Amarathoner, Natarajan Chandrasekaran knows what it takes to get to the top in the long run. In February 2017, he took over as chairman of Tata Sons, the holding company of Tata Group. It was a period of tumult. Cyrus Mistry had been sacked from the post just a few months earlier following a spat with Tata Sons, and many of the group companies were firefighting. Chandrasekaran quickly got the group moving. In his first board meeting, a top priority he outlined was bringing the companies closer and leveraging their collective strength.

The $110-billion Tata Group is a diverse mix of companies, ranging from software services, consumer goods, metals, automobiles and jewellery to aerospace and defence. Chandrasekaran has been stressing on simplifying the group structure to bring these companies closer. That vision has now begun to take shape. The ‘One Tata’ strategy is straightforward—simplify the group structure, create synergies between companies and scale up.

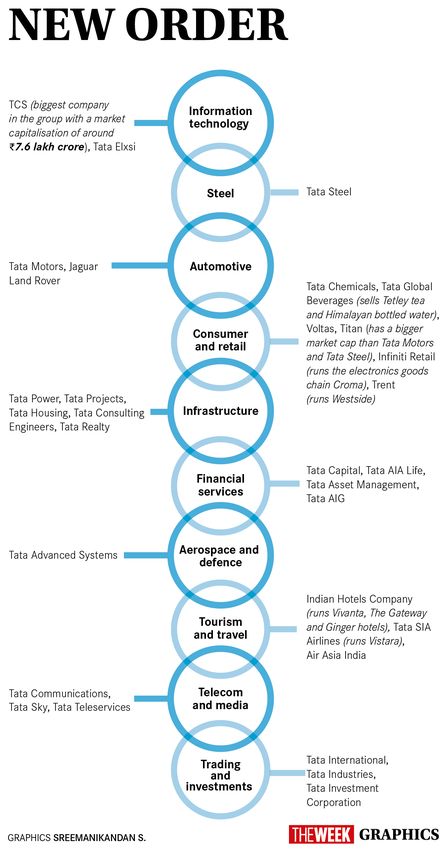

In the new scheme, the group has been divided into 30 companies under 10 business verticals—information technology, steel, automotive, consumer and retail, infrastructure, financial services, aerospace and defence, tourism and travel, telecom and media, and trading and investments.

In the past, several Tata companies were engaged in the aerospace and defence sector. Tata Motors, for instance, was building specialised vehicles for the defence sector. Tata Power’s Strategic Engineering Division had partnered with the ministry of defence and the DRDO to manufacture night vision systems and missile launchers. Now, all defence-related businesses have been consolidated under the aerospace and defence vertical.

Similarly, consumer-facing businesses like Tata Chemicals, Tata Global Beverages, Voltas, Titan, Trent (runs Westside department stores) and Infiniti Retail (runs consumer electronics chain Croma) have been brought under one vertical. All companies will continue to operate independently under the guidance and supervision of its own board of directors. But, they will also look at the opportunities from a wider perspective. This will help Tata build scale in several areas.

Tata Power, Tata Projects, Tata Consulting Engineers, Tata Housing and Tata Realty have now come under the infrastructure vertical. Indian Hotels, Tata SIA Airlines (runs Vistara) and Air Asia India have been brought under the tourism and travel vertical, and Tata International, Tata Industries and Tata Investment Corp. now fall under the new trading and investments vertical.

This exercise will give Tata the ability to define the corporate brand. “The task of the rejuvenation of the Tata brand has its second coming,” said Harish Bijoor, founder of Harish Bijoor Consults. “The version 1.0 was under Ratan Tata with the corporate brand equity, manuals that were put together, the entire process that was put together and the funding that was established. This is version 2.0. There is a Tata mother brand, under that you have the companies, which in turn have their own brands and these brands further have variants. So, its four degrees of separation between mother brand and the consumer, and bridging this and the umbilical connect that you want to create is the task at hand.”

As a part of the restructuring, some group companies are shedding non-core businesses and trimming down their subsidiaries. Tata Group has committed $10 billion to deleverage and restructure companies, consolidate cross-holdings, acquire strategic assets and infuse capital. Tata Steel’s subsidiary TS Global Holdings sold its entire stake in NatSteel Holdings. Earlier, Tata Power sold the Strategic Engineering Division to Tata Advanced Systems as a part of the plans to integrate all the defence businesses. Tata Power also sold its stake in Tata Communications to reduce cross-holding.

There has been speculation that the group may divest its stake in the ailing Jaguar Land Rover, but Chandrasekaran has denied any such move. JLR and Tata Motors have been working more closely in recent times. The Harrier SUV Tata Motors recently launched is based on the new Omega platform derived from Land Rover’s D8 platform.

“Chandrasekaran has a major challenge on his hands—to prove that his configuration will deliver the results the Tata Sons board expects,” said Mukund Rajan, former brand custodian and chief ethics officer of Tata Group. “He will have to make sure Tata CEOs stay ambitious and motivated, and do not feel undermined by the appointment of another layer of management above them. More critically, he will be expected to preserve the culture and values of the group, and in order to do this he will need to seek answers from within the group, drawn from its history and legacy.”

Chandrasekaran wants to ensure that the independent companies focus on the core businesses more to build up scale, reduce debt and boost profits. “We are looking at simplification from structure, number of companies, talent, processes, hierarchies, every which way you look at it,” he told THE WEEK in an interview in July 2018.

The group companies are also increasingly looking to work together with other companies in the group. So, while Tata Motors has begun producing electric vehicle (EV) variants of some of its existing passenger cars, a wider EV ecosystem is being built through a partnership with Tata Power for the charging infrastructure and Tata Capital for finance. “The overall move over a medium term is obviously going to create a lot of synergies for the group,” said Mayuresh Joshi, fund manager at Angel Broking. “For example, in their consumer businesses they are into different facets of the entire value chain. Getting them under one umbrella, you can build synergies, both from a cost perspective as well as the revenue accretion perspective. It creates an entire value chain from a customer perspective and instead of approaching different companies, the customer will then perhaps be able to have a holistic bundled package.”

Tata Group has 28 listed entities. In two years under Chandrasekaran’s leadership, the group market capitalisation rose 21 per cent, from Rs8.44 lakh crore to Rs10.8 lakh crore.

The catch, however, is that a large part of the market cap is contributed by TCS, India’s largest software exporter. Its market cap of around Rs7.58 lakh crore is almost 70 per cent of the listed Tata companies’ combined market value.

While Tata Steel has put its European problems behind and seems to be on a strong wicket (Rs1,753 crore consolidated profit in the last quarter), Tata Motors is going through a rough patch. The company reported its worst quarterly loss of Rs26,961 crore owing to an exceptional asset impairmant in JLR. A year ago, it had made a profit of Rs1,215 crore. “The traditional strong point of IT still is key to the group and remains a focal point,” said Joshi. “But, the performance is not universal across every Tata company and they may struggle in a few other areas they are operating in.”