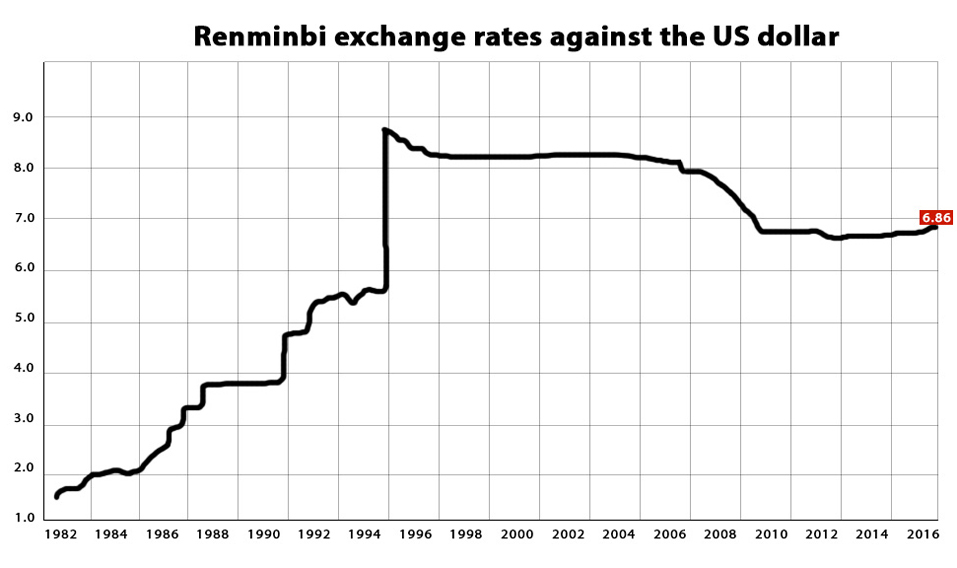

The value of Chinese yuan (CNY) has fallen sharply against the US dollar. As the renminbi (RMB: official name of Chinese currency, meaning people's currency—its unit is yuan) touched its eight-year-old low against the US dollar, the Chinese central bank intervened in the currency market to prevent further downfall. Since August, People's Bank of China has disposed of half a trillion US dollars to stabilise yuan.

From middle class to millionaires, Chinese people have rushed to exchange RMB for foreign currencies. A Bloomberg report, quoting the People's Bank of China, said household deposits soared 8.1 per cent in January to touch $97.4 billion, the biggest since the central bank started pursuing the data in 2011. In October, the holding has reached a record high of $113.1 billion, putting further downward pressure on yuan.

As the authorities enforced stricter norms on currency outflow, people opted for alternative investment portfolio like cryptocurrency. They have exchanged yuan for bitcoin—as the CNY fell, the bitcoin has risen.

With the foreign exchange reserves slipping down, the Chinese government enforced capital control regime with stricter norms for currency outflow. Authorities tightened control on overseas investments that halted acquisition of foreign companies.

The central bank has begun strict monitoring of yuan moving out of the country. The annual foreign exchange quota for Chinese citizen is $50,000. Till October this year, yuan payment equivalent to $275 billion left China, up from $101.5 billion during the same period last year.

PBoC is concerned that hoarded currency in households may easily find its way out of the country as yuan has been predicted to fall further. The dollar has been appreciating steadily since Donald Trump's victory. It is likely to strengthen further in the coming weeks as the US Federal Reserve is expected to announce a hike in its interest rate.

Fear of devaluation

Can renminbi be blamed for the economic woes of the United States? President-elect Donald Trump says China is a 'currency manipulator' that it keeps RMB artificially low to make China goods more competitive in the US market. He said China’s trade and currency policy had led to job loss in the US. According rough estimates, the USA has lost around 6 million jobs, owing to cheaper imports from Asian countries, mostly from China.

During the campaign trail, Trump called for a 45 per cent tariff on Chinese products sold in the US. Lately, during the 'Thank You Tour', Trump warned US companies against shifting their production bases to countries like China and Mexico.

China, being world’s largest exporter of manufactured goods, gains from an undervalued Yuan. The US has a huge trade deficit with China—it rose to $365.7 billion in 2015 from the previous year's $343 billion. Thanks to currency devaluation, China's trade deficit has widened with its trading partners. Though yuan is at its weakest since the global financial crisis of January 2009, many economists believe it is still undervalued.

Fix at 9.15am

Devaluation of currency has been proved to have adverse effect on trading partners. But how does China manage its currency?

The exchange rate of yuan is pegged to a basket of 13 foreign currencies with dollar occupying a dominant place. Depending on the movements of the components of these currencies, the central bank of China fixes and announces the exchange rate every morning at 9.15 am Beijing time. Though based on demand and supply, market pulls, too, play a role in this system of managed floating exchange rate.

People's Bank of China

People's Bank of China

However, China cannot be singled out for currency 'manipulation'. Governments all over the world are concerned about their currency exchange rates as they directly influence the economy. No currency is allowed to float freely and virtually every nation controls flow of currency in one way or other. For instance, the US Federal Reserve keeps changing the interest rate to control flow of cash.

China has huge holdings of US Treasury bonds. The profit earned from the US market is invested there itself and not spent at home to avoid inflation. If China dumps its treasury holdings, the US dollar will start collapsing. But the risk is that value of Chinese holdings may also suffer. Conservatives in the US are angry that China buys a piece of US after selling goods in their land.

Yuan was added to IMF's basket of global currencies along with US dollar, euro, yen and pound in October this year. The challenge before PBoC governor Zhou Xiaochuan is to maintain an exchange rate for yuan which is cheap enough to make Chinese exports competitive but not so low as to encourage capital outflow.