It took DLF, India’s largest real estate developer, just three days to sell its luxury high-rise residential project, ‘The Arbour’, at Golf Course Extension in Gurugram. Priced around Rs7 crore for a four BHK apartment, they were by no means bargainous; and with 1,137 flats in five towers, the project was not a small one, either. But the developer sold flats worth more than Rs8,000 crore even before the project’s launch.

Its location, of course, worked in its favour. “The area has emerged as an accessible and aspirational location being a natural extension to Golf Course Road, with seamless connectivity to other parts of Gurugram, and Delhi and Faridabad,” said Aakash Ohri, group executive director of DLF.

There had been a limited supply of luxury housing projects in Gurugram in the past few years, and the gap had been widening with the increasing demand for larger homes with facilities like swimming pools, clubhouses, multiple parking and concierge services. There has also been a lot of pent up demand in the market, more so after the pandemic, said Vivek Rathi, director of research at real estate consultants Knight Frank. “Applications for the DLF project received were almost four times the number of flats that were on offer. That highlights that the demand is way ahead of the supply.”

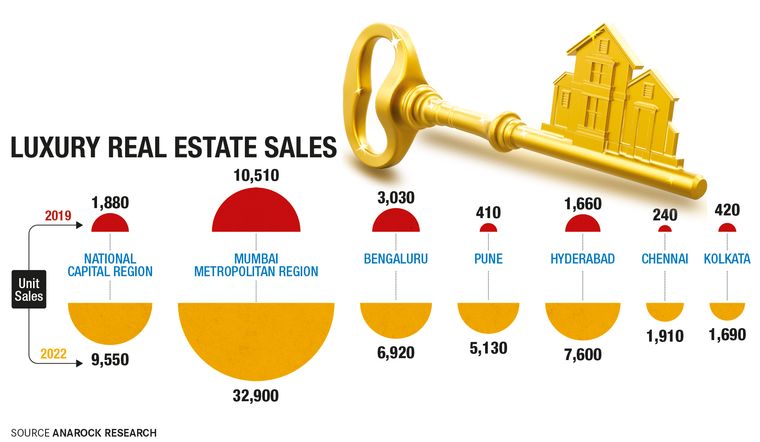

Analysts say the premium real estate market is enjoying a strong economic momentum in most cities; there has been a slew of big-ticket deals in the high-end housing space in Mumbai and Bengaluru. A while ago, retailer Radhakishan Damani’s family and friends bought 28 luxury apartments in the Three Sixty West project in South Mumbai for around Rs1,238 crore. More recently, Niraj Bajaj, chairman of Bajaj Auto, bought a sea-facing triplex apartment worth Rs252 crore in the posh Malabar Hill area in South Mumbai from realty developer Lodha Group; it is said to be the country’s costliest penthouse. Property Deals exceeding Rs50 crore, in fact, happen quite often in the tony neighbourhoods of Bandra and Juhu. In Bengaluru, two properties were recently purchased in the Koramangala area by TVS Group for Rs86 crore, according to real estate consultant Zapkey.

The number of property registrations in Mumbai declined 8 per cent in February 2023 in comparison with a year ago―from 10,379 units to 9,511. However, revenue collections from property registrations crossed Rs1,100 crore, a 79 per cent year-on-year jump from Rs615 crore in February 2022, clearly indicating the rise in the sales of high-end properties, said Anuj Puri, chairman of property consultants Anarock Group.

Mumbai is now ranked 37 (92 in 2022) in the Prime Residential Index that tracks luxury housing prices in top 100 cities in the world. Bengaluru is ranked 63 and Delhi 77. “The value of the area sold in the residential real estate sector is expected to grow 8-12 per cent in FY2023 and a further 14-16 per cent in FY2024,” said Anupama Reddy, vice-president of the credit rating company ICRA. “The shift towards larger spaces, upgrade and preference for home ownership is expected to continue, thereby supporting the demand in the mid and luxury segments.”

One big reason for the recent spike in property deals is the cap on benefits on long-term capital gains (LTCG) deduction announced in the budget this year. Finance minister Nirmala Sitharaman said there would be a Rs10 crore limit for deductions on long-term capital gains tax for reinvestment in residential properties from April 1. Essentially, if one sells a house or any other asset and the capital gains are more than Rs10 crore, then the LTCG benefits that one could avail by investing in a new property would be only up to Rs10 crore and any amount above that will be taxed.

However, it might not be correct to attribute the spike only to the budget. “One of the key reasons we have noted luxury housing is doing well is the strong desire for home ownership across the country post pandemic,” said Rathi. “In this segment, a large chunk of consumers are cash buyers. They have the capital to go out and do the purchase and that becomes an ambition in times like these when Central banks have been reducing money supply and raising interest rates, which directly impacts consumer’s affordability in the lower segments, but not so much in the higher segments.”

Take, for instance, the Bengaluru-based developer Sobha. The contribution of homes in the Rs3 crore plus segment to the total sales has increased to 25 per cent in the nine months of 2022-23 financial year from just 6 per cent a year ago. Jagadish Nangineni, managing director of Sobha, said the company redesigned and launched larger homes to meet the changing demands.

The rich are looking at residential real estate as a favourable avenue for end use as well as as an investment. “In recent years, the real estate market has seen an increase in international investment,” said Ram Raheja, managing director of S. Raheja Realty. “Because of this, high-end developments that meet the desires of wealthy consumers have been created.”

The buyer profile in the segment has also been evolving. In markets like Bengaluru, for instance, IT professionals now account for around half of residential real estate buyers. Viswa Prathap Desu, chief sales officer of the Bengaluru-based developer Brigade Enterprises, said the luxury sector had seen an increase in demand largely because of a shift in customers’ preferences for larger homes with good amenities. “Bengaluru has had an influx of highly skilled professionals with disposable income to pay the premium for luxury homes in the city,” he said.

As the demand for luxury homes is on the rise, new hotspots have emerged for high-end projects all over India, even as the traditional areas, though saturated, continue to see good traction. Wadala in eastern Mumbai, for instance, has seen a few premium projects developed by Macrotech (Lodha) and Ajmera Realty. In the NCR region, the Dwarka Expressway is seeing development of upscale projects. North Bengaluru has also been seeing strong sales growth. “There has been a significant increase in demand for high-end residential properties such as bungalows in affluent urban areas or farmhouses in suburban regions, and vacation homes in the hills and Goa,” said Amit Goyal, CEO, India Sotheby’s International Realty.

Location and proximity to workplaces is a big aspect for luxury home buyers. Wadala, for instance, is not too far away from the business district of Bandra Kurla Complex in Mumbai. North Bengaluru has become attractive because of its proximity to the new international airport, aerospace park and IT hubs.

And the good run may last long this time. “If you look at the high frequency indicators, whether it is credit growth or GST collections, passenger vehicle sales, or the kind of investments being committed in India, all of those are indicative that money is coming in and till that happens, I don’t see a dearth,” said Rathi. According to a luxury outlook survey by Sotheby’s International Realty, 75 per cent of the wealthy believe real estate will do well over the next 2-3 years and 74 per cent of the surveyed high networth individuals (HNI) and ultra HNIs believe real estate is an important asset to hedge against inflation. Typically, real estate bull and bear cycles last 5-7 years and this post pandemic revival in luxury home sales could last a few more years if India clocks a growth rate of around 6.5-7 per cent. However, if there is a deeper economic slowdown or geopolitical tensions escalate, the narrative could change.

While the demand for luxury housing is expected to remain high, Goyal feels availability of the right kind of luxury properties will be a challenge. “We find that in hot vacation markets like north Goa, inventory is hard to come by,” he said. “It is also getting tough to get the right residential property in desirable locations in Delhi. New inventory will get added, but it takes time to build.”