A FEW WEEKS ago, India’s Under-19 team led by Shafali Verma outplayed England in the final and won the inaugural ICC Women's U-19 T20 World Cup. And now, the Women’s Indian Premier League has become a reality. I am sure we all already have our favourite teams and players!

Off field, too, women have been achieving impressive milestones, and a generational shift in mindset is under way.

The female labour force participation rate rose to 25.1 per cent in financial year 2020-21, up from 18.6 per cent a year earlier. Payroll data released by the Employees’ Provident Fund Organisation shows that the share of women among new joinees rose to 27 per cent in financial year 2021-22, up from 21 per cent a year earlier. The ratio of women in leadership positions is also on the rise.

A direct consequence of more women entering the workforce is that they have started taking control of their finances. There is an increased propensity to save and invest as well.

An LIC survey in 2022 said that 91 per cent women believed life insurance was necessary. Another survey, released in 2023 by Max Life Insurance, said that the life insurance ownership was similar for both men (74 per cent) and women (71 per cent), with women closing in swiftly.

But we need to remember that a key step in achieving financial independence and creating wealth is portfolio diversification. It reduces the dependence on a single asset class, optimises returns, and protects against asset specific underperformance. Simply put, a well-diversified portfolio enables sustainable wealth creation.

This is where we see a considerable gap. While traditional investment avenues like bank deposits and physical gold continue to be the preferred choice for women, the importance of investing in equities is not being fully realised.

According to the Reserve Bank's estimates, the average inflation rate in India is 6.7 per cent for FY23. Inflation can impact one’s purchasing power and lower the real returns. So, in order to not lose money, women need to ensure that the interest earned exceeds the inflation rate. The interest rate on savings account was around 3 per cent, and for fixed deposits, it was around 6 per cent in 2022. Also, gold, which is considered to be a hedge against inflation, has severely underperformed at times. This means, investing only in traditional instruments, your savings are losing value with each passing year.

Equities, however, is an asset class that has given returns substantially higher than the inflation in five of the past six years. For wealth creation, capital appreciation is as important as capital protection. Equities are thus a must-have in every portfolio, along with other asset classes like debt and precious metals.

Also read

- 'Want to help create inclusive spaces': Tanvi Sriramaneni

- 'Parents should be educated about breastfeeding': Jincy Varghese

- How women of this generation are more opinionated and outspoken

- 'Want to see more psychologists spreading awareness on social media': Divija Bhasin

- 'Want to change culture of unkind behaviour at workplaces': Podcaster Cardoz

- 'We cannot call ourselves animal lovers if we ignore their suffering': Priyanka Mehar

START EARLY, STAY INVESTED

It is advisable for women to start investing in equities early on. The younger they are, the higher can be the allocation to equities as the threshold for risk is higher.

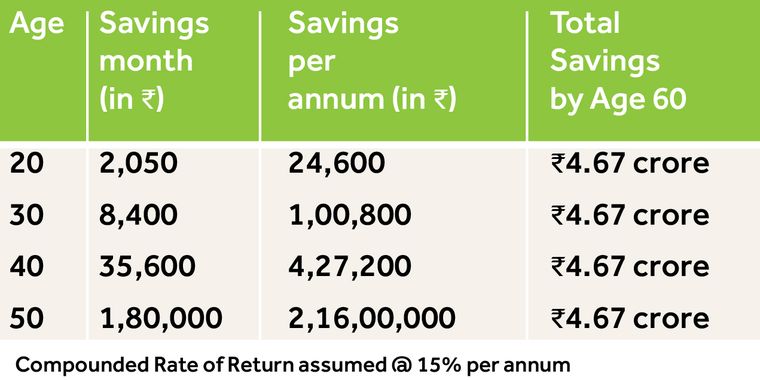

Also, by starting young, the capital has more time to appreciate due to the power of compounding. The table shows that to reach a corpus of Rs4.67 crore by the age of 60, you need to invest Rs2,050 a month, if you start investing at the age of 20. To reach the same corpus, you need to invest Rs8,400 a month, if you start at the age of 30!

It is also a great time to begin one’s journey in the Indian markets. Our economy has remained resilient, despite a global slowdown. Tailwinds of demographic advantage, strong consumption and supportive government policies will continue to trigger growth in the years ahead.

The writer is chairperson and MD of Prabhudas Lilladher Group.