A CABINET NOTE on the formation of the Bharat Sanchar Nigam Ltd in 2000 more or less summed up its objective—“The process of corporatisation is likely to increase competitiveness and reduce costs.” The proposed capital structure for the company at the time was Rs 5,000 crore in equity share capital, total reserves of Rs 58,000 crore, debt of Rs 5,000 crore and total capital employed of Rs 68,000 crore.

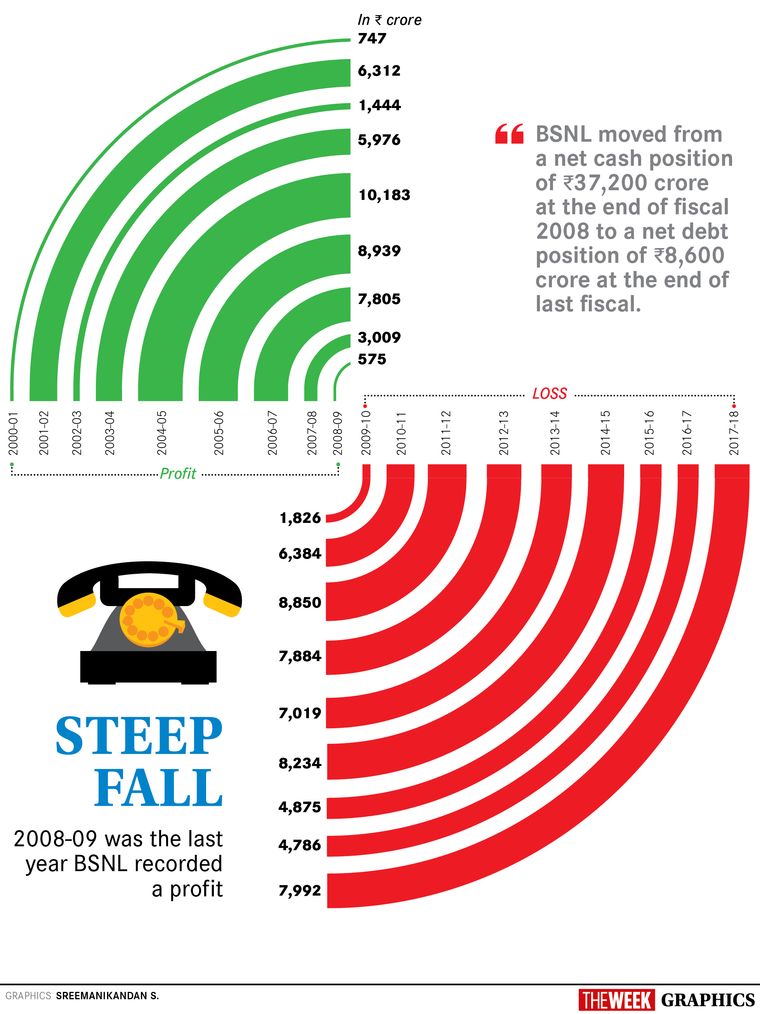

BSNL did spectacularly well in the initial years. It posted a Rs 10,000-crore profit in 2004-2005, and the government accorded it the Mini Ratna status in 2006. However, just as BSNL was rising, mobile telephony took off in a big way. The company tried to keep pace with the changing market dynamics and increased competition. Things, however, have only gone downhill since 2007. The profit came down to Rs 575 crore in 2008-09. BSNL has not reported a profit ever since.

For the year that ended in March 2018, BSNL’s losses stood at Rs 7,992 crore. In the first half (April-September) of financial year 2018-19, it reported a loss of 04,844 crore, according to data presented in Parliament by Manoj Sinha, minister of state for communications. This February, for the first time in its history, BSNL failed to pay its employees on time. The dues were cleared by March 14.

BSNL moved from a net cash position of Rs 37,200 crore at the end of fiscal 2008 to a net debt position of Rs 8,600 crore at the end of last fiscal, said Rohit Chordia, analyst at Kotak Institutional Equities. “Sector stress has only been rising in the past few years and BSNL’s ability to withstand it, with its uncompetitive cost structure and inferior network, was always limited,” he said.

While competitors Airtel, Vodafone-Idea and Jio have bet big on 4G mobile technology, BSNL offers only the outdated 3G. It has been seeking allocation of 4G spectrum by equity infusion of around Rs 6,767 crore from the department of telecom (DoT) for more than a year. Sinha told Parliament on December 26 that proposals from BSNL and Mahanagar Telephone Nigam (MTNL), which operates in Mumbai and Delhi, for 4G spectrum were under consideration. The matter has been referred to the Telecom Regulatory Authority of India (TRAI).

A report on loss-making public sector undertakings, submitted by the department of heavy industries to the Lok Sabha three months ago, had cited the huge expenses incurred by BSNL in providing telephone services in remote areas via satellite and point-to-point radio links as one of the reasons for its losses. Satellite transponder charges payable to ISRO are huge, said the report.

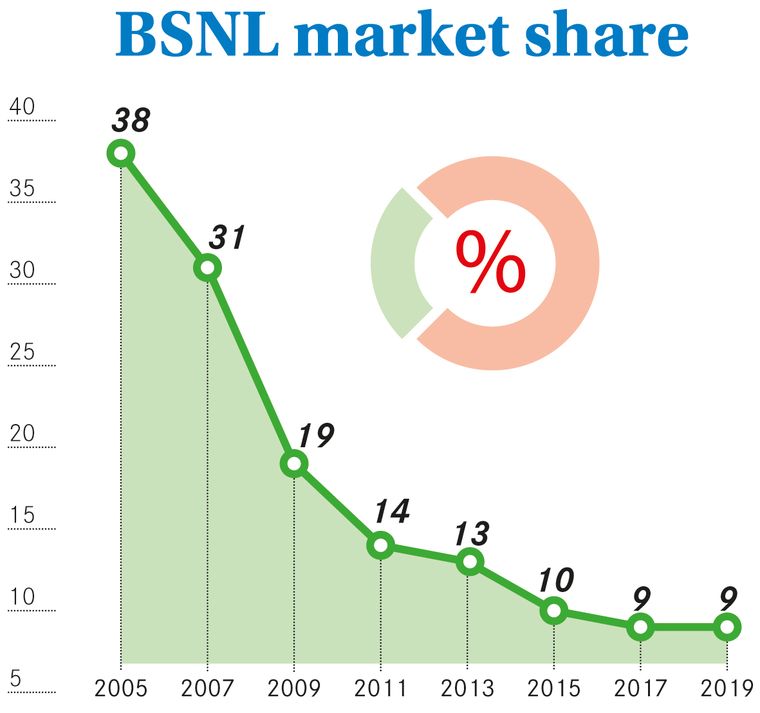

BSNL’s market share, according to data from the TRAI, has come down to 9.7 per cent in January 2019 from 19 per cent in March 2009. Vodafone-Idea is the largest operator with a market share of 35.12 per cent, followed by Bharti Airtel (28.80 per cent) and Reliance Jio (24.49 per cent).

“After the entry of Reliance Jio, and due to the predatory pricing in the telecom sector, all the operators have faced problems,” said Prahlad Rai, general secretary of All India BSNL Executives’ Association. “Officers in DoT are indifferent towards BSNL. In the last two years, the board has been requesting DoT to grant 4G spectrum to BSNL. The minister on many occasions assured that 4G spectrum will be allotted to BSNL and MTNL soon. But, nothing has been done.” A report by the Indian Institute of Management Ahmedabad has said that any further loss of market share due to non-allocation of 4G would make BSNL virtually defunct in a few years.

BSNL is not present in Mumbai and Delhi, two of the country’s most lucrative telecom markets. MTNL provides the service there. Merging BSNL and MTNL could reduce cost and strengthen the company, and a parliamentary panel had recommended the same. However, no steps have been taken in that direction.

The legacy workforce is another issue. BSNL has more than Rs 1.71 lakh employees on its rolls. In contrast, Bharti Airtel has just around 25,000. Employee benefits account for a significant chunk of BSNL’s expenditure. “Overstaffing is a major risk which the company faces as it has little flexibility to address the problem,” said credit ratings agency CARE. “For other operators, this cost is around 5 per cent of total operating income; for BSNL it was around 64 per cent for 2018.”

The DoT is learnt to be working on a voluntary retirement scheme. As the election code of conduct is in effect, the government will have to seek permission from the Election Commission to get a cabinet approval to implement the scheme. Trade union leaders, however, said no concrete proposal had been put forth by the management. P. Abhimanyu, general secretary of BSNL Employees Union, alleged that the management was doing things in a “clandestine manner”.

The union, the largest in BSNL, is not in favour of a VRS. Abhimanyu pointed out that many employees would retire in a few years, reducing staff strength automatically. “The estimate is that around Rs 6,000 crore will be required to implement the VRS,” said Abhimanyu. “BSNL is not in a position to spend so much money right now. Who will fund the VRS?”

In a tweet, Anupam Shrivastava, chairman and managing director of BSNL, dismissed the reports that the company was planning to lay off employees. A turnaround of BSNL, he wrote, was being devised by the DoT and the company, and it would include allotment of 4G spectrum and a VRS.

DoT is reportedly working on a revival package worth around Rs 13,000 crore. Also, BSNL has been tasked with implementing various projects worth around Rs 50,000 crore for the government, including an optical fibre-based network for the defence services and submarine optical fibre project for providing connectivity to the Andaman and Nicobar Islands.

The IIM Ahmedabad has suggested various measures for BSNL’s revival, which included accelerating asset transfers, creating a separate fibre infrastructure division, facilitating 4G spectrum allocation, organisational restructuring and a VRS. There have been reports that BSNL has started trialling 4G in some circles. It has sought 700MHz spectrum, through which it can offer 4G. However, the government is yet to take a decision on allotment of 4G spectrum.

BSNL has vacant land parcels valued around Rs 1 lakh crore. “These assets could be monetised and the funds thus generated could be used to strengthen and further develop BSNL,” said K. Jaya Prakash, general secretary, National Union of BSNL Workers.

Though it awaits allocation of 4G spectrum, BSNL does not want to be left behind in the 5G race. The company has signed a memorandum of understanding with Ciena, an American networking systems and services company, to prepare its network for 5G.

For now, BSNL employees hope that the salary delay was just a one-off issue and things would get better in the months to come. And, the onus of taking crucial decisions may now lie on the new government at the Centre.