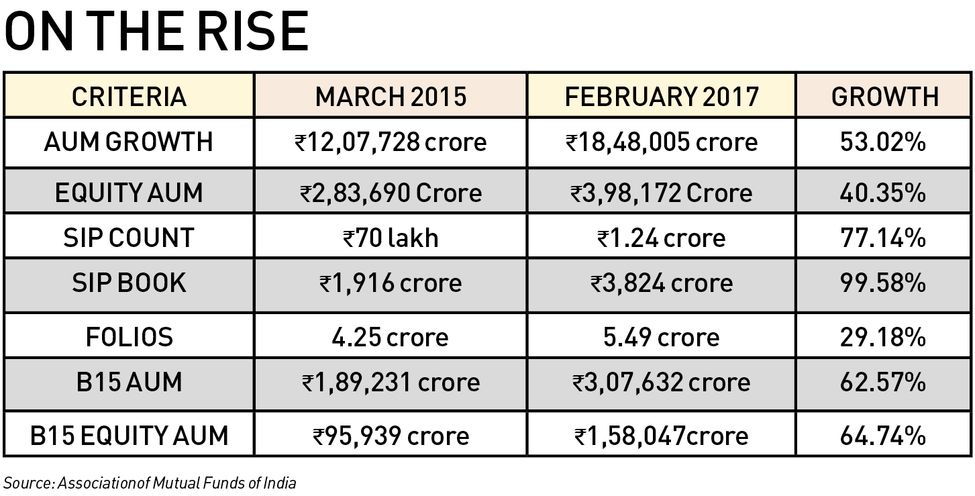

From March 2015 to February 2017, the mutual fund industry's assets under management (AUM) grew by 53 per cent, while equity AUM grew 59 per cent to over 03,98,000 crore. Given the fact that the equity market generates reasonably good returns over the longer term, there has been an increased acceptance for investing through systematic investment plans (SIP). It is remarkable to note that in the last three-year period, the industry’s SIP book grew by 100 per cent as the number of SIPs grew by 77 per cent. We have also seen a growing trend of signing up for monthly SIPs for terms of more than five years.

AUM contribution from smaller, B15 markets (beyond top 15 cities) grew almost 63 per cent in this period, with equity AUM growing 65 per cent. Through my interactions with market participants in over 60 small towns over the last two years, I can attest that the sentiment in these markets for mutual funds reflects the investing trend.

Clearly, mutual funds have found favour in the Indian hinterland, with B15 investors using equity mutual funds and SIP for long-term wealth creation. So, what contributed to this turnaround?

The past two decades have seen the Indian mutual fund industry emerge stronger, amidst daunting forces of market variability, global and domestic economy, and regulatory developments to name a few. Regulation ensured stronger, proactive focus on governance and risk management practices at fund houses, which in turn helped strengthen processes, to effectively enhance the fund experience.

The regulator’s move to introduce T15 (top 15 markets) and B15 as concepts, supported by investor education was possibly one of the earliest triggers for a segmented approach to developing interior markets. A game changer, this paved way for fund houses to strengthen distribution and approach pockets of retail investors across India in an organised manner.

Positive change in the political arena, coupled with progressive economic reforms and tough measures also contributed to the investor sentiment. This possibly played a strong role in driving optimism, and in turn investor participation in the markets.

The government’s national mission on financial inclusion—the Pradhan Mantri Jan Dhan Yojana—was launched in 2014. With its focus on driving penetration at affordable cost through use of technology, the programme ensured strong bottom-up awareness about financial inclusion across rural and urban households. The Digital India mission launched in 2015 to transform India into a digitally empowered society with its focus on developing digital infrastructure, digital literacy and digital services, also supported the financial inclusion agenda.

The demonetisation drive in November 2016 was the third and definitive step in this direction. By bringing money into the mainstream economy, demonetisation positively impacted the economy in several ways. Some of them being increased tax collections, enhanced government spending capability, curtailing inflation, and increased adoption of digital platforms, to name a few.

All of these brought the focus right back on how Indians spend, save, and most importantly, invest. Mutual funds greatly benefited from the demonetisation exercise. For example, the industry’s monthly average inflow into equity was Rs 19,000 crore pre-demonetisation. This grew to Rs 24,960 crore, and post December 2016, stands at about Rs 24,500 crore.

The 2017-2018 fiscal year is also expected to be a crucial year in the move towards cashless and digital transactions. The digital medium has now emerged a 24x7 channel to educate and inform customers and provide a platform for seamless transactions.

As we have seen, investor education, fund experience, geographical reach, and operational ease through digital platforms have all contributed to the increasing investor interest in mutual funds.

In the year ahead, introduction of new, emerging asset classes such as infrastructure investment trusts (InvITs) and real estate investment trusts (REITs), the go-ahead on celebrity endorsements for mutual funds as a category, and the industry’s collective focus on investor education are some of the positives to look forward to. I am also extremely bullish on the Association of Mutual Funds of India (AMFI)-led investor education campaign, ‘Mutual Fund Sahi Hai’ which would create a big pull for the mutual fund industry over the next few years.

The industry has around 5.49 crore folios. Roughly two crore folios have unique PAN numbers and the new folio base in the next two to three years, in my view, should cross five crore investors. Each year, we add around 80 lakh investors. I think we should easily be able to touch five crore unique PAN numbers by the end of 2019.

It is imperative to point out here, that the market is also expected to support the high growth potential of the industry.

The market never moves linearly; it undergoes intermittent volatility on account of factors arising out of both domestic and global economy. The market has steadily inched upwards in recent months. Valuation is the function of earnings growth and optimistic outlook. As long these two exist, the broad market direction remains bullish. On the other side, optimistic outlook drives flow both in domestic and global markets. Interest rate reduction combined with government spending in building infrastructure may boost the growth in the economy and in earnings as well. All of this should lead to better outlook and in turn more opportunities for corporates. So I see positives ahead for the equity market, with scope for positive surprises on earnings.

The fixed income market is likely to stay stable on the back of stable fiscal policy of the Centre as well as stable inflation outlook. Commodities including crude oil are in favour, keeping the inflation somewhat low. Agricultural output has been very good in the current fiscal year keeping pulse prices in check. The currency movement too has been favourable given the weakening of Dollar Index globally and rising flow of the dollar into India. The only uncertainty remains the outlook of other central bankers in the world who are on the rising interest rate trend due to their respective countries internal dynamics. This in some sense drives the decision making process at the Reserve Bank of India and, hence, the rate decision. Whichever way one looks at it, stable interest scenario, if not further reduction in rates, can be expected in the near future.

With the markets looking favourable and market drivers in place, industry participants from this point on, need to gear up to serve this growing surge. I see customer experience emerging as a starting point to drive the next wave of products, processes, services, and platform innovations. As far as the investor is concerned, optimism, discipline and focus on asset allocation based on goal-orientation will reward him significantly in the long run.