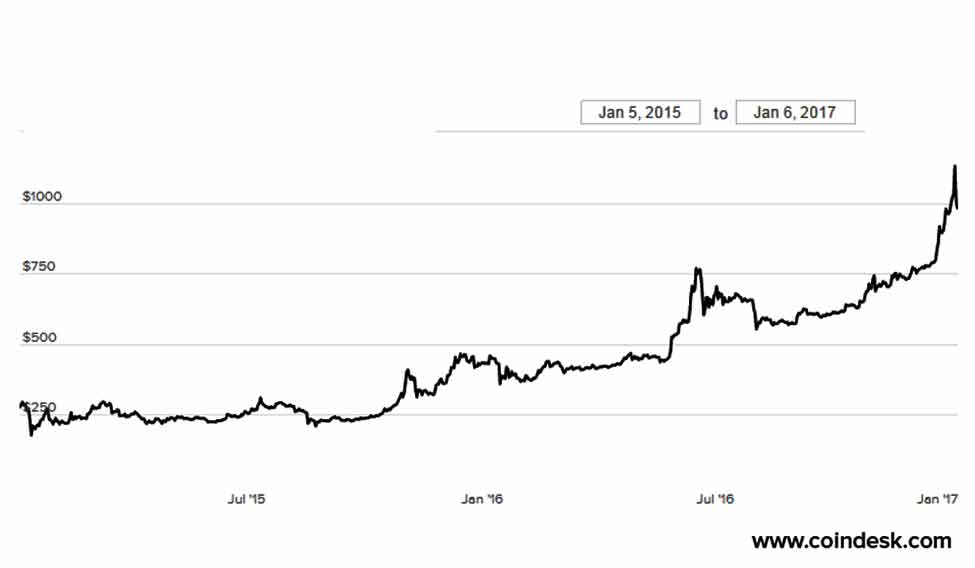

The price of Bitcoin has been surging for the past many weeks. On January 2, its value against the greenback touched $1,019, crossing $1,000 for the first time in three years. According to CoinDesk USD Bitcoin Price Index (BPI) data, it rose sharply from $750.71 on December 5 to $1,129.87 on January 4. The price is edging towards its all-time high of $1,216.17 which it achieved in January 2013.

In 2016, Bitcoin’s value rallied from $430 to $969. That makes a spectacular growth rate of 125 per cent in just a year. Analysts assert that Bitcoin will continue to perform well in this year.

While most currencies staggered, the robust appreciation of Bitcoin has raised many eyebrows. What is pushing up the price of Bitcoin?

Value of Bitcoin against US Dollars. Source: CoinDesk

Value of Bitcoin against US Dollars. Source: CoinDesk

China leading

China has been a major driving force behind the value spikes. According to a CoinDesk review, Chinese miners and exchanges like Okcoin, Huobu, BTCC, Bitfinex and LakeBTC have dominated Bitcoin trading in 2016.

Following capital outflow, the People's Bank of China imposed restrictions on Renminbi. The Chinese have outsmarted the central bank's capital control by switching over to decentralised currencies. Investors put their confidence in Bitcoin as the value of Chinese currency fell by 7 per cent in 2016. Deprecation of yuan is further pushing up demand for Bitcoin in the country. The volume of Bitcoin trading is still on the rise there.

Fewer Bitcoins

Miners keep the Bitcoins they produce by solving difficult mathematical problems with computer power. Each day, new Bitcoins are generated, but the coins' flow is regulated by varying the complexity of the problems. Miners typically produce one block every ten minutes. On July 9, 2016, Bitcoin halved its rewards to miners—instead of 25 BTC they get only 12.5 BTC—leading to a shortage of supply. The outcome was a bullish trend in its value. As of now, there are about 15 million coins worth more $15 billion at its current value.

Interest rates

The Bitcoin community has been earning handsome returns on their investments—82 per cent annually. The fall in bond yields and low returns from regular currencies are pushing investors to the safest virtual currency. Assets in Bitcoin as an alternative investment will be a bigger trend in 2017.

Currency wars

Cryptocurrencies have gained credibility owing to cold currency wars. Tougher controls by central banks coupled with political instability have increased search for a borderless currency. More wealthy people are putting money outside geographical boundaries. For them, Bitcoin is a safe haven for their assets or a hedging mechanism against instability in global currency markets. Bitcoin has attracted more people as an uncorrelated asset and capitalised on the strong market momentum.

Demonetisation of larger currencies in many countries may find increasing demand for Bitcoins from these countries.

Liberty Teller staff helps a person purchase Bitcoin from a Bitcoin ATM in Boston, Massachusetts. File photo: AFP

Liberty Teller staff helps a person purchase Bitcoin from a Bitcoin ATM in Boston, Massachusetts. File photo: AFP

Transaction volume

Since its launch in 2009, Bitcoin has survived many downfalls—it was declared dead many times. Now it is seen as the best way to transfer money confidentially and without interference. Sharp fluctuations in value have only made Bitcoin more resilient. In the summer of 2015, a clash in the Bitcoin community over the size of the blocks led to a fall of 21 per cent in value in just about three weeks. Soon after the clash was over, the demand for Bitcoin shot up.

The user base of Bitcoin has been widening. With the rise in the network and users, the transaction volume too has multiplied. The increase in trade has made a positive impact on its value.

Technological gains

Technological advancements through better apps, digital wallets, software security and faster connectivity greatly improved the infrastructure of cryptocurrencies. Innovations in blockchains and privacy of transaction have made them more acceptable. Innovations have helped improve fungility—all Bitcoins have same value irrespective of its past ownership—of transactions.

Increased uncertainties

Political uncertainties have bolstered the value of the strongest virtual currency. Britain's decision to leave the European Union has shot up Bitcoin price. Large volumes of Bitcoin were traded before and after the Brexit referendum.

Uncertainties over the Trump's presidency have too helped the Bitcoin gain. When stock markets declined worldwide after Donald Trump was declared the winner in the US presidential election, the value of Bitcoins appreciated by 4 per cent in one day.

Digital future

Continuing deflationary trends in the global market and gold losing its sheen are favourable factors for the virtual currency. Currency market observers assert newer highs for Bitcoins this year.

Bitcoin logo at a trade show in in New York. Bitcoin users exchange cash for digital money using online exchanges, then store it in a computer program that serves as a wallet. The program can transfer payments directly to shops or individuals around the world, eliminating transaction fees and the need for bank or credit card information. File photo: AP

Bitcoin logo at a trade show in in New York. Bitcoin users exchange cash for digital money using online exchanges, then store it in a computer program that serves as a wallet. The program can transfer payments directly to shops or individuals around the world, eliminating transaction fees and the need for bank or credit card information. File photo: AP