At a time global central banks are rushing to end their pandemic-era easy money policies and are turning more hawkish amid a surge in inflation, the Reserve Bank of India (RBI) continues to sing a different tune. Contrary to expectations, the monetary policy committee of the RBI on Thursday left key interest rates unchanged and also retained its “accommodative” stance, as it believes nurturing growth is still key, compared with inflation, which it expects will peak this quarter and then moderate.

Flagging the potential downside risks to economic activity from the highly contagious Omicron variant of Covid-19, the MPC unanimously left the repo rate unchanged at 4 per cent. The reverse repo rate was also left unchanged at 3.35 per cent. The decision to maintain an accommodative stance though was not as unanimous, with one member, Professor Jayanth Varma expressing reservations on this front.

RBI Governor Shaktikanta Das, while noting that the pace of infections due to the Omicron variant was moderating quickly, pointed to some loss of momentum in economic activity reflected in high frequency indicators like manufacturing as well as services purchasing managers index and sale of tractors, two-wheeler and passenger vehicles. Demand for contact-intensive services too remained muted, he said.

He also said that headline inflation was likely to peak in this January-March quarter within the tolerance band and then moderate closer to target in the second half of the next financial year. The RBI has a medium term consumer inflation target of 4 per cent, within a band of 2 per cent to 6 per cent.

“Taking into consideration the outlook for inflation and growth, in particular the comfort provided by the improving inflation outlook, the uncertainties related to Omicron and global spillovers, the MPC was of the view that continued policy support is warranted for a durable and broad-based recovery,” said Das.

Retail inflation in December 2021 hit a five-month high of 5.59 per cent. RBI sees retail inflation at 5.7 per cent in the March quarter, but then fall to 4.9 per cent in the April-June quarter.

Overall, for the current financial year, RBI has retained its retail inflation forecast at 5.3 per cent and sees inflation at 4.5 per cent for 2022-23, although Das flagged hardening of crude oil prices as a “major upside risk to the inflation outlook.”

Brent crude oil prices have surged, testing $95 a barrel, as economies rebound, and geo-political tensions fuelled by the Russia-Ukraine crisis rise. Domestically, while retail fuel prices have remained steady, they are expected to spike sharply in March, once the various state assembly elections are over. A sharp rise in fuel prices could also drive transport and logistics costs higher, adding in to upside inflation risks. Therefore, analysts feel, the central bank could have used this policy meet to start its monetary policy normalisation.

For instance, Suvodeep Rakshit, senior economist at Kotak Institutional Equities, had hoped that the RBI would raise the reverse repo rate by at least 20 basis points.

“Today’s policy risks sharper adjustments if inflation risks materialise. Inflation risks, especially from fuel prices, remains a concern and can materialise relatively soon,” he said.

Rakshit expects the consumer inflation in 2022-23 will be at 5 per cent, 50 bps higher than RBI’s expectations.

The RBI, though still feels, that there needs to be continued support for driving growth. Das pointed that real GDP growth of 9.2 per cent in 2021-22 will take it “modestly above” the level of GDP in 2019-20. Private consumption, the mainstay of domestic demand, continued to trail its pre-pandemic level, he further said.

“The persistent increase in international commodity prices, surge in volatility of global financial markets and global supply bottlenecks can exacerbate risks to the outlook,” said Das.

For the 2022-23 financial year, real GDP growth has been projected at 7.8 per cent; with the June quarter GDP growth expected to come in at 17.2 per cent (April-June quarter last year was hit by the deadly second wave of COVID19).

“At the current juncture, the conduct of domestic monetary policy is primarily attuned to the evolving inflation and growth dynamics even as we remain watchful of spillovers from the uncertain global developments and divergent monetary policy responses,” said Das.

He further added that the monetary policy would continue to be guided by its primary mandate of price stability over the medium term, while also ensuring a strong and sustained

economic recovery.

Das said that despite the pandemic-induced bouts of volatility, India’s financial system had been resilient and was now in a better position to meet credit demands as economic recovery takes hold and investment activity picks up.

The balance sheets of scheduled commercial banks are also “relatively stronger,” with higher capital adequacy, reduced non-performing assets, higher provisioning cover and improved profitability in coming years, he noted.

However, one needed to be watchful said Das, advising banks and other financial entities to further strengthen their corporate governance and risk management strategies to build resilience in an increasingly dynamic and uncertain economic environment.

In May and June 2021, when India was battling the second wave of the pandemic, the RBI had announced on-tap liquidity facilities of Rs 50,000 crore and Rs 15,000 crore for emergency health services and contact-intensive sectors, respectively. The two schemes have been further expanded to June 30, 2022 from March 31, 2022, in the wake of the ongoing wave of COVID.

Even as the RBI left its benchmark repo rate unchanged for the tenth consecutive time, it has over the last few months, begun mopping excess liquidity in the system via various variable rate reverse repo (VRRR) auctions. Das noted on Thursday that with the progressive return to normalcy, it was logical to restore the revised liquidity management.

In this context, variable rate repo operations of varying tenors will henceforth be conducted by the RBI as and when warranted by the evolving liquidity and financial conditions. Further, variable rate repos (VRRs) and variable rate reverse repos (VRRRs) of 14-day tenor will operate as the main liquidity management tool based on liquidity conditions, the RBI added.

The timing of availability of fixed rate reverse repo and MSF (marginal standing facility) operations has also been curtailed to between 17:30 and 23:59 hours on all days, versus earlier 09:00 to 23:59 hours instituted in March 2020 to deal with the pandemic.

Contrary to expectations, the RBI MPC didn’t bite the bullet this time around and remained dovish even as inflation concerns loomed and global central banks began tightening their policies. But, as Das himself, pointed, “we are living in a world of knightian uncertainty in the absence of determinate knowledge about the next mutation of Covid-19.”

How things pan out on the pandemic front will well determine the future course of action of the RBI.

RBI continues to focus on growth over inflation; keeps repo, reverse repo rates on hold

RBI retained retail inflation forecast at 5.3 per cent

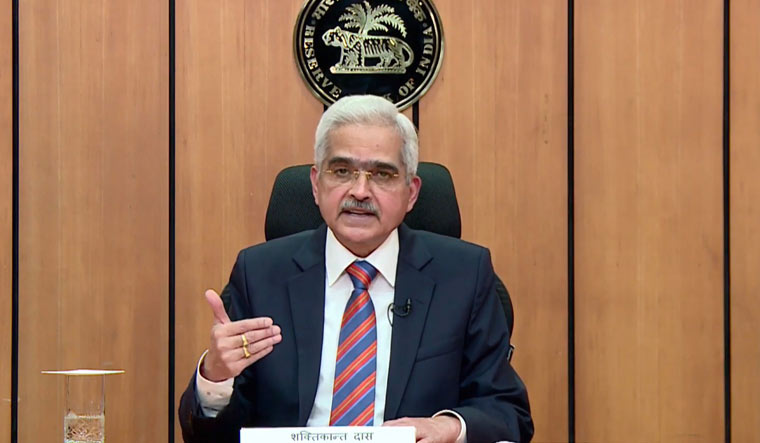

RBI Governor Shaktikanta Das announces the central bank's monetary policy decisions | PTI

RBI Governor Shaktikanta Das announces the central bank's monetary policy decisions | PTI

TAGS

📣 The Week is now on Telegram. Click here to join our channel (@TheWeekmagazine) and stay updated with the latest headlines

read more

-

Gaza war: World Central Kitchen to resume aid supply after staff deaths in Israeli airstrike

-

Naxalite killed in encounter with security personnel in Chhattisgarh's Sukma

-

Real-life 'Baby Reindeer' stalker claims she is victim; says Gadd is using show to stalk her now

-

CSK vs SRH: Ruturaj Gaikwad's fine form resumes, Yellow Army make 212/3

-

Nature conservation works, and we're getting better at it

*Articles appearing as INFOCUS/THE WEEK FOCUS are marketing initiatives