HDFC Bank, the country's largest private sector lender has raised its marginal cost of funds-based lending rate (MCLR) by 35 basis points. Several other banks, including the country's largest lender State Bank, have raised their lending rates over the last few weeks.

Like it or not, lending rates are going to go up further as the Reserve Bank of India (RBI) tightens liquidity and raises its repo rate in a bid to tame high inflation.

In a surprise move last month, RBI raised repo rate by 40 basis points in an out-of-turn MPC meet.

On Wednesday, most economists see the central bank's monetary policy committee (MPC) raising the rate at which it lends commercial banks further; the expectation varies from 25 basis points to 50 basis points.

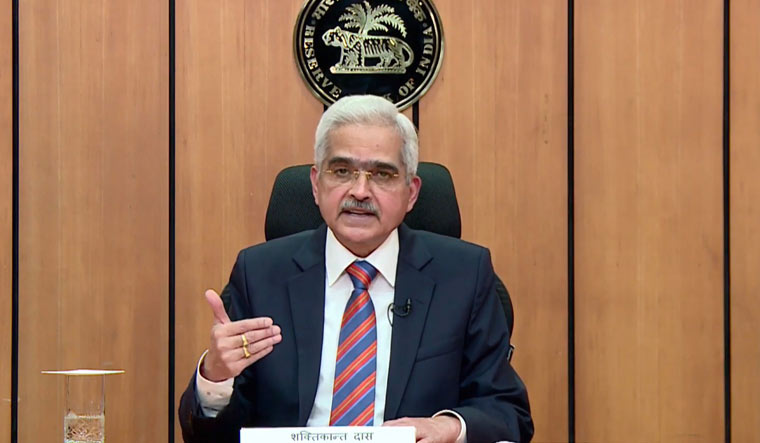

Governor Shakti Shaktikanta Das had said in a recent TV interview that expectation of rate hike in the next MPC meet was a "no brainer."

For long, the RBI has focused on supporting growth at a time the Covid-19 pandemic had hit hard. But, the Russia-Ukraine conflict, supply-side bottlenecks and a surge in crude oil and other commodity prices have led to a sharp rise in inflation.

Retail inflation in April touched an eight-year high of 7.79 per cent, which was well above RBI's upper end of the target band of 2-6 per cent. Inflation in March, too, had been above the upper end of the target at 6.95 per cent.

Globally central banks are raising interest rates with inflation hitting multi-decade highs in countries like the US. This global monetary tightening and a strengthening US dollar will also weigh on RBI's actions.

The rate hikes come even as GDP growth remains slow. Latest data showed GDP growth has slowed from 20.1 per cent in the April-June quarter to 4.1 per cent in the Jan-March quarter.

It is "not an easy job for the central banker," said Indranil Pan, chief economist at Yes Bank.

"We see the RBI extending its 40 bps repo hike of May with a 35 bps increase in June, followed by 25 bps each in August and September. By this time, we expect the global growth to have softened enough to pull down commodity prices and thus provide some comfort to the domestic inflation cycle too," he said.

Shanti Ekambaram, group president - consumer banking, Kotak Mahindra Bank expects repo rate to be raised by 35-50 bps on Wednesday.

"It is likely that the RBI's stance will be 'neutral' while it will stay committed to bringing back inflation closer to the targeted levels through all possible instruments. Based on inflation data and external factors, including oil and commodity prices, expect a total of 100 to 150 bps increase in repo rate from the current 4.40 per cent," said Ekambaram.

In the last MPC meeting in April, the RBI had raised its inflation forecast for 2022-23 to 5.7 per cent from 4.5 per cent. It is expected to further revise this forecast upwards this time around.

"Inflation management is tricky as the real repo rate is deeply negative at -3.4 per cent (4.4 per cent - headline CPI at 7.8 per cent) and -2.6 per cent assuming core inflation of 7%. Thus, to arrive at a neutral real rate of 1 per cent, RBI will have to substantially increase the repo rate and tighten liquidity," pointed Dhananjay Sinha, MD and head – strategist , JM Financial Institutional Securities.

He sees RBI raising repo rate by 150 bps over the next 12-months, with a 40-50 bps hike on June 8.

In recent weeks, the government has taken some steps to reign in prices. For instance, central excise duty on petrol and diesel was reduced by Rs 8 and Rs 6 per litre respectively.

If this and other measures help cool inflation at least to some extent, it may open up some room for RBI to go slow on future rate hikes, say analysts.

"We expect that the RBI will hike the repo rate by another 35-40 basis points in the June meeting. However, we will not be surprised if they prefer to go slow on rate hikes given the government is also responding to the inflation risks. The recent announcement on fuel tax cuts and reduction of import duties on edible oils will provide some comfort to the RBI," said Pankaj Pathak, Fund Manager-Fixed Income, Quantum Asset Management.

So, at least in the next few months, expect your EMIs to go up as lending rates rise. But, banks are also raising their deposit rates. That could offer some good news for savers amid volatile capital markets.