MANY CABINS IN Delhi’s Rajiv Gandhi Bhawan, which houses the civil aviation ministry, were vacant for most of the day on March 20. The senior officials were all at North Block. Aviation Minister Suresh Prabhu had called a meeting, which was attended also by finance ministry officials. The agenda was the beleaguered Jet Airways.

Earlier, several Jet Airways trade unions had written to the government, seeking its immediate intervention. The National Aviator’s Guild, which is a union of Jet pilots, wrote to Prime Minister Narendra Modi, seeking his help to get their overdue salaries. The Jet Aircraft Maintenance Engineers Welfare Association wrote to the Directorate General of Civil Aviation requesting its intervention for salary payment.

The meeting, which lasted about five hours, was attended by Prabhu, civil aviation secretary Pradeep Singh Kharola, State Bank of India chairman Rajnish Kumar, revenue secretary Ajay Bhushan Pandey, banking secretary Rajeev Kumar, Director General of Civil Aviation B.S. Bhullar and Airport Authority of India chairman Guruprasad Mohapatra. Executives from Boston Consulting Group and Goldman Sachs also attended.

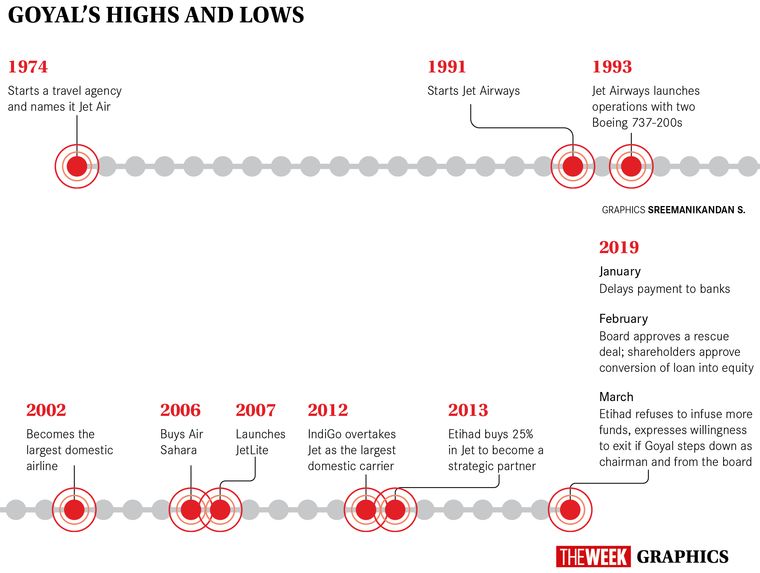

Before the meeting, Kharola and Nripendra Misra, who is the prime minister’s principal secretary, had apprised Prabhu and Finance Minister Arun Jaitley of the status of the airline’s business. Jet Airways has a debt burden of about Rs8,200 crore, and another Rs13,000 crore that it owes to vendors and lessors. Most of its employees have not been getting salaries for months.

Prabhu had two prerogatives—the airline should be able to clear salary dues by the end of March and it should be back in business in three months. Jaitley agreed on these. By then, Jet had grounded two-thirds of its fleet and was operating only on a quarter of the international routes.

“We do not want the airline to die,” said Rajnish Kumar after the meeting. “We believe that it is in everybody’s interest that Jet Airways should continue to fly.” He made it clear that the lenders’ consortium, led by SBI, was not moving bankruptcy proceedings at the National Company Law Tribunal. Instead, a bank-led resolution plan was seen as the best approach.

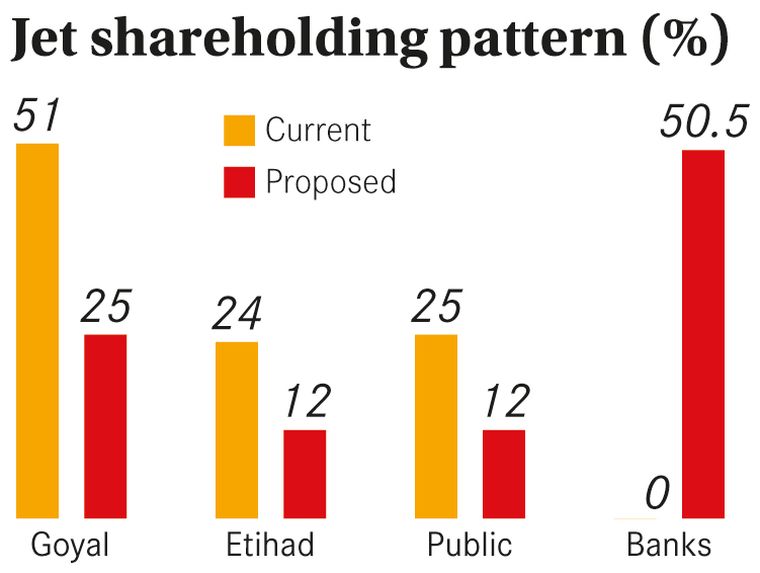

The resolution plan was finalised on March 25, as Jet Airways chairman Naresh Goyal resigned from his post and the board, paving way for the lenders to infuse some Rs1,500 crore that the airline needed urgently. Goyal’s wife, Anita, also resigned from the board. The banks will issue 11.4 million fresh equity shares so that they will hold 50.5 per cent, bringing down Goyal’s share from 51 per cent to 25 per cent, Etihad’s from 25 per cent to 12 per cent, and the public’s from 25 per cent to 12 per cent.

Responding to the criticism that the government was going out of its way and placing bets with money from public sector banks to help private entity, banking secretary Kumar said the government’s interest was to “limit NPAs and to secure livelihood of everyone involved with the airline”.

Prabhu said everything that could be done was being done. “It is everyone’s prerogative to see that those connected with the airline do not lose out on anything,” he said.

As part of the resolution plan, banks should announce an open auction for the Jet equity held by them on April 9, and handover the shares to the new investors by June. Only after evaluating the bids received will the banks be in a position to determine the haircuts to be taken by them on their advances.

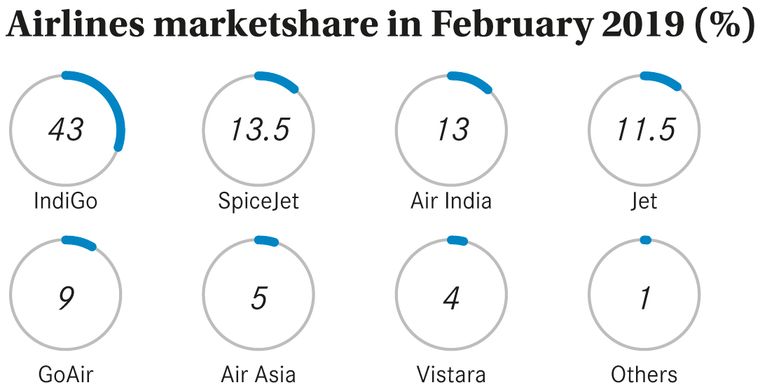

The goal now is to allow Jet Airways to operate by making partial payments, while a new management steers it clear of the crisis, said a corporate lawyer representing Jet. Going ahead, Jet is likely to receive deliveries of five new aircraft. Meanwhile, discussions are under way between the DGCA, AAI and other airlines to see if any of Jet Airway’s routes could be serviced by them. SpiceJet and IndiGo are learnt to have shown interest in servicing some domestic routes. Lessors are likely to hand over five Boeing 737 aircraft grounded by Jet to SpiceJet. IndiGo, which had been facing a shortage of pilots, is said to have sent offer letters to about 60 pilots from Jet.

Jet’s prospective buyers include some foreign airlines and Tata Sons. Tata had held discussions to buy a stake in Jet earlier. Goyal’s exit has made the proposition all the more attractive. Jet’s network will be a perfect fit for its joint venture with Singapore Airlines, Vistara.

Another potential buyer is Qatar Airways, which has long been looking for an entry into the Indian domestic market. Its proposal to set up a domestic service has been pending with the aviation ministry. Goyal had approached Qatar Airways with a presentation earlier this month. But foreign carriers are not allowed to hold more than 49 per cent in an Indian airline, and Qatar will need an Indian partner to go forward.

As Jet’s debt has not diluted because of the restructuring, buyers will have to bear at least a part of the liabilities. And not everybody is convinced that the resolution plan will work. Lawyer Yeshwanth Shenoy, who has long been fighting to make air travel safe, said banks were buying into the stressed airline knowing well that its damages are beyond repair. “You have no right whatsoever to wilfully and deliberately drain public money into bottomless pits,” he wrote in a letter to SBI chairman. “It is a criminal act against the investors and also the state.”

Experts, however, believe Jet will easily find takers, especially because of its plum slots at domestic and international airports.