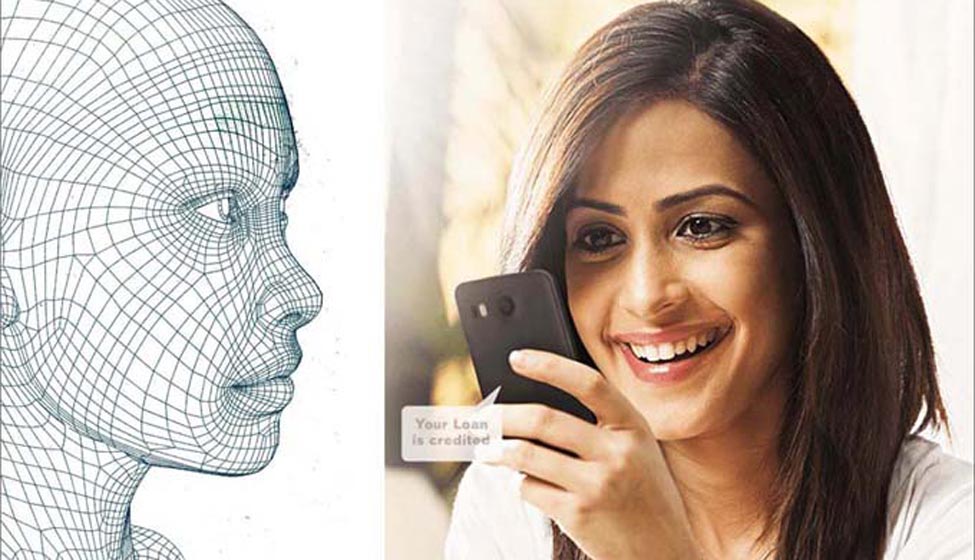

Artificial Intelligence is central to a financial tech startup, CASHe, arguably India's first mobile lending platform. It offers quick, short term loans -- and all the information that is required, can be sent from your mobile phone.

This works well for those to whom regular channels to procure a loan, in an emergency, are blocked, possibly by a low credit rating. CASHe doesn't care. It uses its own AI algorithm called SLQ which trusts your mobile and social networking data rather than looking to a CIBIL.

CASHe developed and implemented an algorithm which allows customers to apply and approves a loan within 8 minutes. While other lending institutions use standard ranking techniques coupled with human intervention, CASHe’s SLQ engine considers everyone to be part of a giant community. Thus it not only focuses on individualistic aspects but also on how everyone is connected to people around them, avoiding being a traditional preconditioned ranking system.

Loans can range from Rs 5000 to Rs 1 lakh. Interest rates will be higher than bank loans—but the young professionals who are its target, don't seem to mind, as the loan periods are usually very short. Average loan size for a 15-day period is Rs 13,000 and for 90 days is Rs 65,000. The age group that most uses CASHe is 25-30 years.

CASHe is founded by Raman Kumar, former founder-CEO of the NASDAQ listed M*Modal Inc, a leading voice recognition, healthcare document technology company that he took from a start-up to a unicorn, sold to One Equity Partners for over a billion dollars in 2012.

CASHe has recorded 100,000 downloads at the Android app store with over 10,000 borrowers and 80% repeat customers within a span of 6 months.