SOMEONE SUGGESTED THAT we just look at the map and…” Pieter Elbers makes a motion resembling a dart being thrown, and laughs. “That’s not really how we select a new route to fly to,” he says, the grin firmly in place.

Elbers, CEO of IndiGo, Asia’s biggest airline and eighth largest in the world, is in his element after another round of laughing all the way to the bank―four quarters of profits in a row even as many fellow airlines are floundering or staring at bankruptcy. And the ‘going international’ strategy, which he set in motion a year ago, is now in top gear.

It is this choice of destinations that has the aviation world agog, and the subject of the question to Elbers. After starting the predictable India-Gulf routes a few years ago, the airline dialled up the expansion push by many notches this year with flights to, wait for it, Baku (Azerbaijan), Tbilisi (Georgia), Nairobi (Kenya), Jakarta (Indonesia) and more.

“We establish some market info first, looking into general parameters like GDP and foreign investments. Then we looked at whether Indians want to go to these places, how much of a detour is necessary to get there today and what options they have now,” says Elbers in an interaction with THE WEEK.

Third, he adds, is the entrepreneurial approach of taking a risk with a new route, as much as using the weight of IndiGo’s dominance in the domestic market as an advantage. “A Delhi to Baku flight is actually an India to Baku flight, because we connect so many domestic destinations to Delhi,” he says. “I’m encouraged by what I see in some of these new markets. The appetite of the Indian consumer to explore internationally is just about to start. We’ve only seen the tip of the iceberg.”

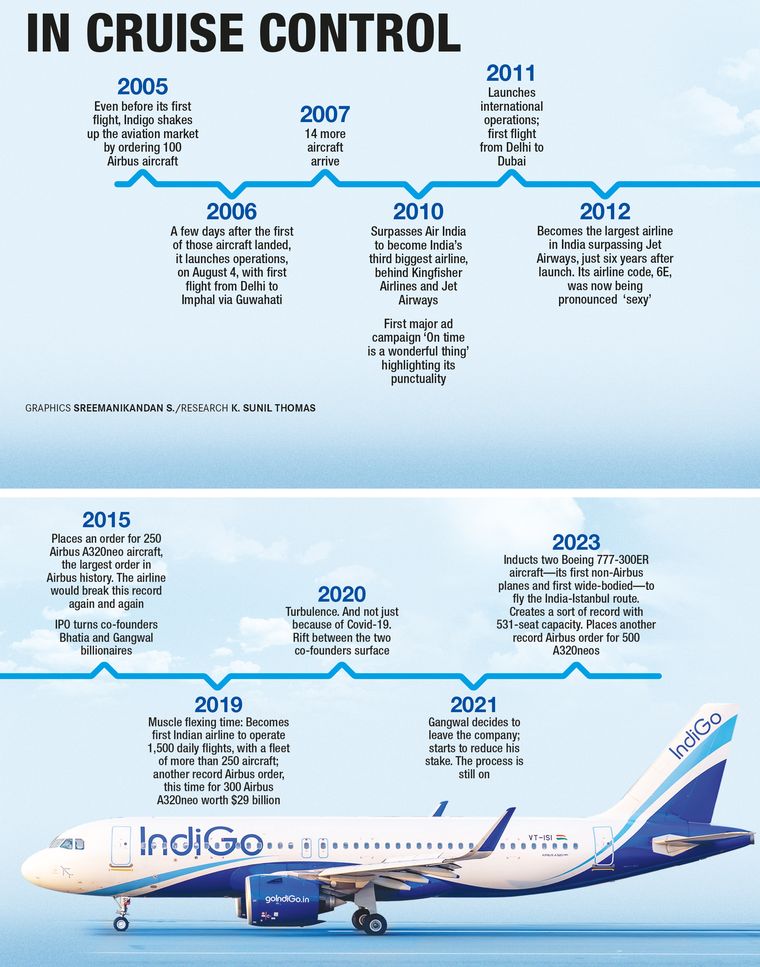

We might have as well seen just the tip of the iceberg as far as IndiGo’s insatiable thirst for market dominance is concerned. Founded in 2006 by travel entrepreneur Rahul Bhatia and Rakesh Gangwal, who was president & CEO of US Airways, the airline quickly captured the nation’s imagination with its lean, mean business model, and leapfrogged established players like Jet Airways and Air India to become India’s biggest in barely six years.

Swiftly adding new destinations in India and the neighbourhood (Gulf and Southeast Asia), the airline had even freaked out the Directorate of Civil Aviation, which warned that such rapid expansion could impact safety. As Kingfisher Airlines, Jet Airways and Go First went belly up over the years, IndiGo steadily increased its market share, which currently stands at a staggering 62.6 per cent, a dominance rarely seen in open aviation markets.

But Bhatia (Gangwal is on his way out, diluting his stake as per an armistice reached between the warring co-founders recently) and Elbers are not content. “Our internationalisation strategy is coming to fruition,” says Elbers. “Traditionally, IndiGo was focused on the Gulf region. We are now stretching our wings.”

While Medina (Saudi Arabia) and Bali (Indonesia) are the next two international destinations to be added, taking up the total number to 14, they are only a small part of a larger strategy. IndiGo already has a code-sharing partnership with Turkish Airlines, which has seen not only Indian passengers being herded to the Istanbul hub for flights to destinations across Europe, but also the biggest international flight from India―the wide-bodied Boeing 777s that can carry 531 passengers.

This larger-than-life approach is what gives a different dimension to IndiGo’s plans. It is not just satisfied with being a domestic market leader or even the biggest international operator from India; its aim is to carve for itself a niche as a global operator by turning India into a global hub, similar to what Emirates has done for Dubai, or Singapore Airlines for the city-state.

“About 65 per cent of the world population lives within the range of our aircraft (from India) today; so we have a lot of opportunity to find new routes and destinations,” says Elbers, pointing out how India’s geographical range is helping it to develop its network. For instance, while its current aircraft can fly from Mumbai to Nairobi, it will need bigger planes to do the same destination from Delhi. The vastness of the country allows the airline to operate different destinations from different cities. And the situation will further improve when the aircraft on order, like the Airbus A321XLR (Extra Long Range), come in.

IndiGo’s intent to take the battle to the global carriers is clear. It is offering India as a new hub opportunity for international travellers between east and west, and herding in the increasing number of Indians who are travelling abroad by offering them direct routes, instead of transits through Doha or Dubai.

“I don’t see why foreign carriers can fly to so many places in India and we remain limited to Delhi and Mumbai,” says Elbers. “We can do it ourselves. If Singapore Airlines can fly to more than 10 destinations in India, why should we limit ourselves in India to only fly from one destination to Singapore? It is India’s time. It is also our time. That is the strategy we set for ourselves one year ago.”

But with all that breakneck expansion spree, IndiGo does foresee trouble ahead, particularly with technical glitches and supply chain issues nagging it since the pandemic. The latest, a powder metal problem with its Pratt & Whitney engines. Along with the earlier issues with the A320neo engines, the number of planes to be grounded is estimated to cross 70 by the new year.

“We have adopted a whole range of mitigating measures―leases extended, inducted new ATRs, and have recently arranged for another 11 damp lease aircraft,” says Elbers. But cost control will remain an issue, as leased aircraft will come with older engines, which means less fuel efficiency, which in turn will squeeze profit margins in a business where margins are even otherwise razor thin.

So far a tightly run ship, IndiGo will be in unfamiliar waters with the global expansion owing to the changes to the format it has operated in so far. The departure of Gangwal, a staunch advocate of the low-cost model that had included using only one type of aircraft for cost optimisation in maintenance and pilot training, might have an effect. Some international routes of IndiGo are rumoured to be loss-making, and the airline is yet to make a decision on having business class service, which rakes in a lot more money, on its newer routes. The planes will have to be reconfigured accordingly if the decision is positive though the buzz has picked up pace over the past few days.

Then, there is, of course, the Tatas. Air India is on a five-year transformation exercise, while the nimble Vistara continues to wow passengers with its service excellence so much that the Tatas are said to be going slow in its merger with Air India. The real threat for IndiGo, however, would be from Air India Express, which Bombay House plans to position as an aggressive low-cost carrier for domestic and nearby international routes. Considering that the Tatas’ have deep pockets and deeper patience, IndiGo would need to keep its domestic flanks protected during its eager push into becoming a global carrier.

Elbers though is cool as cucumber, and he has set his eyes on doubling the size of IndiGo by the end of the decade. “Bigger, better and global―that is what IndiGo is doing,” he says. “Representing the size and potential of India itself.”

Aiming high

IndiGo CEO Pieter Elbers on the carrier’s plans

Business class on IndiGo

We are awaiting our Airbus A321 XLR (Extra Long Range) aircraft order. We are awaiting Airbus to share the final capability. We haven’t decided yet whether to introduce business class (on international flights). We will keep that flexible.

Exact configuration (all economy or a mix of economy class and business class) will have some impact on the range (depending on) whether you have 230 passengers or 190. And we have the flexibility to decide on the exact number of XLRs.

India as a transit hub

Our new international destinations are not only connections in itself, but has even (created) connectivity―we now see people flying from Tbilisi to Delhi and then connecting to Phuket. New traffic flows help us realise the vision of India becoming an aviation hub and not only a big market.

Partnerships

New code-share with BA; same with Qatar Airways, Qantas from earlier. Code-share with Turkish means five cities in the US and 30 destinations in Europe. In India, everyone knows IndiGo; outside India, there is still work to be done. These code-shares will help in that.

Geographical position of India is extremely helpful. Not only are we operating domestic in the largest population on earth and the soon-to-be third largest economy in the world, we are also located with a big market to the north, and a relevant market to the east and west. You can go east, west and north from India itself and we develop our partnerships with exactly this in mind. So BA brings in passengers from the UK, Qantas from Australia and with that we are building our global presence.

Increasing delays

I would love to have 1,900 flights a day all leaving on time. Check our OAG (a provider of digital flight information) data, we are thinking as a very ‘on time performance’ airline domestically.

Udan

Some of the Udan routes are building up to be structural routes. Udan is a temporary scheme. Against that backdrop, it is good for IndiGo to participate in it. Routes are opening and we are participating in it. We have the ambition to fly those routes even when Udan is no longer there.

The typical Indian traveller

India hosts today a huge variety of travellers. So we have people who fly Delhi-Mumbai every week, people who fly all over the country because their factories are all over. But we also have first time travellers―people who used to travel on trains but are now coming onboard. The Udan scheme is helping in that. The Indian consumer is a huge variety. On an average plane of IndiGo, if you ask who is flying for the first time, you see a lot of hands going up. Udan has played a significant part in that.

Flying to Russia and China

I don’t want to speculate. We will monitor the Indian government’s position on this (flying to Russia) before deciding. Today, it’s not in our planning, but we are not ruling out anything going forward.

Regarding China, we have opened our flights to Hong Kong, and, of course, we monitor the situation there closely.

Looking ahead

We will continue our network expansion. We have 85 destinations within India, and we will continue adding new routes.