A‘virus’ started spreading through the air waves in India in the third week of May. No, not the novel coronavirus. A flood of social media messages, from WhatsApp forwards to Facebook posts, saying that the new generation of ultrafast mobile technology, 5G, was responsible for the deadly second wave of the Covid-19 pandemic in India.

One theory said that radiation from 5G base towers helped the spread of ‘corona’. Another said the strong radio waves were causing small changes to people’s bodies, making them more susceptible to the virus.

With local leaders and farmers' groups in Uttar Pradesh, Punjab and Haryana pitching in with their fears and calling for a halt to 5G trials, the government was forced to come up with an explanation. While the ministry of information and broadcasting did a fact check and stamped the rumours fake, the Department of Telecommunications (DoT) issued a statement saying that there was “no connection between 5G technology and the outbreak of Covid-19”. The Uttar Pradesh Police ordered all district commissioners to crack down on those spreading 5G conspiracy theories. The Cellular Operators Association of India (COAI) called on states, particularly Haryana, to quell the rumours as they were getting out of hand.

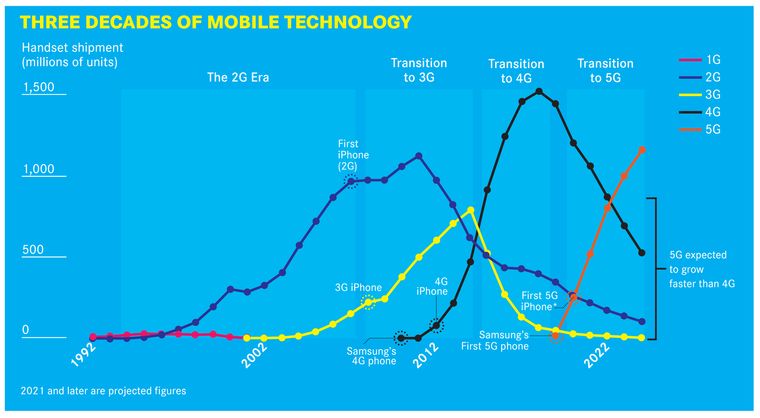

The irony is that 5G trials, or even the auctioning of spectrum to start the service, are yet to start in India! Because of many delays, the government’s clearance for trials—by telcos Reliance Jio, Airtel, Vi (formerly Vodafone-Idea) and MTNL—came through only a week ago.

The trials will run for up to six months, though indications are that auction of 5G spectrum (radio bands needed by the telcos to offer the service in) may now be delayed till early next year. Experts estimate that this will push the public launch of 5G in the country to mid-2022.

That is a shame because 5G services are now available not only in advanced markets like Europe and the US, but also closer to home in Thailand, the UAE and Singapore. In China, about 70 per cent of new mobile devices sold are 5G capable. Even the Parliamentary standing committee on IT voiced its concern over the delay recently: “India may miss the 5G bus!”

Nitin Bansal, India head of telecom gear maker Ericsson, however, said India was not behind in its 5G roadmap. Ericsson is the frontrunner in providing 5G equipment to Indian operators, as Chinese firms Huawei and ZTE have been kept out of the trials. “5G rollout hinges on government policies, investments and device ecosystem. It’s about how soon the spectrum is freed up and made available given the need for accommodating increasing data traffic,” he said.

Interestingly, soon after the second Modi government took charge two years ago, Telecom and IT Minister Ravi Shankar Prasad had declared that 5G trials would start in 100 days. Two months later, Reliance Industries chairman Mukesh Ambani called 5G ‘an exciting frontier’ at the company's annual general body meeting of shareholders, and said a made-in-India 5G solution would be ready for field deployment in a year. Reliance promotes Jio, India's largest telecom service provider.

Some 700 days after Prasad’s promise and close to the second half of the year that Ambani had set as a target, 5G remains a blueprint at best. Spectrum auctions were postponed many times, partly due to telecom operators’ grouse that the base price is too high and partly due to the pandemic slowing down the government. While spectrum is provided in various bands, telcos have been clamouring for more millimetre wave band—much of which is in the kitty of defence and space departments, who use it for satellite navigation and communication. These departments do not seem to be in a hurry to give it up.

Then there is the China factor. Even before the Ladakh clashes soured the relations between the two Asian powers, alarm bells had started ringing over using technology and equipment from Chinese players like Huawei and ZTE for 5G. The worry, also voiced by countries like the US, involved suspicions over their technology giving ‘backdoor’ access to Chinese intelligence. DoT sat on it for months, and took a decision much after many other countries, delaying the entire process for months. The Indian 5G trials order does not ban the Chinese firms per se, but it omits their names from those allowed. Chances are that once the actual deployment starts, DoT will bring out a list of ‘trusted sources’ from whom to buy tech and gear.

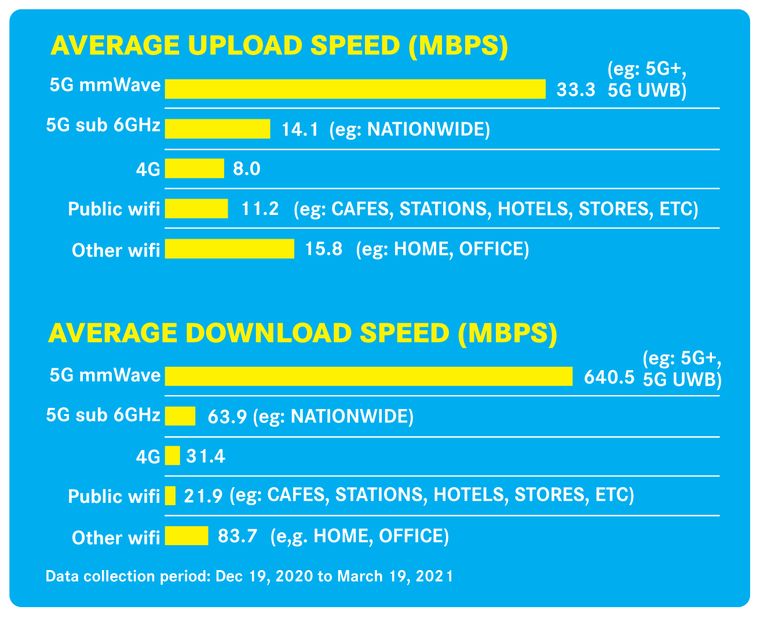

For telcos, it is a bittersweet scenario. Quicker 5G rollout would mean more revenue and cost control, as the superior technology allows more customers per base tower compared with 4G. Revenues could also increase if they are able to charge more for the ‘premium’ 5G offerings.

But it would also mean investing heavily in upgrading infrastructure. More cell towers will have to be installed, involving vexatious rentals and permissions across the country. Old copper wiring based networks, which now form about 70 per cent of India’s networks, may need to be converted to optical fibre. Operators like Vi are already bleeding heavily and additionally burdened by the Supreme Court’s order to pay the government aggregated gross revenue (AGR) dues that runs into thousands of crores of rupees.

“The financial status of telecom providers is one of the reasons for the delay in 5G rollout,” said Rishi Bhatnagar, chairman, IET Future Tech Panel. “The money they spent on 3G and 4G has not given them enough returns to incentivise investments in 5G.”

Yet, it comes as a silver lining to the cloud that India’s mobile users remain gung-ho about the technology. The latest Ericsson Consumer Lab study says 67 per cent of those surveyed said they intended to upgrade to 5G services the moment it became available. It was the highest in the world. At least four crore Indians could take up 5G in the first year of its arrival.

The report also said Indian consumers were willing to pay as much as 50 per cent more for 5G plans. “Going forward, prices won’t be a problem,” said Parv Sharma, research analyst at Counterpoint Research, a leading telecom consultancy. “Operators might charge a bit of a premium for 5G because everybody wants to increase ARPUs (average revenue per user), but not so much that people would not want to upgrade.”

From smartphone models ranging from an iPhone 12, which costs around Rs80,000, to Realme 8, a 5G smartphone priced around Rs15,000, a plethora of 5G phones are already available in the Indian market. “Smartphone customers today are prepared to invest more in future-ready 5G smartphones and as buying cycles increase, 5G mobile ecosystem will be further strengthened by both network and mobile brands,” said Rahul Sharma, founder of Micromax, which is set to launch its 5G-capable phone in the second half of 2021.

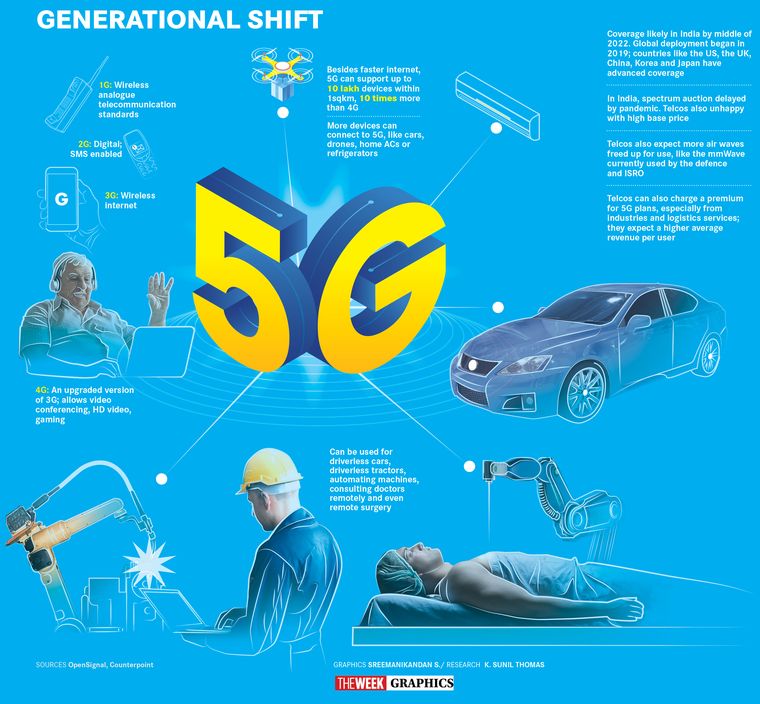

While the common man is enthused over the impending increase in internet speeds and better video calls, focusing on that would be beside the point. “Apart from that, 5G will offer a much better ecosystem from an Internet-of-Things (IoT, the term used to describe machines being operated and tracked from a distance) perspective. It will offer better application for industries and agriculture,” said Parv of Counterpoint.

And then there is the greater common good. “Autonomous tractors will be a better use case for India than autonomous cars,” said Bhatnagar. “Remote surgery will definitely benefit rural India as it will improve availability of experts for major surgical procedures. Such use cases will help in uncovering new business models and improve opportunities for India.”

Telecom industry veteran Mahendra Nahata, whose HFCL is developing indigenous 5G technology, agrees. “Driverless cars can come, but we [should] have other priorities—remote education, medical diagnosis in rural areas, agriculture, industry 4.0,” he said. “These are the use cases that improve the life of people, improve governance, (and) need to be developed in India.”