As Indians get used to a regime of falling interest rates and lower EMIs on home loans, they are also looking for new avenues to earn better returns on their investments, with fixed deposits and savings accounts turning unattractive.

The phenomenon seems to be evident in the corporate bond market, which has seen a bunch of successful public issuances of non-convertible debentures (NCDs) in the past few months. The one that made people sit up and take notice was Mahindra & Mahindra Finance's maiden Rs 1,000-crore public issue in May-June, which ended up garnering Rs 1,924.47 crore. The NCDs were offered under nine different series, with interest rates ranging between 8.6 per cent and 9 per cent. Rating agencies India Ratings and Research and Credit Analysis and Research (CARE) had awarded AAA ratings to the issue, denoting the highest degree of safety regarding timely servicing of financial obligations and carrying the lowest credit risk.

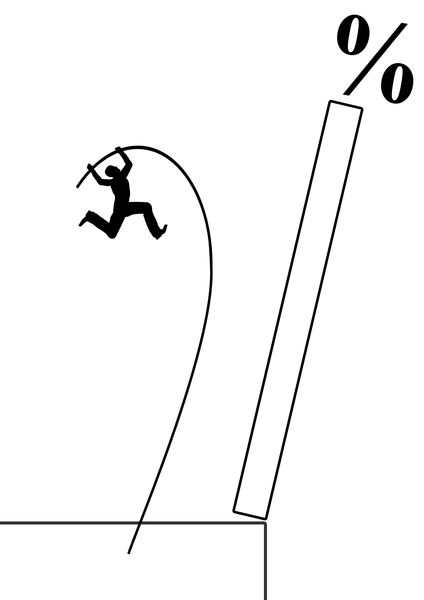

Karthik Srinivasan, senior vice president and co-head for financial sector ratings at ICRA, said, “The coupon rate on the NCDs will be a function of interest rates, tenure of the instrument and the credit rating of the company issuing the NCDs. In general, the coupon is likely to be higher than fixed deposit rates for corresponding tenures. The actual total returns to the investor will be a function of interest rates in the economy. Given the inverse relation between interest rate and price of a bond, the investor can get higher returns [subject to transaction costs] in a falling interest rate scenario should she wish to sell the NCDs in the secondary market.”

Mahindra's issue was followed by one from Edelweiss Housing Finance in July. The size of the issue was Rs 500 crore and offered investors the opportunity to lock in an interest rate of 9.57 per cent per annum with a monthly interest option or of 10 per cent with an annual interest option for ten years. Three-year and five-year NCDs were also on offer, with interest rates of 9.5 per cent and 9.75 per cent, respectively. The issue was rated AA+ by Brickwork Ratings and AA by both ICRA and CARE. It collected Rs 812 crore on the first day itself and 75 per cent of the subscription was for the ten-year papers, says Anil Kothuri, CEO of Edelweiss Housing Finance.

From the issuer's point of view, it is not the market conditions and trend in interest rates that are driving the retail outreach. “One of the main reasons to opt for public NCD issuance is to diversify the sources of funds beyond banks and other wholesale lenders,” says Srinivasan. “The public issuance also provides a platform to further improve their visibility and franchise among the retail segments. Further, public issuance of NCDs allows the issuers to raise longer tenure funds which may not be available from wholesale sources, thus helping on the asset liability matching for issuer.”

Kothuri seems to echo him. “All our borrowing was from banks or from the mutual funds through NCDs that we have issued,” he says. “And we also have some small amount that we get from the National Housing Bank. Our effort was to add a fourth source of funding, which is the retail investor. We are not a deposit-taking HFC [housing finance company]. So our only way of reaching the retail investor is through an issue like this, which is why we came out with our maiden issue to meet this fourth source of funding for us.”

But then, was it initially difficult to take issuances like these to the retail investor, especially when the corporate bond market is populated largely by institutional investors and most individuals have a limited understanding of fixed income instruments? “Our customers and investors were also not familiar with the nuances of applying for NCD in the demat form,” says K.R. Bijimon, chief general manager at Muthoot Finance, which did its 15th NCD issue in April. “But with our large network of branches, we could educate them, and motivated them to open demat accounts.”

Clearly, distributors played an important role here and, according to ICRA's Srinivasan, were a factor behind the success of the recent issuances. “The expectations of interest rate reduction in foreseeable future has also aided in enticing retail investors to lock in the higher rates for a longer tenure.”

Kothuri believes that NCDs are not really the esoteric product they are made out to be and the market does offer entry points for retail investors. “The average retail investor looks for yield and has the ratings as a guide to the security of the issuer. To that extent, it doesn't call for too much sophistication to navigate this market, and the history of public issues and this sort of NCDs has been quite positive. When you compare the other options for the retail investor—hundis, chit funds and such like—this is much, much better,” he says.

At the same time, a first-time retail issue comes with its challenges, especially in terms of pricing of the issue and marketing. “Once you get those right, I think you will get a good response to the issue,” says Kothuri.

So does that mean there will be more such issues in the coming months? Not really, as there are hurdles. “Given that the cost of retail issuance is higher than that for a private placement or a bilateral borrowing, the proportion of such NCDs remains low compared to the total borrowings of the company,” says Srinivasan.

All the same, Muthoot is going for another issue in August and Kothuri sees his company tapping the retail market every year. Were the flow of paper to continue, the beneficiary would be the individual investor.