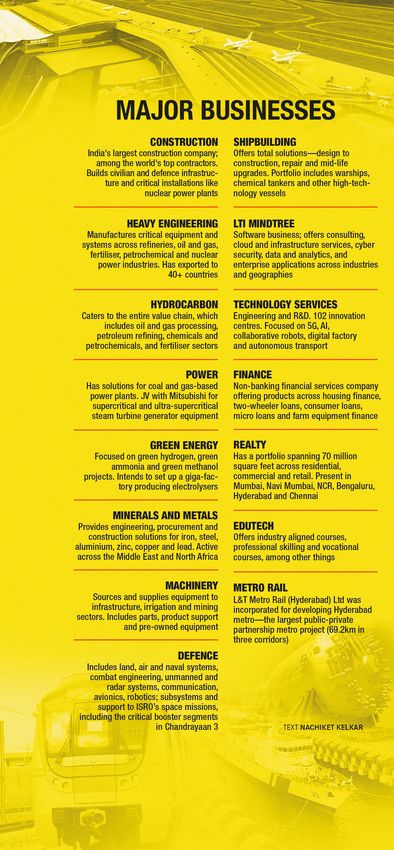

LARSEN & TOUBRO BUILT its reputation as an engineering and construction company. But it is now a lot more than that, with a strong presence in heavy engineering, thermal power plants, defence, information technology, financial services, real estate and smart city projects. And the company is preparing itself for changes in the ecosystem.

S.N. Subrahmanyan, who succeeded A.M. Naik as chairman and managing director on October 1, said in his first letter to the staff that the world was going through massive changes and L&T must be ready for it. Subrahmanyan had been groomed by Naik for almost a decade to steer the company into the future. But that future could well be very different from what the company imagined a while ago. It is restructuring old businesses like financial services and thermal power plants, and embracing new areas like renewable energy and defence.

L&T continues to grow in its core engineering and construction space. Its order inflows last quarter surged 57 per cent to Rs65,520 crore and its order book stood at Rs4.12 lakh crore at the end of June 30, 2023, an all-time high. International orders comprised 42 per cent of total order inflows in the June quarter.

Renewable energy will be a big focus area in this next wave of growth. “Given the compulsions of dealing with climate change and fully aware of the responsibility to contribute to a sustainable planet, the company has identified areas to work around green energy both as a manufacturer of equipment as well as an EPC (engineering, procurement and construction) participant,” said R. Shankar Raman, chief financial officer of L&T.

Already a large player in solar energy, L&T is looking at green hydrogen as a key business in the future, with plans to invest around $4 billion in three to five years along with its partners. It has set up a green hydrogen plant at the A.M. Naik Heavy Engineering Complex in Hazira, Gujarat. The company is also set to build the world’s largest green hydrogen plant in NEOM, an ambitious smart city project in Saudi Arabia.

L&T recently set up a joint venture with ReNew Power and Indian Oil, called GH4India, for developing green hydrogen and its derivatives like green ammonia and methanol. All three companies will have an equal stake in the venture. “As our participation in renewable energy space increases, we see a phased transition from executing fossil fuel plants,” said Shankar Raman. But these are still early days of worldwide energy transition and it would take a few years for the plans to take shape.

Just as the shift in the energy business is nudged by a global movement towards renewable energy, L&T’s financial services business is also undergoing a big change owing to the growing demand for credit among retail customers.

L&T entered the financial services business in 1994 with a non-banking finance company to provide credit to its construction equipment customers. Over time, it built a large wholesale loan book and entered areas like mutual funds and wealth management.

At some point the company was hoping to get a banking licence. But, with the Reserve Bank keeping large corporate houses out of banking and the financial business lagging within L&T Group, the company restructured it. “The business portfolio of financial services business was built keeping in view the possibility of obtaining a banking licence. Given the regulatory stance, such a licence was appearing remote. The company decided to refashion its business portfolio by exiting wholesale lending, project finance, asset management and wealth management,” said Shankar Raman.

A year ago, L&T Finance sold the mutual fund business to HSBC Asset Management for $425 million. Before that, it had sold its wealth management business to IIFL. The company is now focusing on housing finance, consumer loans, farm equipment finance, micro loans and loans to small and medium enterprises. Retail now contributes about 82 per cent of the overall loan mix. The goal is to take it to 90 per cent by March 2024. L&T Finance has roped in former ICICI Bank executive Sudipta Roy as its chief operating officer and he will take charge as managing director and CEO in January 2024, when incumbent Dinanath Dubhashi will superannuate.

It is not surprising, as retail loans have seen tremendous growth across the sector, around 25 per cent a year between March 2021 and March 2023. L&T’s plan is to become “a significant player in retail and rural markets using digital technology and brand as a strong differentiator”, said Shankar Raman. L&T Financial Services is expected to complete its transformation into a digitally-enabled retail powerhouse by the end of the Lakshya 2026 strategic plan.

Lakshya 2026, announced in 2022, envisages group revenue rising to Rs2.7 lakh crore by FY2026. The plan is looking also at strong growth in the IT and technology services as well.

Started in 1996, L&T Infotech has been growing steadily over the years, both organically and inorganically. L&T acquired Bengaluru-based Mindtree in 2019 and the two businesses were merged a year ago, creating the sixth largest IT services firm in India by revenue. LTI Mindtree reported a revenue of Rs33,183 crore and a net profit of Rs4,408 crore in 2022-23. Separately, L&T Technology Services reported a revenue of Rs8,014 crore last year, and a net profit of Rs1,170 crore.

Till about six years ago, the infrastructure vertical contributed almost half of the profits of the group. That has been gradually falling as the IT and technology services businesses have expanded. However, the IT services industry has seen a sharp slowdown in the recent quarters as clients in developed markets have cut back on spends or delayed decisions amid the economic downturn.

Shankar Raman is not too worried about these challenges. “As is the case with every business, IT services business also faces periodical challenges in the form of rapidly changing technology, talent availability, clients’ priorities, policy-induced visa restrictions and wage inflation. We are optimistic about the long-term prospects of all our services businesses,” he said.

In the past few quarters, the market has been worried about the declining margins at L&T, especially in the infrastructure projects segment. In the quarter ended on June 30, margins in the infrastructure projects segment declined to 5.1 per cent from 6.5 per cent. But this is attributed to the legacy projects during the Covid-19 pandemic and high staff costs. “The margin that we are reporting presently is a product of cost committed towards project order book execution during the post Covid and Ukraine-Russia war period,” said Shankar Raman. “The disrupted supply chain resulted in sharp inflation of products used in engineering and construction projects. The wage cost also shot up considering the reverse migratory trend of workmen.”

Also read

- Larsen & Toubro records 15 per cent rise in Q3 profit; misses estimates

- L&T reports 45 pc increase in net profit to Rs 3,223 crore in September quarter

- 'My whole life has been L&T and nothing else': A.M. Naik

- L&T's A.M. Naik: A happy bundle of contradictions

- How A.M. Naik transformed L&T into a multinational conglomerate

With the fall in input costs, improvement of the supply chain, completion of legacy projects and higher margins from the newer projects, the company should report better margins from the 2024-25 financial year.

As L&T transitions into the future, its services portfolio―IT and engineering services, financial services, realty, ed-tech and e-commerce―constitutes 32 per cent of its revenues. The margins have historically been better in services business. Subrahmanyan, however, said engineering would always form the core of the company. “Going forward L&T’s bouquet of services will keep expanding. But, that does not mean we will move away from engineering and construction, which has been our core expertise. Rather, we are exploring ways to move up the value chain to improve our margins in this segment as well,” he said.

Subrahmanyan wants L&T to be selective―choose projects involving a minimum investment threshold and aim for more complex projects. The company is also leveraging newer technologies, like 3D printing, in a big way to enhance productivity. “The innovations resulting from the digitalisation of our various processes have made project execution faster, safer and more accurate,” he said.