V.G. SIDDHARTHA read Das Kapital when he was studying economics at St Aloysius College, Mangalore. He became an admirer of Karl Marx and was convinced that communism was the best way forward. Then he read about Stalin, and all those communist leaders who lived like kings. He thought it was not fair, and dropped the idea of becoming a communist.

Capitalism’s call was much stronger. He never got out of it. He once prophetically said: “Entrepreneurs don’t retire; they die.”

By most yardsticks Siddhartha, 60, was a successful businessman. He built India’s largest coffee chain from scratch. He was Asia’s largest coffee planter. He created one of the most visible retail brands in India. But, at the end of the day, none of that mattered. And he gave up.

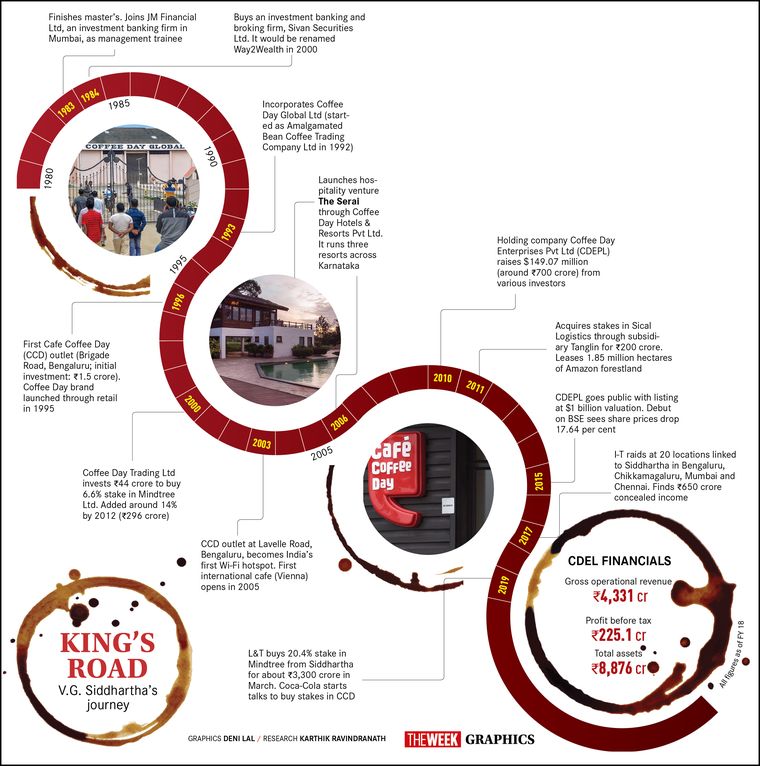

Born into a family of coffee planters in Chikkamagaluru, Karnataka, Siddhartha found his true calling after his education in Mangalore and a stint with JM Financial in Mumbai. He started the Amalgamated Bean Coffee Trading Company in 1992 to export coffee beans from his estates and from other growers. A frost in Brazil in 1994, and his commitment to sell at agreed prices even when coffee prices were soaring helped him become India’s biggest un-roasted coffee exporter.

Siddhartha set up the first Cafe Coffee Day outlet in 1996 on the busy Brigade Road at the heart of Bengaluru. The surf-and-sip cafe was a hit in the city, which was going through an information technology boom, and there was no looking back.

While at college, Siddhartha had wanted to become a soldier. He was depressed that he could not clear the NDA entrance. But he remained a fighter throughout his career. When Starbucks came to India, he spent sleepless nights. And, arguably, he beat the American coffee giant hands down. He always believed that competition made CCD think hard about the business model. “We are still a startup, learning and adaptable,” he once said. “I have stopped worrying.”

What Siddhartha made CCD into was remarkable. “He poured passion into every step of his involvement in the space,” said brand expert Harish Bijoor. “He took a long time doing this, but he did it with passion and perfection, quite like the brew his brand dishes out day in and day out to millions in the country. We speak of experiential branding today as an imperative; Siddhartha offered it to his customers in 1996.”

In a short span of time, CCD became a symbol of the new India. “It is a fully professionally-run organisation,” said Naresh Malhotra, former CEO of CCD. “When I came on board as CEO, Siddhartha gave me a free hand and a lot of freedom to function. He never interfered in my way of working. At the same time he was very shy and never attended functions or went to clubs or made public appearances. He kept to himself.”

The brew turned bitter when Siddhartha started expanding at a rapid pace and diverting money into other businesses. “He wanted to try his hands at multiple things and as a result had multiple exposures that could not take off as expected or were incurring losses,” said Murthy B.S., CEO of LeadershipCapital Consulting, Bengaluru. “To diversify into different businesses he had borrowed a lot of money from multiple sources, including banks. For instance, he had bought huge tracts of land abroad to source raw material for his furniture business. He had dreamt of making this furniture global, but it remained in a transition stage. Besides this, his logistics business, which was privately held, was incurring losses. As a result, he ran into debt and also tax issues.”

Siddhartha’s run-ins with the taxmen were mentioned in a letter he purportedly wrote before he went missing on July 29 from Mangaluru. He blamed a former director general of the income tax department and also pressure from a private equity firm that had forced him to buy back shares. In January, the I-T department had attached his shares worth Rs74.9 lakh of the IT services company Mindtree. Of these, shares worth Rs22.20 lakh were held by Coffee Day Enterprises and Rs52.70 lakh by Siddhartha. It is said that the shares were released only after getting some commitments. Coffee Day Enterprises and Siddhartha recently sold their 21 per cent stake in Mindtree to L&T. In 2017 also I-T sleuths had raided around 20 properties of Siddhartha in Bengaluru, Chikkamagaluru, Mumbai and Chennai.

Senior Congress leader Brijesh Kalappa even said that Siddhartha’s father-in-law, former chief minister S.M. Krishna, joining the BJP was an attempt to save him from the income tax department. “My heart goes out to Shri S.M. Krishna,” said Kalappa. “He tried everything possible to avert a crisis for Siddhartha, even switching loyalties to the BJP at the fag end of his life, but the worst is staring him in the face.”

But it could not have been just the tax woes. Reports say US buyout giant KKR has a debt exposure of around Rs255 crore to CCD and Siddhartha’s personal holding entities. “Once private equity firms come on the board of companies they start keeping a tab of day-to-day affairs of the company and become too intrusive,” said Kris Lakshmikanth, founder and CEO of the executive search firm Head Hunters India. “I feel that Siddhartha’s over-exposure to the stock market and his diversion of funds from CCD may have been scrutinised by the PE firm and it in turn must have put pressure on him.”

It is said that Siddhartha’s exposure to the stock market proved detrimental to him. He had started stock trading at a young age, while working at JM Financial after his postgraduation. Later he started the investment firm Way2Wealth. “No one knows exactly how much money he had borrowed from different sources and where all he invested it,” said Lakshmikanth. “However, one thing is sure that he had invested a lot of money in the stock market, and when the market was doing badly, particularly after the IL&FS crisis, he had lost a lot of money. Since all the stock market investments are on a personal front, it is difficult to gauge the exact exposure and investment he had in the stock market.”

Without Siddhartha, the future of CCD hangs in balance. Experts say it might be taken over by another firm in the long run. Though there were rumours about a possible stake sale to Coca-Cola, it did not materialise. CCD held a board meeting and has appointed S.V. Ranganath as interim chairman of the board and Nitin Bagmane as interim chief operating officer of the company. “Siddhartha’s death may not solve the problems for his successors or the company,” said Alok Shende of Ascentius Consulting. “The liabilities that he has left behind will continue into the future as well.”