In a new year message to his employees a week ago, industrialist Kumar Mangalam Birla spoke at length about how India and the world were facing thte after-effects of what he called ‘slowbalisation’. “This new world,” he said, “is not for the faint-hearted.”

Finance Minister Nirmala Sitharaman by no means is faint-hearted. Anyone who has seen her working would agree that the lady means business, even though she goes about it rather grumpy-faced. But faint-hearted? No, sire.

Yet, when Sitharaman gets up to present the Union budget on February 1, it will put to test every bit of her resolve. For this is no ordinary budget. At no point since Manmohan Singh, as P.V. Narasimha Rao’s finance minister, set in motion India’s liberalisation story in 1991 has the annual event assumed such significance. At stake is not just the future of India’s fortunes, but also the political legacy of Prime Minister Narendra Modi.

Till about three years ago, India was the world’s fastest-growing major economy. Then everything went awry. As non-performing assets piled up, banks and the financial system came under immense stress. In them, non-banking financial companies (NBFCs) that lend to small businesses and consumers, in turn, faced a shortage of cash, percolating the woe down the value chain. Modi’s demonetisation of high value currency notes in 2016 remains an unmitigated disaster, particularly for small businesses and farmers. Spending by rural population, already plagued by bad crops and falling prices, plummeted. Rule changes like the Real Estate Regulation Act (RERA) and Goods and Services Tax (GST), aimed at structurally cleaning up and simplifying the system, led to transitional pangs, further compounding the problem.

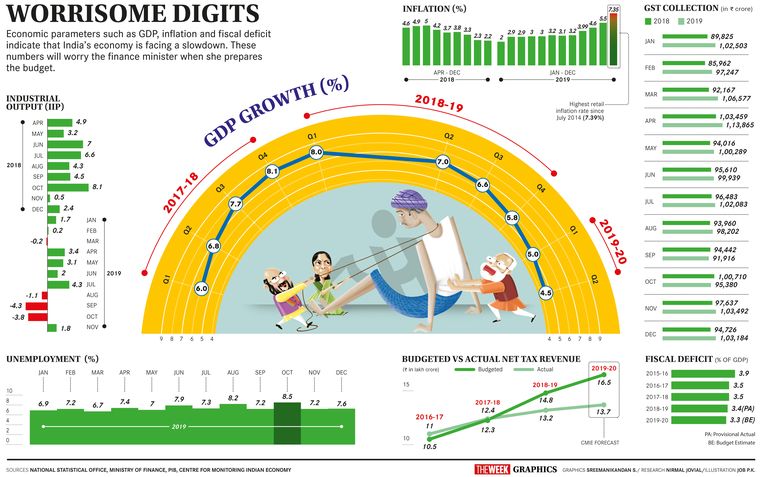

The result? Indian economy plummeted to its lowest growth rate in a decade. Growth rate slowed down for six quarters straight, hitting a low of 4.5 per cent for the three-month period ending in September. This is despite the Reserve Bank cutting lending rates by 135 basis points over the past one year in a desperate attempt to increase lending and consumption. While imports were down 8.37 per cent, exports fell by 2.21 per cent, and manufacturing output shrank 3.8 per cent.

Tax collections were about half of what Sitharaman targeted in her July budget, which she presented soon after Modi stormed back to power. It is now certain that the fiscal deficit—the gap between the money government makes and the money it spends—will go way beyond the target of 3.3 per cent of the GDP. Subhash Garg, who was finance secretary till recently, mused in a social media post that it may go as high as 5 per cent. That is no good news. Spending in the remaining months of this financial year (till March 31) is being curtailed by various ministries and departments, though it goes directly against Sitharaman’s stated objective of boosting growth by government spending. “It is obvious that the government is clueless and seems to think that ignorance is bliss,” lashed out former finance minister P. Chidambaram, a staunch detractor of Sitharaman.

The finance minister had announced a series of stimulus packages since her last budget. The cut in corporate tax to an effective rate of 25 per cent for existing businesses and 17 per cent for new businesses was aimed at attracting foreign companies to set up shop in India. Then, on New Year’s Eve, she rolled out a 0102 lakh crore National Infrastructure Pipeline, aimed to boost spending on infrastructure projects.

Rating agencies were not impressed, though. Moody’s slashed India’s growth forecast to 4.9 per cent, dropping further from its previous downgrade to 5.8 per cent. The Reserve Bank and the National Statistical Office (NSO) also slashed their forecast for the current financial year to 5 per cent, the lowest in a decade. Then the International Monetary Fund put the figure at 4.8 per cent.

Sitharaman’s supporters argue that her measures need time to bear fruit. But time is something the Indian economy cannot afford to while away right now. The effect of the slowdown is most visible in employment. Lakhs of people, particularly those in contract jobs and the unorganised sector, and small businessmen have lost their livelihood since the slowdown struck. Most corporates, hit by lack of funding from banks and NBFCs and the drop in consumption, are focussing on clearing their inventories and trimming expenses rather than expanding or investing in new ventures.

The biggest casualty of all this has been what analysts refer to as the consumer sentiment. “Cars, bikes, houses, anything expensive is not selling. The common man is uncertain and confused, and is looking at something to get along with their daily lives,” said Chander Agarwal, managing director of TCIExpress, one of India’s leading logistics companies.

It is, in fact, worse than that. “We are extremely close to a tipping point of a major recession,” said Nobel laureate Abhijit Banerjee. “The critical problem in the Indian economy is demand.”

It seems the finance minister has her task cut out—making people spend. But, how will she achieve it?

Sitharaman has a passion for making pickles. In 2017, soon after she became defence minister, a video of her making avakaaya, an Andhra variant of mango pickle, along with family members went viral. Just like how she paid attention to selecting the ingredients, getting the mix right and letting the process take over to make the perfect pickle, she now has to spur spending, boost business and inspire growth, while going forward with the social security measures and structural reforms she set out to do with her first budget.

It is not just about reviving growth any longer. Modi set the ambitious target of making India a $5-trillion economy in five years in his Independence Day speech (currently India is at around half that figure). Now the onus is on the finance minister to provide a roadmap in this budget.

MONEY FOR NOTHING

While the demand for a cut in income tax rates comes up every budget season, it is louder this time around. “To revive growth, we need to create and spur demand, and that comes from putting more money in the hands of the consumer, so that it can go into the market as investment or expenditure or consumption,” said Neeru Ahuja (partner, direct taxes) and Divya Baweja (partner, personal tax) at the consultancy firm Deloitte.

“This year, there is a stronger expectation that the cut may happen because the finance minister had announced that she would focus on personal tax. As the corporate tax cut has already been done, expectations are more on the personal tax side,” said Baweja. Industry bodies and corporate heads have also called for raising the exemption limit and a rejig of the slabs.

Can the government afford it? The corporate tax cut is estimated to add Rs1.45 lakh crore to the fiscal deficit, not to forget the fact that GST receipts falling short of estimates will pinch the exchequer hard. “I feel it will come in terms of deductions for insurance and pension schemes rather than changing the slabs,” said S. Ravi, tax expert and former chairman of the Bombay Stock Exchange. Other avenues for individual taxpayers could include raising the exemption limit for Section 80c. A direct tax code draft had proposed raising the exemption limit of Rs1.5 lakh to Rs3 lakh.

MORE! MORE! MORE!

Despite the fiscal situation, Sitharaman is left without any option other than releasing funds and hoping that it would kickstart growth. This could range from a ‘fund of funds’ for micro, small and medium enterprises, more funds for infrastructure development (including tax-free bonds) and more stimulus packages for the real estate sector.

A massive infusion of money into social security programmes is expected, and it may not be limited to health insurance and pension schemes. “Till income growth comes back, we should look at enhancement of the Centrally sponsored income transfer scheme and employment augmentation so as to buttress consumption,” said Suyash Choudhary, head (fixed income), IDFC AMC. This may happen through MNREGA or some new direct transfer schemes.

TO CUT OR NOT TO CUT

The government took a leap of faith by cutting corporate tax in September. But, corporates want more. While the hope was that this would bring in foreign investment in the manufacturing sector, there is a demand that the same largesse be extended to the services sector, where India is a strong global player, and to MSMEs.

Again, why not a single flat rate for both new as well as existing manufacturers? “The Union budget could announce a roadmap for convergence of all corporate tax rates to 15 per cent, with no exemptions and incentives by April 1, 2023. A signalling to this effect could help further boost investor sentiment and encourage investments,” said Vikram Kirloskar, president, Confederation of Indian Industries.

The industry is on a better footing when it comes to the exemption of long-term capital gains tax on equity. Other demands include scrapping or reductions of dividend distribution tax, reworking withholding tax as credit rather than waiting for refunds, and an extension of the sunset clause for special economic zones for another five years. Exporters want clarity on the Merchandise Export from India Scheme (MEIS), which was originally intended to end this year. “Uncertainty over MEIS has completely wiped out exporters’ liquidity and has put them in the doldrums with regard to finalising new contracts,” said Sharad Kumar Saraf, president of the Federation of Indian Export Organisations.

GOD OF SMALL THINGS

There is almost universal acknowledgement that the budget’s focus should be on providing a leg up to MSMEs on whose revival a lot hinges on. “We need to rely on MSMEs for better job growth. Special NBFCs should be established to finance MSMEs and such lending should be categorised as priority sector lending,” said Niranjan Hiranandani, president of the industry bodies Associated Chambers of Commerce and Industry of India and National Real Estate Development Council. He suggested that converting “good” NBFCs to banks would ease cash flow and aid growth of small businesses.

ENGINE OF GROWTH

The idiom ‘squeaky wheel gets the grease’ aptly describes the auto industry, which inadvertently became the face of the economic slowdown. Car and bike sales have fallen consistently since the summer of 2018, except for two green shoots during the festive months. Troubled by the government support to electric vehicles and the BS VI emission standards coming into effect in April, the industry has been asking for a GST cut. “The Centre should consider a temporary reduction in GST from 28 per cent to 18 per cent for two-three years,” said Rajiv Bajaj, managing director of Bajaj Auto.

Then there is the demand for tweaking fuel prices. “If you don’t reduce the very, very high taxes on fuel in India, the auto industry is going to go for a toss,” said Agarwal of TCIExpress. “More than vehicle costs, it is the operating cost that pinches.”

LAND OF HOPE

A victim of its own excesses, the real estate sector is yet to recover from the double whammy of demonetisation and RERA, not to mention the crash in consumer sentiment. But, as Avneesh Sood, director of Eros Group, said, “A slowing economy underscores the importance of real estate as an option to boost GDP growth.” Ahuja of Deloitte agreed. “If housing takes off, allied industries like construction, cement and the entire supply chain takes off,” she said. “It is labour intensive, it creates jobs and is a direct foil to rural economic distress.”

Modi’s ‘housing for all by 2022’ push with focus on affordable housing and Sitharaman’s incentives announced in the last budget on rental housing augur well for a future uptick. Then there is the demand for raising home loan exemption limits and the ceiling for affordable housing definition from the current Rs45 lakh.

“The government can enhance the eligibility criteria for credit-linked subsidy scheme and GST rate benefits to boost affordable housing demand,” said Shishir Baijal, India chairman and managing director of real estate advisory firm Knight Frank. Added Pradeep Misra, chairman and managing director of the real estate firm REPL, “Industry status for the real estate sector along with provisions of single-window clearance is highly expected.”

A prolonged period of uncertainty and slowdown has tempered the hopes of even the optimists. “We are not looking for a U- or V-shaped recovery in the near future,” said Choudhary of IDFC. “It will be a slow grind back into better growth over a period of time.”

While no one is expecting Sitharaman to swing a magic wand on February 1, it is imperative that she does something to improve the sentiments. “It is just a sentiment,” said Nagesh Kumar, head of the United Nations Economic and Social Commission in Delhi. “All it takes is some good news to reverse the overall sentiment.” What remains to be seen is not how strong-hearted Sitharaman is, but how big-hearted she can be.

WHAT STATES WANT

SUSHIL KUMAR MODI

deputy chief minister and finance minister, Bihar

* Currently, there is no policy for disposal of silt from the rivers. We have asked for a national silt policy. It will go a long way in addressing the issue of floods that cause damage every year.

* Currently, the fiscal deficit allowed is up to to 3 per cent of the GDP. We have demanded that it be raised to 3.5 per cent. It will allow states to borrow more money.

* We have asked for support for the women self-help groups as they are a major movement in the country.

AS TOLD TO PRATUL SHARMA

WHAT STATES WANT

TARUN BHANOT

finance minister, Madhya Pradesh

* The sharing pattern for the funding of Centrally sponsored schemes should be reverted to what it was during the UPA government—the 80:20 share ratio. The state should not have to give a share of more than 20 per cent for the Central schemes.

* Our borrowing limit under Fiscal Responsibility of Budget Management Act should be increased from 3 per cent of the GDP to 4 per cent.

* The share that the state gets under devolution should be given in a timely manner.

AS TOLD TO SRAVANI SARKAR