Infrastructure investment trusts, or InvITs, billed as a way out of the impasse for India’s fund-starved infrastructure sector, have become a reality a good four years after they were mooted.

The first InvIT, from IRB, started trading on stock exchanges last week, and the second, India Grid Trust, is currently open for subscription. And if the market response is any indication, the category has found favour with retail and institutional investors alike already.

For those still not sure what the category offers and whether it is for them, here is a quick introduction.

An InvIT is a vehicle created to primarily invest in revenue-generating infrastructure assets. It is a ‘trust’ by definition and its ‘units’ (shares) are listed on stock exchanges and traded based on their net asset value (NAV). It has a pass-through structure and is therefore required to distribute majority of their earnings to unit holders.

As per the October, 2013 notification of ministry of finance, InvITs are eligible to invest in transport, energy, water sanitation, communications and social & commercial infrastructure sectors.

With InvITs, investors join the infra party

With InvITs, investors join the infra party

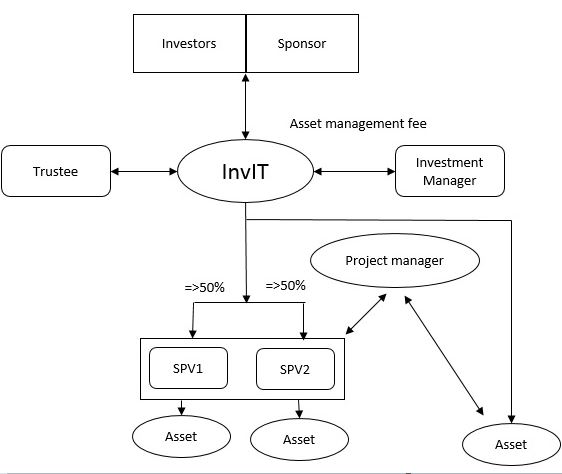

The way it works, a sponsor sets up an InvIT and appoints the trustee. The InvIT holds assets either directly or through a special purpose vehicle (SPV). InvITs are required to hold controlling interest and not less than 50% equity share capital or interest in the SPVs (except in the case of public private partnership projects where such holding is disallowed by the government or regulatory provisions).

The sponsor is required to hold at least 15% of the outstanding units of the listed InvIT at all time. The trustee holds assets for the benefit of unit holders, oversee activities, and ensure compliance with respect to reporting and disclosure requirements. While the Investment manager is responsible for investment-related decisions of for the InvIT, the project manager undertakes the operations and management of the assets.

As the name suggests, InvITs are proposed to provide a suitable structure for financing/refinancing of infrastructure projects, many of which are delayed and ‘stressed’ due to reasons like increasing debt finance costs, lack of/ locked-up equity of private investors and delay in project implementation. The route allows sponsors to monetise revenue-generating real estate and infrastructure assets while enabling investors or unit holders to invest in these assets without actually owning them.

Thus, InvITs benefit the infrastructure sector through providing long-term re-finance for existing infrastructure projects, freeing up developer’s capital for reinvestment in new infrastructure projects, providing refinancing/ takeout of existing debt and helping banks free up/reduce loan exposure, thereby helping them create headroom for new funding requirements.

InvITs can raise funds through either public offer or private placement, with the minimum value of assets fixed at Rs 500 crore either way. InvITs funded through public offer are required to have a minimum public float of 25%, a minimum of 20 unit holders other than the sponsor, and are required to invest mainly in completed and revenue generating projects. InvITs funded through private placement enjoy greater flexibility, and can have a minimum of five and a maximum of 2,000 unit holders.

InvITs enjoy favourable tax treatment, including exemption from dividend distribution tax and relaxation of capital gains tax. Worldwide, these are positioned as high-dividend paying investments suitable for investors seeking long-term, stable cash flows with moderate capital appreciation.

However, the minimum application size per applicant has been kept at Rs 10 lakh before listing and Rs 5 lakh thereafter in public-funded InvITs, and Rs 1 crore both before and after listing in case of private placement.

Hence, these are an attractive option for high networth individuals and institutional investors, though not quite for small investors.

Now for a caveat. Most infrastructure sectors face regulatory and inherent structural risks. Besides, InvITs may not be useful for all segments within infrastructure. For example, within roads segment, InvITs may prove a better option for annuity-based projects where the annual income is assured, compared with toll-based project which are vulnerable to fluctuations in traffic volumes and have higher risks attached.

Binaifer F. Jehani is director, Industry & Customised Research, CRISIL Research