Gazal Kalra would have probably laughed if you had told her a few years ago that she would be running a trucking business. “I had never even met a truck driver when Deepak (Garg, who cofounded the logistics startup Rivigo with Kalra) came up with an ‘Uber for trucking’ idea,” she said.

She is not complaining now, as Rivigo became a unicorn a few months ago. A unicorn is a new business, generally with a strong tech base, that is valued at $1 billion (roughly Rs7,000 crore) or more.

For Kalra, however, it was never about the big bucks. “The idea was never to become a unicorn by x year or y year,” she said. “We were solving an important problem.” Rivigo offers a relay trucking logistics model where truckers drive only four or five hours and pass on the goods to the next driver in the relay. It speeds up deliveries and allows drivers to return home every night. “The more we spoke to truck drivers, the more we realised what a profound thing we were getting into,” she said. “We were solving an important problem. All these success metrics that the world appreciates are just an outcome.”

Call it a big billion rush, or businesses that are changing the landscape, or simply the unleashing of the nation’s entrepreneurial spirit, India is now the third largest home of unicorns, behind only the US and China. In 2018, seventeen Indian startups became unicorns, including the likes of Flipkart, Ola, Swiggy and Byju’s. Ten more joined the list in 2019. Two Indian unicorns—Paytm and Oyo—are already ‘decacorns’, with a valuation of more than $10 billion.

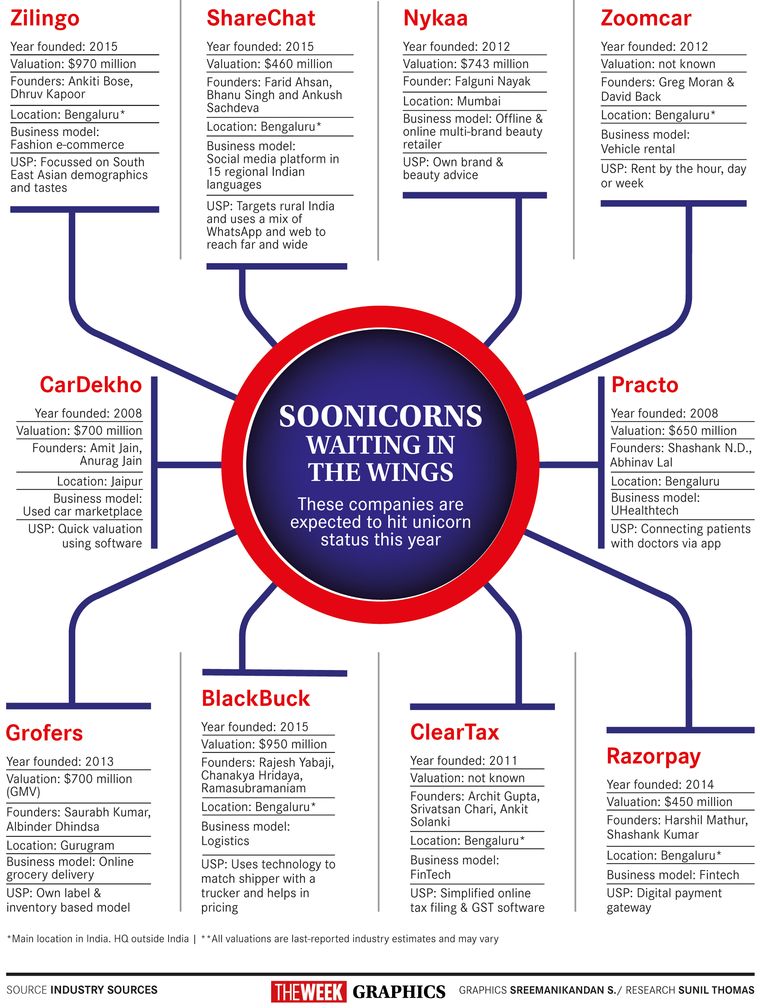

And, in 2020, of course, India is in the throes of an entrepreneurial revolution. Any youngster armed with a million-dollar idea has a very realistic chance of scaling up quickly into the big billion league. India has 9,300 startups at various stages, according to a report by the National Association of Software & Service Companies. Some other reports say there are 24,000. With an estimated 216 ‘soonicorns’ (soon-to-be unicorns) bubbling just beneath the surface, NASSCOM estimates there will be more than 100 Indian unicorns in less than five years, commanding a total valuation of up to Rs27 lakh crore.

It is leading to a gold rush, no doubt. “The unicorn wave in India has inspired us as entrepreneurs to aim not to be the best in India, but to be world class,” said Sharan Grandigae, founder of Redd, a design startup in Bengaluru. The chicken—and the egg—in this unicorn scramble has been global investors like SoftBank, Tencent and Tiger Capital who dole out thousands of crores of rupees. Total funding for Indian startups crossed Rs30,000 crore last year. “We have just scratched the surface of what India’s startup ecosystem could possibly achieve,” said Apoorv Ranjan Sharma, cofounder and president of Venture Catalysts, a funding firm. “Aspirational entrepreneurs are embracing technology and moving away from job-focussed mentality to start something of their own. This newly-identified startup spirit is what will lead to the creation of future unicorns.”

Unicorns and their near-romantic appeal to the imagination of the young generation stems from the notion that regular guys can hope to succeed even without massive investments in offices and stores and a supply chain. “Indians are entrepreneurial by nature, and though there was always a stigma about failure, now, there are enough stories of successes spurring people on,” said Sandeep Aggarwal, cofounder of ShopClues, which became a unicorn in 2016. Aggarwal, who is also the founder and CEO of Droom, a soonicorn, however, said India had a lot of structural limitations. “Cost of capital (to start a business) is high; so is real estate,” he said.

Technology is what comes to the rescue here. Droom, for example, has a proprietary solution called Orange Book Value (OBV), which evaluates the price of used cars and mobile phones. Similarly, Zoomcar—a Bengaluru-based vehicle rental firm which is racing towards unicorn status—has something called Cadabra that tracks a car’s usage, right from clutch position to braking and acceleration. “We mine this data to have a comprehensive behaviour analysis of our consumers and try to align our offerings accordingly,” said Greg Moran, CEO and cofounder of Zoomcar. “Technology is the secret that is enabling this revolution.”

They are also getting inspired by stories of tenacity. Take, for example, twenty-somethings Farid Ahsan, Bhanu Singh and Ankush Sachdeva, whose regional language social media platform ShareChat is slated to hit unicorn status this year. The IIT Kanpur buddies worked on 14 projects, all of which flopped, before they hit gold with ShareChat. Said Sachdeva, who is CEO of the company: “ShareChat came from observing how Indians behave on the internet and this motivated us to discover the logic behind their thought process.” ShareChat has six crore regular users in 15 Indian languages, including Bhojpuri and Haryanvi.

Or the case of Falguni Nayak, who chucked her fancy investment job in Mumbai after visiting a multi-brand beauty store during a business trip abroad. “I was amazed by the profusion of beauty solutions, displays and women behind counters offering advice. This made me realise there was such a huge gap in India,” said Nayak. “I saw the need for a multi-brand retail format that gives unbiased advice to consumers, guides them on beauty concerns and offers solutions that are easy to access across the length and breadth of the country.” The result was Nykaa, which started as an online beauty store, and later spread as real-world stores across the country. Nykaa is presently just $257 million short of unicorn status.

For some of these people it was a matter of unleashing the entrepreneurship in their blood. Hari Menon, for instance, cofounded grocery e-tailer BigBasket after selling his first venture, FabMall hyper retail concept, to Aditya Birla Group. Many of these billion dollar babies, however, shirk away from the tag. “I am embarrassed that unicorn is the only aspect the media is talking about us,” said Yashish Dahiya, CEO and cofounder of PolicyBazaar.com, which became a unicorn in 2018. “We have added Rs8 lakh crore of life cover, which implies that Rs8 lakh crore can be paid to people if they die. That level of protection, social security, has been created in our country where it is the biggest issue. That is genuine achievement. What is $1 billion dollar valuation compared to that?”

There is another reason, too. Hitting unicorn valuation may be like scaling a peak, but holding on or aiming for higher summits is a bigger challenge. InMobi (mobile advertising) and MuSigma (data analytics) ran into turbulence after they achieved unicorn status. Unicorns Snapdeal and ShopClues have seen their valuations dropping below the $1 billion mark.

Valuation, in fact, is the elephant in the room. It is calculated based on a combination of a company’s current and future business model, the future earning capacity of the product or service it is offering and the percentage of control premium of the investor. One of the biggest reasons for the unicorn craze has been global investors loosening their purse strings for Indian companies. The total amount of funding for Indian unicorn wannabes doubled in 2018, to $4.2 billion.

But the question is, how much is too much?

“I think we are heading for a unicorn bust,” said PolicyBazaar’s Dahiya. “A lot of people in the unicorn club will not exist a few years from now.” Adding to the fear is the fact that many unicorns are yet to make profits and have high cash burn rate.

Unicorns have also been shaken by the global meltdown of poster boys like Uber and WeWork. Uber’s initial public offering and listing on the New York Stock Exchange was sort of a disaster, with its valuation plummeting from $82.4 billion to $45.5 billion. The New York Times described WeWork’s failed effort to go public and the subsequent quitting of its cofounder & CEO Adam Neumann as as “an implosion unlike any other in the history of startups”.

“Valuations have become unrealistic,” said S. Ravi, former chairman of the Bombay Stock Exchange. Sarbvir Singh, managing partner (India) of venture capital firm Waterbridge, put it more succinctly: “It is fun to talk about valuation and you put in all that money, but you have to get money back also.”

Ravi pointed out that the ‘disruptor’ effect of technology could also be a double-edged sword. “Everyone is overpricing themselves without realising that a product’s shelf life in the tech world is short,” he said. “Entrepreneurs should always remember that tomorrow someone could always come in with a newer idea, a newer format.”

The way forward for unicorns and soonicorns is constant innovation and reinvention. “To stay ahead of competition and remain relevant to the consumers, one must constantly innovate and if after the initial burst, a company does not do this consistently enough, it faces the risk of going off track,” said Menon. In fact, many unicorns are trying various measures to stay relevant. Paytm diversified into ‘babycorns’ with Paytm Bank and Paytm Mall, while Ola is moving beyond ride-sharing to electric mobility with Ola Electric. Oyo is reported to be expanding into student housing and Byju’s is taking its form of edutech to western markets.

While 2020 is set to see more Indian companies becoming unicorns, it could also possibly see WeWork-like meltdowns. The real story, however, is not one of billion-dollar valuations, but the celebration of the ordinary Indian unleashing his potential. “Take any field, see the apps, the startups, Indian boys and girls are shifting from traditional jobs into venturism,” said Ravi.

While online shopping (e-commerce), digital payments (fintech) and delivery services (logistics) scored so far, experts believe the next spate of unicorns would be found in areas like electric mobility, agriculture tech, education and health care solutions. And, the unicorn saga may just have the panacea for the economic slowdown as well. “I believe the economic slowdown may inspire India’s next unicorn,” said Ravi. “Amid desperate times, ideas with the right potential find it easier to surface.”