Adi’s spell was truly great,” said Nadir Godrej in a touching tribute to his older brother, when Adi Godrej stepped down as chairman of Godrej Industries in August 2021 and passed on the mantle to him.

It was, indeed. Under Adi’s leadership, the group’s flagship, Godrej Consumer Products (GCPL), grew from being a homegrown consumer goods maker to a multinational company with a strong presence in south east Asia, Africa and Latin America. And Godrej Properties became one of the top real estate firms with projects countrywide.

Nadir seems to have filled his brother’s big shoes comfortably, as Godrej continues to expand into newer areas like financial services and sexual wellness, and its overseas operations rapidly growing through acquisitions. It bought Megasari in Indonesia, Darling Group in Africa, Issue Group and Argencos in Latin America, and Strength of Nature in the US, among many other companies in the past decade. And, there seems to be appetite for more.

In India, however, the group has been more discreet. It recently bought the consumer care business of Raymond for Rs2,825 crore. The last acquisition before that was almost three decades ago when it bought Transelektra Domestic Products, bringing the Goodknight brand into its fold.

The acquisition of Raymond’s consumer care business gives GCPL access to two popular brands―Park Avenue and Kamasutra. While Park Avenue is strong in deodorants and has a fairly strong recall in male grooming, Kamasutra will give GCPL access to the fast-growing sexual wellness segment. Godrej had tried its hands at deodorants through its Cinthol brand, but with limited success. “Cinthol has a strong brand equity, but not necessarily in the deodorant space,” said Sameer Shah, chief financial officer of GCPL. “What we saw in Park Avenue is very strong brand equity and market share. It is the second largest player along with the Kamasutra brand and has significant cost synergies.”

GCPL believes deodorants could be the next sunrise sector in the country. “We see significant headroom for growth over two-three decades. There is also a significant opportunity in premiumising condoms,” said Shah.

While there is no doubt that the acquisition is a sound move, there have been concerns over the valuation. “The valuation of 55 times EBITDA (earnings before interest, taxes, depreciation and amortization in financial year 2023) looks stretched,” said Varun Lohchab, head of institutional research at HDFC Securities. In comparison, investor KKR bought stake in Vini Cosmetics (the market leader in deodorants with stronger financials) at a valuation of 35 times earnings (EBITDA in financial year 2022).

Last year, FMCG companies faced subdued demand, especially in rural markets. But, things are picking up. “Domestic volumes grew 11 per cent (in the January-March quarter), a function of healthy growth in soaps and sustained recovery in household insecticides,” said Richard Liu, analyst at JM Financial Institutional Securities.

India remains GCPL’s largest market, though more than 40 per cent of its revenue now comes from overseas markets like Indonesia, Africa, the Middle East and Latin America. Revenue from Africa alone was Rs3,415 crore last year.

Godrej is now simplifying its international operations, essentially revisiting operating models and focusing on reducing complexities. “In Nigeria, for example, we have outsourced our entire distribution. We do not have a sales force there now. It may come at a percentage higher cost, but we get significant distribution reach,” said Shah.

The Indian FMCG market is a crowded space now, with many new entrants tapping into niche and low-penetrated categories. GCPL is eyeing this space. It is investing Rs100 crore in Early Spring, a Rs300-crore early-stage consumer fund. The aim is to collaborate with new-age companies in the home and personal care, and the health and wellness spaces. “We intend to leverage our understanding over the past decades to enable early-stage founders offer differentiated products in India,” said Omar Momin, head of mergers and acquisitions at GCPL.

The Godrejs have set up a family office as well, with the intention of investing in new-age businesses. Adi’s son Pirojsha, who is the executive chairperson of Godrej Properties, oversees it. Nadir has also invested in his personal capacity in Hector Beverages, which sells juices and traditional beverages under the Paper Boat brand.

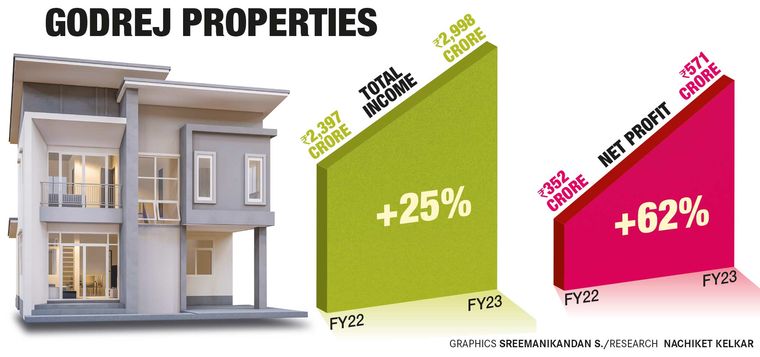

Unlike FMCG, where companies faced demand issues last year, real estate companies benefited from a boom in the residential market. Godrej Properties rode this boom to establish itself as a strong national player, with projects across India. It saw its highest ever annual sales last year, with booking value surging 56 per cent to Rs12,232 crore and 40 per cent volume growth.

“We closed financial year 2023 as our best-ever for business development, with the addition of 18 new products with an expected combined revenue potential of over Rs32,000 crore, more than double the guidance of Rs15,000 crores given at the start of the year, and growing by more than 250 per cent from the previous year’s actual,” said Pirojsha.

Synergies have always been a key factor Godrej has looked for when entering or acquiring new businesses. The strong brand name in the real estate market seems to have encouraged the group to venture into financial services. Godrej launched Godrej Capital in November 2020, providing home loans to customers buying houses in Godrej Properties projects. It quickly scaled up the operations to offer not just home loans to a wider customer base, but also loans against property and finance to small enterprises.

“There are very clear advantages that we have because we are part of the Godrej group,” said Manish Shah, managing director and CEO of Godrej Capital. “One is just the strength of the brand and what it means to the Indian consumer. Second, financial strengths that come from internally as a group being quite low-leveraged and at the same time the quality of the relationships that we have with banks. The third is access to the customer ecosystems.”

At launch, Godrej Capital had targeted to have Rs10,000 crore of assets in three years. In its third year, it has a book of Rs6,000 crore and expects to close the year with assets of close to Rs12,000 crore. As it looks to scale up the business, Godrej Capital is expanding to other areas like loans for working capital and supply chain finance. Affordable housing is also of immense interest to Godrej Capital.

The promoters have invested Rs1,500 crore in Godrej Capital and have committed 01,200 crore more, which is likely to be invested in the current financial year. The company is hopeful of having a Rs50,000 crore asset book in five years.

Godrej Capital will face tough challenge from companies that are significantly larger and have wide networks. For instance, assets under management at the country’s largest mortgage lender, Housing Development Finance Corporation (HDFC), was Rs7.23 lakh crore at the end of March 2023. Even the non-banking finance company Piramal Enterprises had assets of Rs63,989 crore last financial year.

Nadir admitted that Godrej Agrovet had a difficult year in 2022-23. The company entered the dairy business in 2015, acquiring Creamline Dairy Products. It sells milk and milk products under the Jersey brand and is mainly present in south India. It plans to scale up the business across the country, but has been facing speed bumps. For instance, owing to the rise in milk procurement costs and a weak flush season due to unseasonal rains and the lumpy skin disease outbreak, the dairy business reported a loss of Rs11 crore in 2022-23, even as the revenue rose 28 per cent to Rs1,501 crore.

The company recently opened a new research and development centre called Adi Godrej Centre for Chemical Research and Development. Nadir said it would help in accelerating growth in the contract manufacturing segment. “A big thing would be the focus on disproportionately growing, less volatile revenue streams, which would include value-added categories in dairy, licensing products in crop protection and contract manufacturing in Astec Lifesciences,” he said.

In the animal protein business, Godrej Tyson is strategically shifting focus to branded products, gradually reducing its emphasis on live bird sales.

Godrej is one of the largest oleochemicals (chemicals derived from natural fats and oils) makers in the world, and it exports a range chemicals like fatty acids, glycerine and surfactants. (Substances that reduce the surface tension of a liquid in which it is dissolved. They are widely used in detergents.) “We are growing more and more in biologicals,” said Nadir. “We have a new biological sophorolipids (bio-based antimicrobial formulating agents), which is a powerful surfactant. It is antibacterial and antiviral.”

With FMCG and real estate expected to continue the good show and the agri business likely to recover, Godrej Industries is looking at another strong year. The financial services business could add further strength in the years to come.