Press Release

₹ 1 lakh invested in the scheme at inception has grown to ₹ 2.51 lakh compared to ₹ 2.06 lakh in Nifty 500 TRI

Mumbai, February 11, 2026: ICICI Prudential Business Cycle Fund (the Scheme), an open ended equity scheme following a business-cycle-based investing theme, has completed five years since inception, marked by consistent performance across varying market conditions.

Launched on January 18, 2021, the Scheme aims to opportunistically invest across sectors and themes based on the prevailing stage of the business cycle, with the objective of generating long-term capital appreciation. The investment approach is rooted in identifying macroeconomic trends and dynamically allocating capital to sectors positioned to benefit from different phases of the economic cycle.

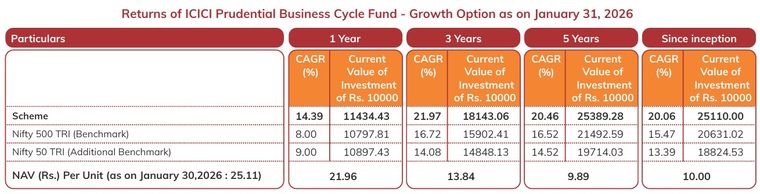

A lump sum investment of Rs 1 lakh at the time of inception (January 18, 2021), as of January 31, 2026, would be approximately worth Rs. 2.51 lakh, i.e. a CAGR of 20.06%. A similar investment in Scheme benchmark (Nifty 500 TRI) would have yielded Rs. 2.06 lakh i.e. a CAGR of 15.47%.

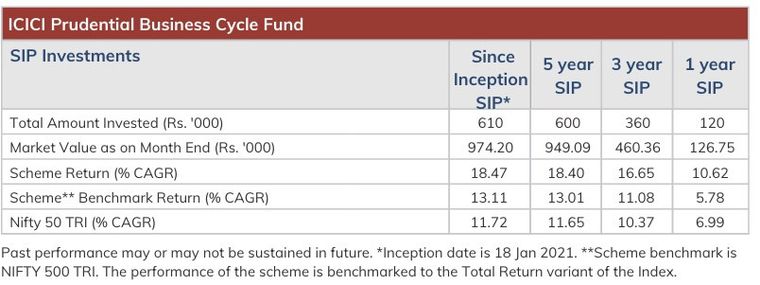

In terms of SIP performance, a monthly investment of Rs. 10,000 via SIP since the inception which would amount to a total investment of Rs 6.10 lakh would have grown to approximately Rs. 9.74 lakh as of January 31, 2026 i.e. a CAGR of 18.47%. A similar investment in the Scheme’s benchmark would have yielded a CAGR of 13.11%.

The returns are calculated by XIRR approach assuming investment of Rs 10000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and final value and a series of cash inflows and outflows with the correct allowance for the time impact of the transactions.

Over the five-year period since launch, the fund has grown reasonably, reflecting the effectiveness of its business-cycle-driven allocation strategy across phases of recovery, expansion, and slowdown.

The Scheme follows a top-down investment approach, guided by a range of macroeconomic indicators such as growth trends, inflation, interest rates, fiscal dynamics, and global economic conditions. Based on the assessment of the prevailing business cycle, the AMC identifies suitable sectors and themes, following which stock selection is undertaken within those segments.

S Naren, ED & CIO, ICICI Prudential AMC said, “A large part of India’s economy is inherently cyclical, and equity leadership tends to shift as the business cycle evolves. Our focus is on understanding where the Indian and global economy are positioned in the cycle and aligning sector exposure accordingly over a three-to-four-year horizon. The business-cycle approach emphasises identifying inflection points where sentiment and fundamentals diverge. History shows that disciplined, data-driven calls at such turning points can be rewarding for long-term investors.”

The Scheme follows a cycle-aware approach, positioning the portfolio to benefit from shifts in the domestic and global business cycle while maintaining a relatively high-conviction structure. As of January 31, 2026, the portfolio is predominantly tilted towards domestic-facing sectors*, with close to 80% of assets aligned to areas expected to benefit from improving economic activity. Financials form the core allocation, supported by exposure to automobiles, construction and select industrial segments, while maintaining tactical cash levels for flexibility. This positioning reflects a focus on sectors where earnings recovery, balance-sheet improvement or structural tailwinds are not yet fully reflected in market valuations, enabling the Scheme to seek alpha across varying market conditions. The portfolio positioning remains dynamic and is reviewed periodically in line with evolving macroeconomic conditions.

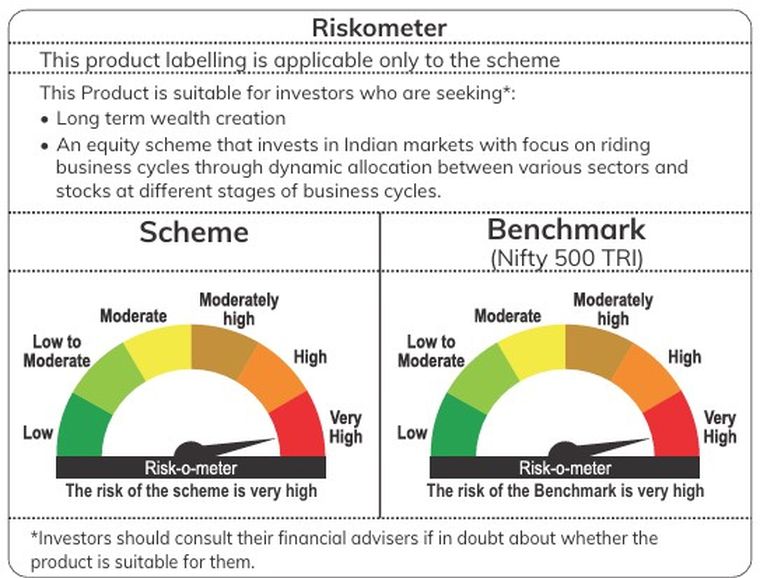

ICICI Prudential Business Cycle Fund is suitable for investors seeking long-term wealth creation and who are comfortable with equity-market volatility, while looking to benefit from a disciplined approach to navigating business cycles through active sector allocation.

-x-

For more information, please contact:

Adil Bakhshi, Principal - PR & Corporate Communication

Email: pr@icicipruamc.com

Phone: 91-22-66470274

Riskometer & Disclaimers:

NOTES:

1. Different plans shall have different expense structure. The performance details provided herein are of ICICI Prudential Business Cycle Fund.

2. The scheme is currently managed by Manish Banthia, Manan Tijoriwala & Divya Jain.

Mr. Manish Banthia has been managing this fund since Jan 2021. Total Schemes managed by the Fund Manager is 25 (25 are jointly managed).

Mr. Manan Tijoriwala has been managing this fund since August, 2025. Total Schemes managed by the Fund Manager is 1 (0 are jointly managed).

Ms. Divya Jain has been managing this fund since Jan 2026. Total Schemes managed by the Fund Manager is 2 (2 are jointly managed). Refer factsheet from page no. 114 for performance of other schemes currently managed by Manish Banthia, Manan Tijoriwala & Divya Jain.

3. Date of inception: 18-Jan-21.

4. Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment.

5. Load is not considered for computation of returns.

6. In case, the start/end date of the concerned period is a non-business date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period

7. NAV is adjusted to the extent of IDCW declared for computation of returns.

8. The performance of the scheme is benchmarked to the Total Return variant of the Index.

9. With effect from January 01, 2026, Divya Jain has been appointed as the fund manager under the scheme.

10. Mr. Anish Tawakley has ceased to be the Fund Manager effective February 05, 2026.

*The list is inclusive and not exhaustive. The stock(s)/sector(s) mentioned do not constitute any recommendation, and ICICI Prudential Mutual Fund may or may not have any future position in these stock(s)/sector(s).

The portfolio of the scheme is subject to changes within the provisions of the Scheme Information Document of the scheme. Please refer to the SID for investment pattern, strategy and risk factors.

Disclaimer and Riskometer

ICICI Prudential Business Cycle Fund - An open ended equity scheme following business cycles based investing theme.

Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis. The above Riskometers areas on Jan 31, 2026. Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.