Two decades ago, sitting next to a burger-chomping carpenter going on a vacation on a low-cost flight in the US, Captain G.R. Gopinath had an epiphany—like the carpenter, why can’t ‘everyone’ fly in India as well? It is the ‘eureka’ moment the aviation pioneer credits to his decision to start India’s first low-cost airline, Air Deccan. The rest is chequered history.

Less known is that it was not his only eureka moment. Just before Air Deccan was born, Gopinath had to take a low-cost flight from London which was not flying from Heathrow, but a less known small airport called Luton. “That’s when I realised that London had six airports and all were international!” he said. Luton, the smallest among them, carried roughly the same number of passengers travelling through all of India’s 40 or so airports at that time.

Fast forward to today, India’s air traffic is hovering close to its pre-pandemic high of 14 crore passengers a year. That may sound impressive when you compare it with the 1.3 crore back in 2002. But it is cold comfort when you compare it with some other statistics. Brazil has a population of 21 crore, but its air passenger numbers just before Covid was 10 crore. Malaysia has a population of three crore, and nearly two crore annual air travellers. Ireland’s population is just half a crore, but it sold four crore flight tickets a year before the pandemic. China, which has a population comparable with India, had a high of nearly 66 crore passengers pre-Covid.

“For aviation to grow, you need to create an ecosystem [beyond] airlines. You need airports,” said Gopinath. “Airlines can’t grow in isolation.”

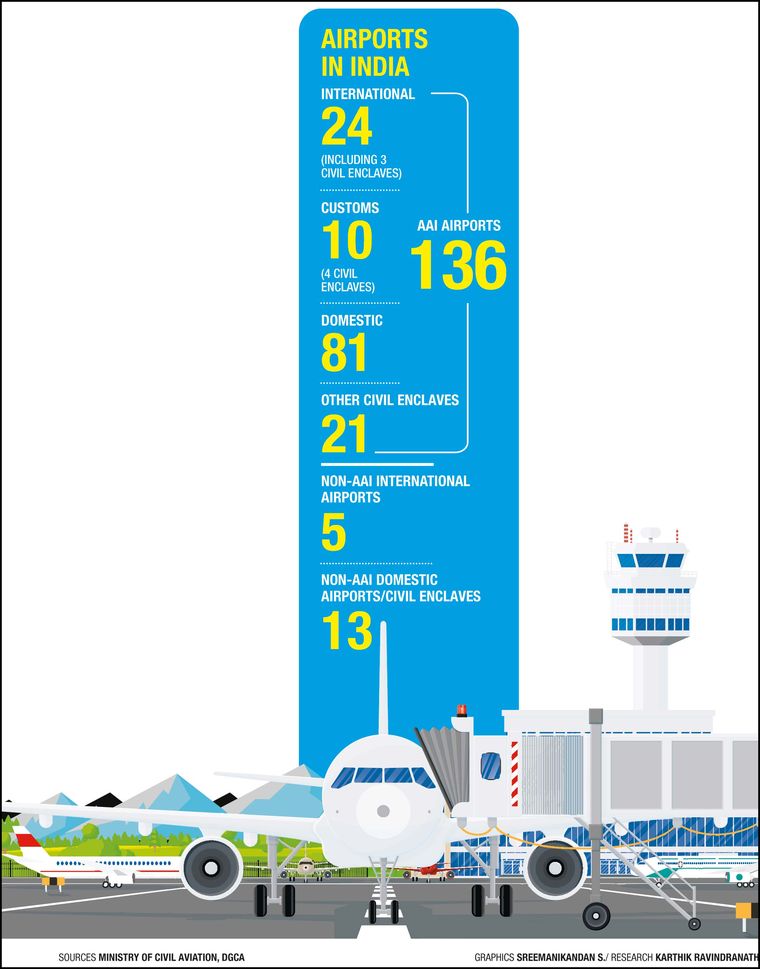

With all the hyperbole of revenge travel and two new airlines being launched, it is easy to forget that aviation infrastructure and reforms have not kept pace. On paper, India has 275 airports, but only about 140 are active as far as commercial traffic is concerned. Most of them can handle only daytime flights.

MRO (maintenance, repair and overhaul) mechanism is next to non-existent in the country, despite repeated incentives in Union budgets over the past few years. Most aircraft operating in India still go abroad for MRO.

“India needs more airports, and fast!” said Sidharath Kapur, former executive director of GMR Airports and CEO of Adani Airports. “Airports Authority of India (AAI) needs to expand. [There needs to be a] clear focus on expansion of infra and privatisation. Most cities are going to need second airports.”

Despite the Modi government’s focus on airports being up there (right next to highways) in the infra capex push, airport expansion has not gained the desired pace. The issue may just be the approach of treating airports as “glass and steel palaces” as Gopinath said, rather than functional transport hubs that can help everyone fly.

“We need to de-glamourise the whole aviation sector when you go to the masses,” said Jagannarayan Padmanabhan, director and practice leader (transport and logistics) at CRISIL. “[The question should be] how do you mainstream travel like any other mode of transport with the right cost structure.”

Steady privatisation of airports might have increased their efficiency, but it has also led to costs shooting up, from user charges to the exorbitant cost at food courts within the terminals. Gopinath feels competition needs to come to airports as well. “Just like you have airlines competing with each other, we need multiple airports to compete with each other,” he said. “Earlier we had a public sector monopoly which was inefficient; now you have a private sector which is efficient, but still a monopoly. We need privatisation, but we don’t need cartelisation.”

Adani Airport Holdings is the biggest private airport operator in the country with seven airports under its wings, including Mumbai’s CSMIA. Adani runs six AAI airports on a 50-year public-private partnership model. Additionally, the group is also building Mumbai’s second airport coming up in Navi Mumbai, which means it will have a monopoly on civilian air traffic in and out of India’s commercial capital.

Similarly, the national capital region is set to have its second airport in Greater Noida, which is being constructed by a consortium of Zurich Airports, Uttar Pradesh government and the Noida Authority. “We are looking forward to developing a world-class airport for the people of India that truly combines Indian hospitality with Swiss efficiency,” said Christoph Schnellmann, CEO, Yamuna International Airport Private Limited, the holding company of Noida airport. Delhi’s Indira Gandhi International Airport is run by the GMR group, which also runs the Rajiv Gandhi International Airport in Hyderabad.

While big city airports are in the process of expansion, the fortune does not extend to all airports and towns. Private operators will go in only to towns where there are profits to be made. It was one of the reasons the next round of AAI airport privatisation has been delayed. While the UDAN scheme has helped in extending connectivity of small towns across the country, it is clear that more needs to be done.

“There has to be a clear focus on the expansion of airport infrastructure and privatisation, and it is already delayed,” said Kapur. “The most critical factor here is land, and state governments have to step in. Land acquisition takes time. For instance, if Chennai needs to expand in seven years time, the acquisition of land needs to happen now.”