Chinese techpreneur Duan Yongping made headlines in the 1990s when his Subor gaming consoles successfully took on Japanese giant Nintendo. In 1995, he left the gaming industry and started an electronics manufacturing company called Bubugao, which later became BBK Electronics.

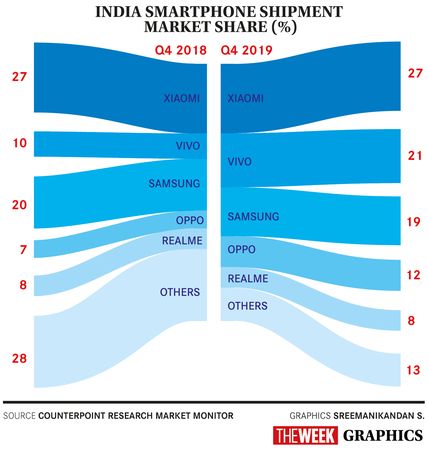

The name BBK Electronics might not ring a bell for most Indians, but its brands are household names in the country. According to the latest data from market researcher Counterpoint Research, in the quarter ended in December 2019, three BBK brands—Vivo, Oppo and RealMe—held 41 per cent share of India’s smartphone market. A year earlier they held just 25 per cent. While Oppo’s market share rose from 7 per cent to 12 per cent, Vivo’s share jumped from 10 per cent to 21 per cent. Realme, which started as a sub-brand of Oppo, is now operating as a separate entity, and has captured 8 per cent of the market. OnePlus, also owned by BBK, is a strong player in the premium end of the market, competing with the likes of iPhone and Samsung’s Galaxy S series.

Samsung, the world’s largest mobile maker, seems to be the biggest casualty of BBK’s dream run in India. Its market share declined to 19 per cent in the December quarter, from 25 per cent in the June quarter of 2019 and 20 per cent a year ago. Xiaomi, the fellow Chinese brand, retained its position as the single-largest brand in the country with a market share of 27 per cent.

One thing that has worked for the BBK brands is aggressive pricing. Another thing is the big online sales and marketing push. “India is a price sensitive market,” said Upasana Joshi, associate research manager at market researcher IDC India.

Vivo, Oppo and Realme spend significantly on online promotions. These brands seem to have a long-term commitment to India, and a clear strategy that keeps the customer at the centre. “Our growth in India has been a result of multiple factors—strong product portfolio across price segments, extensive distribution network, reliable aftersales service and substantial marketing inputs to build a strong brand,” said Nipun Marya, director, brand strategy, Vivo India.

Online is the preferred channel for sales for all these companies. Around 80-85 per cent of Realme’s sales come from online channels. Xiaomi, which entered India in 2014, started with a big focus online, before expanding to retail stores. Even now, 60 per cent of its devices are sold online.

Interestingly, Chinese phone makers keep their products competitive in the price-sensitive market by making them in India. Many of these companies have local assembly plants, and they are focusing on increasing local sourcing. “More than 99 per cent of smartphones that are sold in India are manufactured locally,” said Muralikrishnan B., chief operations officer of Xiaomi India. Xiaomi has more than 6,000 preferred retail partners and it is targetting the tier-III towns in a big way through 2,500 small format stores.

Vivo, which has invested Rs4,000 crore in India, will invest another Rs3,500 crore over four phases to expand its manufacturing facilities. “As part of the phase-II expansion, the company plans to add 5,000 plus employees, taking the total employment in Vivo manufacturing facilities to 15,000,” said Marya. Vivo has set up 650 company-owned service centres as well.

Though the brands owned by BBK compete against each other, the group has segmented them in such a way that each company gets its space to grow and synergies are harnessed. OnePlus, for instance, shares manufacturing facilities with Oppo. Oppo’s Android-based operating system, Color OS, is shared with Realme. Innovations by one company eventually go to other group companies. While OnePlus focuses on the premium end, Vivo is more mainstream across price points and Realme takes the main competitor Xiaomi head on in the entry and mid segments.

Competitors are upping the ante in an attempt to halt the march of these brands. At the premium-end of the market, Apple is putting up a fight with a new price strategy. The iPhone XR, which was launched in 2018, has seen several price cuts in the past one year. It was the top selling smartphone globally in 2019.

Samsung has announced the ‘lite’versions of last year’s flagships Galaxy S10 and Note 10 and some mid-range upgrades. The company had got a good response to the A series, selling more than two million phones in just 40 days. Samsung last year closed its last production plant in China, with its smartphone share there slipping to just 1 per cent. It certainly cannot afford to give up the fight in India. “Samsung needs to relook at the product portfolio with competitive pricing and maintain balance between online/offline offerings as the core strength of Samsung remains offline-heavy. In 2020, we will witness similar offerings by brands across channels to maintain parity and stay relevant,” said IDC’s Joshi.

India is more than an important market for these brands, as they consider it an alternative to China as an export base. OnePlus has already begun manufacturing 5G phones here for exports. “India is one of the priority markets for OnePlus and is fast emerging as a regional headquarters for its expansion into global markets,” said Vikas Agarwal, general manager of OnePlus India. “OnePlus is building India as a global export hub.”

Oppo, too, had announced that it was planning to make India an export hub and would double its production capacity to 100 million units. Xiaomi has been running a pilot project to export smartphones from India to Bangladesh and Nepal.

India’s smartphone industry was a bright spot in the sluggish economy last year. It is estimated to have grown around 9 per cent. With companies getting aggressive right from the beginning of 2020, it may grow faster.