ON RARE OCCASIONS, the government chooses private sector executives for top jobs in public sector banks (PSBs). P.S. Jayakumar, who was appointed managing director and chief executive officer of Bank of Baroda (BoB) in October 2015, was one such exception. Jayakumar, along with Ravi Venkatesan, former chairman of Microsoft India who had joined as the bank’s non-executive chairman, revamped the bank by centralising its processes, strengthening the retail franchise and monetising assets. BoB is among the better capitalised PSBs, and credit ratings agency India Ratings last month affirmed its ‘AAA’ rating on the bank with a stable outlook. “The bank is well-placed to gain market share in the current environment, where many banks and non-banking financial companies are struggling. Also, among the public sector banks, BoB is better placed to raise equity from the capital market,” said Jindal Haria, associate director, India Ratings.

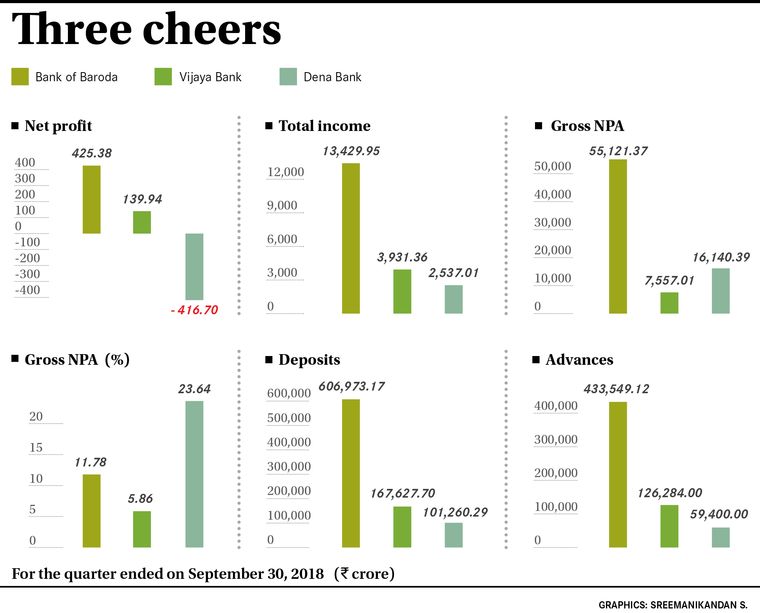

Venkatesan completed his tenure in August 2018, but Jayakumar got a one-year extension. And now he has an even bigger task at hand, that of integrating Vijaya Bank and Dena Bank into BoB. The amalgamation, which will come into effect on April 1, will be the first-ever three-way consolidation of banks in India. It will make BoB the country’s second largest state-owned lender and the third largest bank, ahead of ICICI Bank, and behind State Bank of India and HDFC Bank. The number of PSBs will come down to 19 from the existing 21.

The board of BoB has approved a swap ratio of 402 equity shares of 02 each for every 1,000 shares of Rs10 each of Vijaya Bank and 110 shares for every 1,000 shares of Rs10 each of Dena Bank. The swap ratios favoured BoB, as it implied a discount of 27 per cent to Dena Bank and 6 per cent to Vijaya Bank, based on the closing price of January 2. Dena Bank shares had tumbled 23 per cent since the cabinet cleared the proposal on January 2. Vijaya Bank slipped only 5.3 per cent, while BoB went up 2.3 per cent.

The swap ratio reflected adjustments to net non-performing assets. Dena Bank has been under the Reserve Bank’s prompt corrective action framework.

The government expects that the amalgamated bank will gain scale, and will be better equipped to absorb shocks and meet the credit needs of a growing economy. “The merged entity will have a total business size of Rs15.4 trillion, loan book size of Rs6.6 trillion and branch network of 9,511,” said Rakesh Kumar of Elara Securities.

The merger will help BoB strengthen its presence in the western, southern and north-eastern regions. The number of branches of the combined entity will be the second largest among all banks, and it will have 86,473 employees, said Nitin Aggarwal and Parth Gutka of Motilal Oswal Financial Services.

It may not be, however, smooth sailing. “The challenges of integration of IT systems, employee satisfaction, branch rationalisation and client experiences at the time of merger are issues that are hard to model,” said M.B. Mahesh of ICICI Securities.

The integration of employees is going to be a huge challenge. “It is obvious that if banks are merged, branches will be closed and employees would become surplus,” said C.H. Venkatachalam, general secretary of All India Bank Employees Association. “On the one hand, this will drastically reduce fresh employment at a time when there is a huge need for jobs for educated youth, on the other, it would sharply reduce promotions and growth opportunities of existing employees.”

Finance Minister Arun Jaitley had told the Lok Sabha that there would not be any job losses because of the merger. But Venkatachalam is not convinced. “Technically there may not be any retrenchment, but many specialists will become surplus. Many of them will be transferred once branches are merged or closed. Some middle-aged employees may be offered a voluntary retirement scheme,” he said.

The government had set the ball rolling for PSB mergers two years ago. In 2017, five associate banks and the Bharatiya Mahila Bank were merged with State Bank of India. It happened without any major hiccup, as it was largely involving employees within the group, and the technology and the mother brand were common. But BoB’s case is different. Said Krishnan Sitaraman, senior director, CRISIL Ratings: “A merger of this scale will come with its pros and cons. It gives the merged entity economies of scale, and since the merger involves two relatively stronger banks and a weak bank, the capital requirement comes down slightly. But it needs to be seen how the heads of various departments are accommodated in the merged entity. How the branch rationalisation is carried out will also have to be watched.”

If successful, the merger could set the stage for more consolidation in the banking sector. “The operational stability and profitability of public-sector banks have been largely affected by the ever-rising NPAs and loan defaults,” said Sudish Sharma, executive partner, Lakshmikumaran & Sridharan Attorneys. “Such mergers reflect the government’s focus on strengthening the public banking sector and expanding the geographical reach of banking.”

Despite the cabinet green signal for the merger, there could still be legal hurdles. The Delhi High Court has admitted a petition from All India Bank Officers’ Confederation challenging the merger.