MANY EXPERTS HAVE highlighted asset allocation as the cornerstone of successful investing. According to several studies, including the well-known Brinson, Hood, and Beebower research, “asset allocation can explain around 90 per cent of a portfolio’s performance”. Therefore, the emphasis should be on having a good strategic asset allocation mix, which is crucial for navigating unpredictable markets.

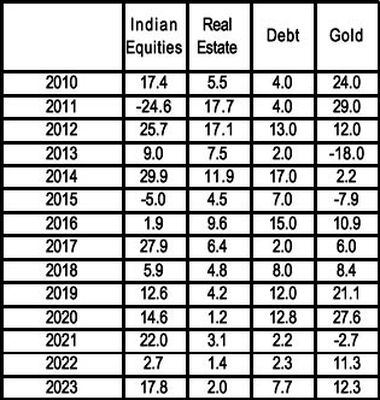

As the above table shows, given the cyclical nature of asset class performance, no single investment consistently outshines others. Instead, a balanced, diversified portfolio is essential to long-term success.

Asset class performance is inherently cyclical and often unpredictable. For instance, 2023 saw significant variability in returns across sectors, illustrating how market dynamics can shift rapidly. Such unpredictability underscores the importance of diversification. By allocating investments across equities, debt, real estate investment trusts (REITs), infrastructure investment trusts (InvITs), and commodities like gold, investors can manage risk effectively while positioning themselves to capitalise on emerging opportunities.

Equities serve as the primary driver of growth in any portfolio, playing a critical role in wealth creation despite their inherent volatility. Historical trends illustrate the cyclical nature of equity performance. Between 1992 and 2002, equities experienced a consolidation phase, delivering a CAGR of three per cent. This was followed by a remarkable growth period from 2002 to 2007, with equities achieving a CAGR of 43 per cent. In later periods, such as 2009 to 2016 and 2017 to 2023, equities offered steadier growth at a CAGR of 15 per cent. These fluctuations underscore the importance of patience and a strategic approach, as equities, while volatile in the short term, provide substantial returns to long-term investors.

Debt instruments, in contrast, bring stability and predictability to a portfolio. They offer consistent returns and act as a buffer against equity market volatility. The CRISIL Composite Bond Fund Index highlights the steady performance of debt investments over rolling five-year periods, making them indispensable for investors seeking balance.

Gold, a traditional safe-haven asset, adds another layer of resilience to a portfolio. With a CAGR of 25.7 per cent from 2005 to 2012 and 14.5 per cent from 2018 to 2024, gold acts as a hedge against inflation and market risks, offering crucial diversification and protection in uncertain times.

Diversification within and across asset classes ensures that the portfolio is not overly reliant on any single investment or sector. Regular rebalancing is also crucial to maintaining the desired asset allocation, allowing investors to adapt to changing market dynamics while staying aligned with their objectives.

This can be effectively achieved by investing in multi-asset funds.

As Ray Dalio, the famous hedge fund manager, reminds us, “We’ve been doing this for 37 years, and we don’t know that we’re going to win. We have to have diversified bets.” In an unpredictable financial landscape, a structured, multi-asset fund is the most reliable path to long-term success. It provides the strength and stability to weather market turbulence and seize opportunities as they arise.

The ICICI Prudential Multi-Asset Fund stands out as one of the longest-running funds in its category, with an impressive track record spanning over 22 years. Since its inception, the fund has delivered a robust CAGR of 21.20 per cent (as of November 29, 2024). Over the same date, it has posted an outstanding one-year return of 22.68 per cent, along with strong three-year and five-year CAGR returns of 19.73 per cent and 20.61 per cent, respectively.

The writer is founder, Dhifin Capital.