Despite introducing major policy reforms like - the Real Estate (Regulation & Development) Act (RERA), insolvency and bankruptcy code, and the Goods and Services Tax - a year after the demonetisation, short term growth in the real estate sector has slowed down says experts.

Shishir Baijal, Chairman and Managing Director, Knight Frank India said that “Business sentiments in the recent history of real estate in India have hit the lowest levels of optimism. While sentiments are largely transient in nature, the prevalent mood in the industry reflects that it has finally come to terms with the short-term adverse impacts of the structural reforms that became a reality over the past 12-odd months.”

“There is also an evident slowdown in the economy with a steady decline in business performances and the dwindling of capital expenditure to worrisome levels. Going forward I feel that the next 12 to 18 months are likely to be the ‘under observation’ period for the real estate sector. Industry stakeholders should spend the period in reorienting businesses in line with the new order,” he added.

Echoing the general sentiment, Rahul Shah, CEO Sumer Group said “We feel that it would take another 3-4 quarters for real estate sector to recover. Not only demonetization, but RERA and GST also had a material impact on sales. Gone are those days where developers would earn a heavy margin on an inventory. Going forward we believe that the margins will be limited to a 12-15 per cent range for a developer. It is already very much evident that the unorganized players have started to feel the pinch and will slowly be wiped off from the market.”

RBI Data

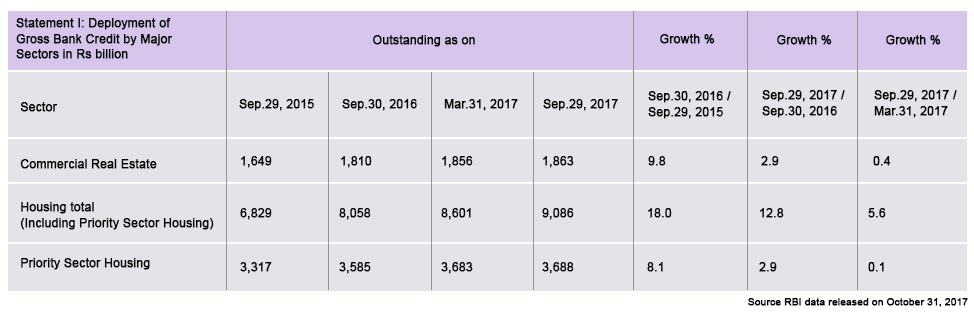

The slowdown is mirrored by the RBI data on deployment of bank credit to real estate sector, released on October 31 (table below). For commercial real estate and priority sector, bank credit growth was flat while growth more than halved in the housing loan disbursals in the non-priority sector.

Rating agency, India Ratings and Research maintained a negative outlook on the real estate sector for FY18, based on the expectation of a continued slump in the sale of residential units. This will result in continued negative cash flows and a further increase in already-high debt levels, resulting in the weakening of the sector’s credit profile, it added

Government’s thrust on housing

However, the government has provided a slew of incentives to boost its flagship scheme, Housing for All by 2022. Major steps taken included granting of infrastructure status to affordable housing, allowing developers a 100 per cent deduction of profits and gains for affordable housing units, determination of liveable area in terms of carpet area (instead of built up) besides providing a credit linked subsidy scheme for people in economically weaker sections, low income group and middle income group.

There has also been an increase in private equity investment in commercial real estate. A number of large foreign private equity funds have made sizeable investments in both commercial and residential real estate sector, experts concluded.