TATA MOTORS LAUNCHED the hatchback Indica in 1998. Though the company had been making trucks and buses for decades and utility vehicles for many years, it was its first attempt at cars. Indica was also the first car to be designed and manufactured by an Indian company. It was a good start. Tata Motors sold about a million Indicas, and went on to make several other models and cornered a market share of 17 per cent in a decade.

But things went south soon, as the company struggled with the ambitious Nano project. By 2013, its market share slipped to single digits, and questions were raised about its sustainability. Though it churned out at least one model every year, none made any impact till the Tiago in 2016 and the Nexon a year later. A game-changer came in 2019, in the form of the Harrier, made on the Omega platform derived from the Tata-owned British carmaker Jaguar Land Rover.

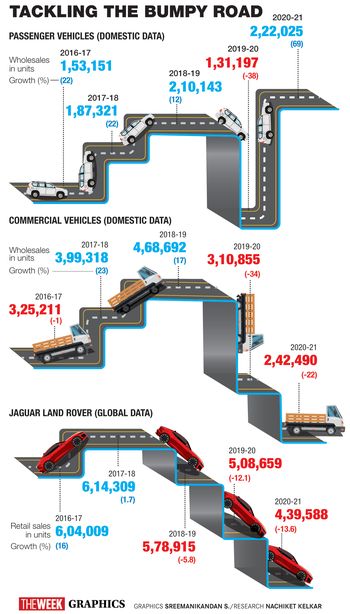

Even as the automobile industry struggled to deal with the pandemic and lockdowns, Tata Motors’s passenger vehicle sales surged 69 per cent from a year ago to 2,22,025 units in the year-ended March 2021. This is when the sector saw a drop of 2 per cent in sales. It was the highest sales in the segment for Tata Motors in eight years, helping it regain the third spot behind market leader Maruti Suzuki and Hyundai Motor India. “Tata Motors gained market share across segments, leading to overall market share of 8.3 per cent, on the back of a strong product portfolio,” said Jinesh Gandhi, research analyst at Motilal Oswal Financial Services.

A good response to the Altroz premium hatchback pushed the company’s share in the compact segment to 15.4 per cent, said Gandhi. His analysis also shows that volumes of the Nexon SUV accelerated 47 per cent. The Harrier and Safari SUVs helped the company gain a market share of 16.1 per cent (up 650 basis points) in the SUV segment.

The company’s electric vehicles business grew three-fold in the last financial year, largely driven by the Nexon EV, which was the largest selling electric car in India—with sales of more than 4,000 units since it was launched in January 2020. Tata Motors is building an ecosystem for EVs with the support of group companies. Tata Power, for instance, is helping set up the charging infrastructure across cities. With Tata Chemicals, it is evaluating technical partners for establishing a lithium ion battery manufacturing plant.

The strong momentum helped Tata Motors report a standalone net profit of Rs1,646 crore in the March quarter against a net loss of Rs4,871 crore a year ago. “Tata Motors has surprised investors with market share gains, margin improvement in ICE (internal combustion engine) segment, while grabbing customer mind space via EV offerings,” said Nishant Vass, analyst at ICICI Securities. In the past one year, Tata Motors shares gained 240 per cent, with the company’s market cap crossing Rs1.11 lakh crore.

India’s automobile sector saw a good recovery after Covid-19 cases ebbed and the country opened up in phases by the end of last year. A devastating second wave, however, hit demand in the April-June quarter. A semiconductor shortage is also hurting automakers globally. The expectation, however, is that demand will bounce back quickly as states start easing restrictions and preference for personal mobility will gain momentum.

Sales of sports utility vehicles have been on the rise in India, with their share hitting 35 per cent of all passenger vehicles sold in the first five months of 2021. Tata Motors has a strong presence in the segment. After the success of Nexon, Harrier and Safari, it is now getting ready for its next big launch, a micro SUV codenamed HBX. Based on the Altroz platform, the HBX will be positioned below the Nexon, taking on the likes of the Mahindra KUV100.

Things seem to be turning around for Jaguar Land Rover, too. In the January-March quarter, JLR’s retail sales were 12.4 per cent higher than the previous year, at 1,23,483 units. More importantly, in China, sales doubled in the period. Sales in North America, another major market, were up 10 per cent. In the UK and in Europe, though, sales slipped 7 per cent and 5 per cent, respectively. Adrian Mardell, the CFO of JLR, recently told investors that overall orders currently are around one lakh units. The Defender SUV that made the global debut in 2019 has been selling quite well.

JLR is important for Tata Motors, as it constitutes half of the company’s global unit sales and accounts for almost 80 per cent of its consolidated revenues. Under Thierry Bollore, the new CEO who joined in September 2020, JLR is moving fast towards electric mobility. Jaguar, which launched the all-electric I-Pace last year, will be an electric brand by 2025. Land Rover will launch its first fully electric vehicle in 2024. By the end of the decade, all Jaguar and Land Rover models will be available in electric. “Our estimation is, about 20 per cent of our sales will be all electric by 2026 with a commitment for tailpipe zero by 2036,” Mardell told investors. JLR, however, will face stiff competition, as its traditional rivals have all been building strong electric portfolios.

Tata Motors is also focusing heavily on reducing its debt, as a part of its plan to become debt free in three years, as envisaged by Tata Group chairman N. Chandrasekaran. The company reduced its net automotive debt by Rs7,300 crore to Rs40,900 crore last year. JLR’s net debt reduced by £300million to £1.9 billion as of March 31, 2021.

At the same time, both Tata Motors and JLR are not slowing down on investments. JLR has planned capital expenditure of £2.5billion to £3billion a year over the next few years. In the domestic business, Tata Motors will invest around Rs3,500 crore. “Having seen three quarters of performance, we are very clearly seeing that once the pandemic or all the lockdowns are out, there is definitely a demand resurgence that happens. Therefore, this time, it’s not a business continuity plan, it’s a business agility plan. We want to be as flexible as we can,” said P.B. Balaji, group CFO of Tata Motors.

There are, however, plenty of challenges to overcome. Like others, Tata Motors is also struggling with the global semiconductor shortage and disruptions in the supply chain. Analysts also point out that the business, commercial vehicles in particular, is cyclical. Another wave of Covid-19 and fresh lockdowns could dent the recovery.

Tata Motors is also dealing with management changes at the top level. Guenter Butschek, the CEO and managing director, was due to depart at the end of June. The company had announced that Daimler Trucks and Buses executive Marc Llistosella would be the new MD and CEO, but later said he was not coming. Butschek is stepping down from June 30, but has agreed to continue to be associated with the company as a consultant till the end of the current financial year.

Butschek had played an important role in turning around Tata Motors. Most models that drive its sales were launched during his tenure. Also, Pratap Bose, the designer behind the company’s ‘impact design language’ in the domestic passenger vehicle business, recently quit. Martin Uhlarik, who was until recently the head of design for Tata Motors European Technical Centre, was appointed the new global design head.