Infrastructure Sector as Enabler for Economic Growth: Infrastructure sector, with its forward and backward linkages to other sectors of the economy, is critical for the economic growth of the nation. The sector being highly labor-intensive leads to significant boost in the employment leading to income generation and spurring domestic demand. The development of infrastructure also leads to operational efficiencies in the economy creating a cycle of higher investments, growth, employment generation and increased demand. The Government is cognizant of the role of infra development to achieve higher economic growth. The National Infrastructure Pipeline and emphasis on the infrastructure sector in Budget 2021-22 is a step in the direction of leveraging infrastructure sector to become a USD 5 trillion economy by 2024-25.

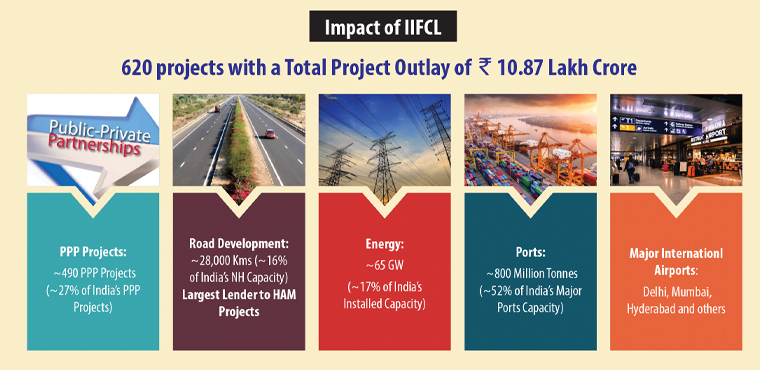

IIFCL’s Role and Impact: IIFCL is a specialist infrastructure financing entity, set up by the Govt. of India in 2006, to provide long-term financial assistance to viable infrastructure projects in India. IIFCL has been playing an instrumental role in the promotion, development and financing of the Infrastructure sector in India.

It is also actively involved in providing inputs and policy support on the infrastructure financing space to the Government through various forums.

On a standalone basis, till March 2021, IIFCL has provided financial assistance to ~ 620 projects with a total project outlay of ~ ₹10.87 Lakh Crore. This includes IIFCL Sanctions and Disbursements of around ₹1.65 Lakh Crore and over ₹83,500 Crore respectively. During FY21, the Company posted record performance with highest ever sanctions and disbursements at ₹20,892 Crore and ₹9,460 Crore, respectively. The company’s Gross NPAs and Net NPAs have reduced to 13.90% and 5.39% (from 19.70% and 9.75% in previous year).

Gearing for the Future:

IIFCL is in the process of bringing in a market-oriented dynamism in all its activities, with an improved credit policy, segmented risk-based pricing, enhanced efforts for recovery, an active treasury management and digitalisation of monitoring of projects for ensuring progress linked disbursements in projects. Aligning itself with the market conditions, IIFCL has reduced its base rate to 7.40% from July 2021, and has put in place a segmented risk-based pricing structure. To strengthen the monitoring and surveillance systems through digitalization, IIFCL is in the process of building an Online Project Monitoring System (OPMS), a first of its kind in India, for real-time project monitoring during construction phase by integrating high end solutions like Drones, AI etc.

Key Achievements in FY 21

13% INCREASE IN CONSOLIDATED CUMULATIVE SANCTIONS FROM ₹1,75,281 CRORE TO ₹1,97,469 CRORE

12% INCREASE IN CONSOLIDATED CUMULATIVE DISBURSEMENTS FROM ₹90,540 CRORE TO ₹1,01,094, CRORE

8% INCREASE IN CONSOLIDATED LOANS TO ₹48,328 CRORE

136% INCREASE IN CONSOLIDATED SANCTIONS FROM FY 20 TO FY 21

74% INCREASE IN CONSOLIDATED DISBURSEMENTS FROM FY 20 TO FY 21

246% INCREASE IN CONSOLIDATED PAT

461% INCREASE IN STANDALONE PAT

₹ 629 Crore HIGHEST EVER RECOVERY FROM NPAS