Highlights:

· The Nifty PSU Bank Index captures the performance of the PSU banks that are traded on the National Stock Exchange.

· Nifty PSU Banks are relatively undervalued as against their Private peers indicating an opportunity to invest in the good dividend yielding ETF*

Mumbai: ICICI Prudential Mutual Fund has announced the launch of ICICI Prudential Nifty PSU Bank ETF, an open-ended exchange traded fund tracking Nifty PSU Bank Index. The ETF will reflect the performance of 12 PSU bank companies which form a part of the index.

Speaking on the launch of the product, Mr Chintan Haria, Head – Investment Strategy, ICICI Prudential AMC said, “Over the past decade, PSU banks have undergone a transformation on account of their improving efficiency, customer centric approach, technological superiority and improving risk management frameworks. As a result, since 2018, net NPAs have fallen by over 65% while capital adequacy ratio has risen by almost 15%. This improvement is reflected in equity market as well, with the Nifty PSU Bank TRI delivering better returns than both Nifty 50 TRI and Nifty Bank TRI over the last few years.”

In 2022, while there were broad-based gains in the banking pack, it was public sector banks that lead the rally. Investors may consider investing periodically as it enables to accumulate more units during times of market correction. This helps enhance returns when markets head higher due to lower average unit purchase cost.

Why Invest in the ICICI Prudential Nifty PSU Bank ETF?

• Robust Demand – Banks intermediate by accepting deposits and lending money to those in need thereby facilitating optimum utilization of scarce resources

• Economic Growth – PSU Banks have effectively captured the GDP growth of the country due to it being a beneficiary from all sectors of the economy

• Improving Asset Quality – Asset quality is improving due to reforms which may lead to risk reduction and higher returns

• Low Capital Requirement – For a minimum investment amount of Rs.1000, an investor gets the opportunity to invest in most of the biggest banks in the country

Fundamentals of PSU Bank Index

Nifty PSU Banks are relatively undervalued as against their private peers indicating an opportunity for investors to invest in the good dividend yielding ETF.

Data as on 31st January 2023. Source: www.niftyindices.com The price-to-earnings (P/E) ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings. The price-to-book (P/B) ratio measures the market's valuation of a company relative to its book value. The dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price. Dividend yielding index does not signify that ICICI Prudential Nifty PSU Bank ETF will pay any dividend/ IDCW to investors.

Growth of PSU Banks

Quantum jump in market capitalization of PSU banks in the last 10 years

sector(s)/stock(s) mentioned in this document do not constitute any recommendation of the same and ICICI Prudential Mutual Fund may or may not have any future positions in the sector(s)/stock(s). The stocks are forming part of the underlying index as on 28th February 2023. The above stocks form part of Index Constituents mentioned in the SID. Companies/Stocks mentioned above are top holdings basis Market Capitalization in Nifty PSU Bank Index as on February 28, 2023. Source NSE India. 10 Year CAGR of Marketcap is used. Past performance may or may not be sustained in future.

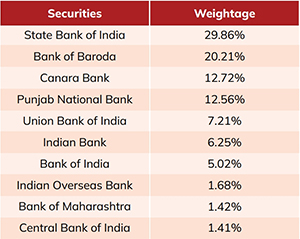

Top 10 Index Constituents

The Nifty PSU Bank Index captures the performance of the PSU Banks that are traded at the National Stock Exchange (NSE).

Data as on 28th February, 2023. Source: www.niftyindices.com . The performance of the index does not signify performance of the scheme.

-x-

For further information, please contact:

Roshni Rohira, Eminence Strategy Consulting

Email: Roshni@eminencestrategy.com, Mobile: +91-9769383310

Riskometer & Disclaimers:

and may vary post NFO, when the actual investments are made. The same shall be updated in accordance with provisions of SEBI circular dated October 5, 2020 on Product labelling in mutual fund schemes on ongoing basis.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

*The dividend yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price. Dividend yielding index does not signify that ICICI Prudential Nifty PSU Bank ETF will pay any dividend/ IDCW to investors.

Disclaimer of BSE Limited: It is to be distinctly understood that the permission given by BSE Limited should not in any way be deemed or construed that the SID has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the SID. The investors are advised to refer to the SID for the full text of the Disclaimer clause of the BSE Limited.

Disclaimer of National Stock Exchange of India Limited: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the 'Disclaimer Clause of NSE"

Disclaimer of NSE Indices Limited (NSE Indices): The Product(s) are not sponsored, endorsed, sold or promoted by NSE Indices Limited (" NSE Indices"). NSE Indices does not make any representation or warranty, express or implied, to the owners of the Product(s) or any member of the public regarding the advisability of investing in securities generally or in the Product(s) particularly or the ability of the Nifty PSU Bank Index to track general stock market performance in India. The relationship of NSE Indices to the Issuer is only in respect of the licensing of certain trademarks and trade names of its Index which is determined, composed and calculated by NSE Indices without regard to the Issuer or the Product(s). NSE Indices does not have any obligation to take the needs of the Issuer or the owners of the Product(s) into consideration in determining, composing or calculating the Nifty PSU Bank Index. NSE Indices is not responsible for or has participated in the determination of the timing of, prices at, or quantities of the Product(s) to be issued or in the determination or calculation of the equation by which the Product(s) is to be converted into cash. NSE Indices has no obligation or liability in connection with the administration, marketing or trading of the Product(s).

NSE Indices do not guarantee the accuracy and/or the completeness of the Nifty PSU Bank Index or any data included therein and they shall have no liability for any errors, omissions, or interruptions therein. NSE Indices does not make any warranty, express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person or entity from the use of the Nifty PSU Bank Index or any data included therein. NSE Indices makes no express or implied warranties, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the index or any data included therein. Without limiting any of the foregoing, NSE Indices expressly disclaim any and all liability for any damages or losses arising out of or related to the Products, including any and all direct, special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.