The big takeaway from Union Budget 2022 was that India is set to launch its own digital currency. The proposed ‘digital rupee’, by all means, looks like a silver bullet aimed at slowing the cryptocurrency boom that has gripped Indian investors. It could, however, end up with significant collateral damage—bringing the banking system to its knees, no less.

“Central Bank Digital Currency (CBDC) could cause a shift away from bank deposits,” warned T. Rabi Sankar, deputy governor of the Reserve Bank of India. “Reduced dis-intermediation of banks carries its own risks. If banks begin to lose deposits over time… interest margin might come under stress, leading to an increase in the cost of credit.”

To put it in layman’s terms, a digital rupee that can be sent and received by private citizens through digital wallet apps loaded on their phones and guaranteed by the RBI would reduce the need to keep money in bank accounts or transact through them. If banks have less money in their accounts, they have less money to lend. That means loans would get more expensive, as the interest charged will be higher.

Of course, the real impact of the digital rupee still remains hard to predict, just like the ether on which it will move around in bits and bytes in a gloriously paperless, and uncertain, future. Much will depend on what shape and form it will finally make its debut in, with the RBI looking at various models that could offset the impact on banks.

But the intent is crystal clear. “Introduction of CBDC will give a big boost to digital economy… [and] will also lead to a more efficient and cheaper currency management system,” Finance Minister Nirmala Sitharaman said in her budget speech on February 1, while announcing the introduction of the digital rupee that will use blockchain and “other technologies”.

Though discussed in theory for long, the digital currency gained urgency among Central banks only recently, after they were faced with the potential rise of cryptocurrencies as an alternative to currencies ordained by governments’ fiat. The rollercoaster ride of crypto’s poster boy, Bitcoin, in recent years, along with assorted fellow cryptocurrencies like Ethereum and Dogecoin, captured the world’s imagination.

It also saw the mushrooming of an ecosystem around it, including crypto miners, traders and exchanges, besides celebrity proponents like Elon Musk. And when Facebook announced its intentions of launching its own digital currency, governments realised they had to act, or lose the plot.

In India, cryptocurrencies seem to have broken through the tech ceiling. An October 2021 study by broker comparison platform BrokerChooser claims that there are more than 10 crore crypto users in the country. The government reaction, however, has been mostly cringingly knee-jerk.

While an inter-ministerial committee recommended the introduction of CBDC way back in November 2017, nothing much was done for the next four years. Instead, the authorities made many attempts, though in vain, to stomp out the ‘challenger’. An RBI ban on cryptocurrencies in 2018 was thrown out by the Supreme Court in 2020, while a bill proposing a blanket ban on all forms of cryptocurrency was hurriedly sent back from Parliament for consultations and re-drafting a few months ago after a popular pushback. The RBI has been repeatedly pushing its demand that cryptocurrencies should be banned since then.

Was the budget announcement of a digital rupee, along with hefty taxes on crypto and other ‘digital assets’, another knee-jerk reaction?

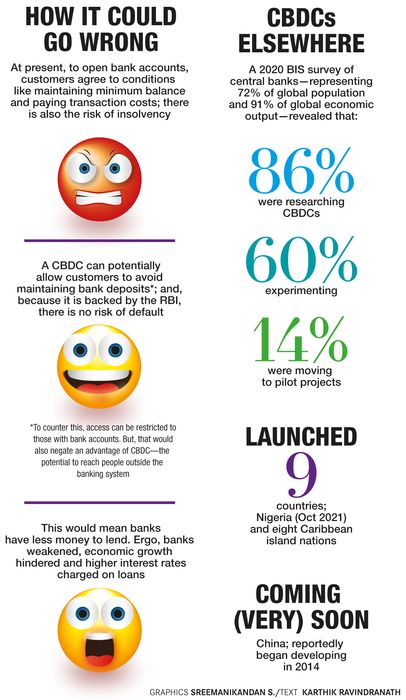

In comparison, a survey by BIS, an international organisation of the world’s central banks, found that 86 per cent of nations were actively researching the potential for CBDCs, 60 per cent were experimenting with the technology and 14 per cent were deploying pilot projects. First off the block are Nigeria and the Bahamas, which have already launched digital versions of their currencies. China is on the verge of launching it, with trial testing in four cities taking place last year.

The digital rupee is officially aiming at an early-2023 launch but is likely to be delayed. From deciding on its underlying technology (blockchain or something else), use cases (on retail private use or for wholesale bank transactions only) and format to trials and testing, all are likely to take time.

“It might get delayed. Other nations have taken four-five years [before] getting digital currency out in the market,” said Sumit Gupta, co-founder & CEO of CoinDCX.

There will also be issues of privacy and security to be figured out. Unlike an anonymous wad of notes, a digital currency will leave a digital trail across transactions. “Needless to say that CBDC design must have robust data governance and data protection frameworks,” argued Shehnaz Ahmed, senior resident fellow at the Vidhi Centre for Legal Policy. “Policymakers will have to balance between safeguarding privacy and oversight for the prevention of financial crimes.”

The risk of cyberattacks, fraud and cheating, particularly in a country with low financial literacy levels like India, is also worrisome. “CBDC ecosystems may be at similar risk for cyber attacks [like] current payment systems,” said Sankar. “Ensuring high standards of cybersecurity is therefore essential.”

But where India has an immense advantage is the way it adopted fintech in recent years, especially its spawning of UPI that has become a runaway hit. This augurs well for the digital rupee.