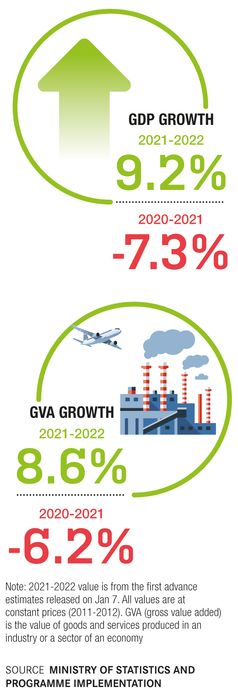

Omicron may be less severe, but has still caused some economic disruption, particularly in the services sector, because of the restrictions imposed in various states. Several economists have recently revised their GDP growth forecasts for the year ending March 2022 to 8.5 per cent to 9 per cent, around 0.5 per cent to 1.0 per cent less than earlier projections.

Therefore, the 2022-2023 Union budget’s thrust area will be boosting economic growth and ensuring that all sectors are ready for a post-pandemic world, while being prepared for future waves. This will require a lot of funding, which is in limited supply. When the pandemic hit in early 2020, GDP growth was already slowing. In 2020-2021, the fiscal deficit was allowed to slip to 9.3 per cent of the GDP to fund stimulus measures. In the 2021-2022 budget, the government targeted a fiscal deficit of 6.8 per cent, much lower than the previous year, but still way above the fiscal glide path of getting it to under 4.5 per cent by 2025-2026.

As private investments are yet to pick up in a big way, the government will have to do the heavy lifting again, but Finance Minister Nirmala Sitharaman will also be expected to take a few more steps towards fiscal consolidation. A comforting factor is that revenue collection has been strong. Between April and November, the revenue collection was Rs13.6 lakh crore, 76 per cent of the budget estimate (against 40 per cent in the same period last year).

The net tax collections stood at Rs11.4 lakh crore (73.5 per cent, compared with 42 per cent last year). The GST collections, too, have been strong at Rs10.7 lakh crore (85 per cent of target). But, this will be offset by higher than expected payouts on food and fertiliser subsidies, health care and rural jobs schemes. Moreover, the Centre is also likely to miss its disinvestment target.

Disinvestment has generated only Rs9,329 crore, so far, against the target of Rs1.75 lakh crore. The government had ambitious plans to take the LIC public, divest stake in Bharat Petroleum, and privatise two public sector banks and a state-run general insurance company, among others. The divestment of BPCL is going to be pushed to next year. The privatisation of two state-owned banks and one general insurer also seems to be delayed.

But, the government is hoping to complete the public issue of LIC stock by the end of March. There is hectic activity, from the bureaucratic corridors of Delhi to investment banking offices in Mumbai, to complete what will be the largest IPO in the country by far. By some estimates, the LIC’s IPO, which is expected to fetch a valuation of Rs1 lakh crore or more, will be the third largest insurance IPO in the world.

However, the insurer is yet to file its draft prospectus with the market regulator SEBI. “I am not sure the IPO will go through by March,” said Madan Sabnavis, chief economist, Bank of Baroda. “Clearance normally takes over two months. So, even if they file the papers by the end of January… it will [have to] be one of the fastest jobs SEBI has done, while being doubly cautious, given the size and scale of the issue.”

Also, as M. Govinda Rao, chief economic adviser, Brickwork Ratings, pointed out, even if the government carried out the divestment of the LIC in the current fiscal year, there would still be a shortfall of close to Rs70,000 crore from the budgeted target. Rao, a member of the Fourteenth Finance Commission, added that as per the nominal GDP estimate (17.6 per cent; first advance estimates), the fiscal deficit works out to be 6.5 per cent.

However, analysts differ on whether the government will be able to meet its fiscal deficit target. Sabnavis and Arun Singh, chief economist, Dun & Bradstreet, felt the fiscal deficit may be around 7-7.1 per cent. “The government has made supplementary demands for Rs3 lakh crore additional expenditure,” said Sabnavis. “So, if this is spent and we fall short of Rs50,000 crore in disinvestment, even if tax revenue increases by Rs1 lakh crore, we could overshoot the target.”The government is expected to peg an even lower target for the next fiscal year. Expectations range from 6-6.5 per cent.

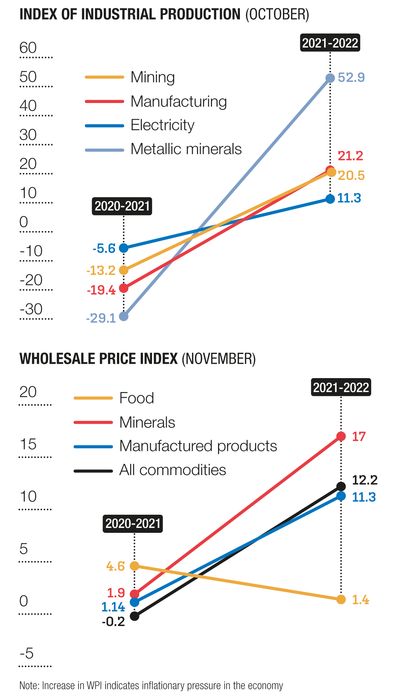

Over the last few years, the Narendra Modi government has emphasised lifting the economy with huge capital expenditure in infrastructure. This is expected to form a big chunk of the budgeted capex this time, too. Defence will also take a big share. At the same time, the government will have to try to boost consumption. Rural consumption has slowed down because of uncertainty over income and a global rise in commodity costs and supply chain disruptions. Singh said there needs to be more money in the hands of the masses through schemes such as NREGA and the PM-Kisan programme.

But, the government’s borrowings are already high. In the next financial year, gross borrowing is expected to be around Rs12 lakh crore (net borrowing: Rs8-9 lakh crore). “The budget faces acute policy trade-offs between nurturing a nascent recovery and diminishing fiscal space with challenging debt dynamics,” said Madhavi Arora, lead economist, Emkay Global Financial Services.

So, in order to reign in the fiscal deficit, where can the government look to cut back? Singh said it may have to look at non-important spending, like some of the subsidies on non-merit goods. Better resource allocation and possible fiscal funding by aggressive asset sales or infrastructure monetisation would also be key, said economists.

In this backdrop, the government is not in a position to increase capex by much, said Sabnavis. “Free food may have to be given; there will have to be more spending on health care,” he said. “Fertiliser subsidies may go up. There will be certain other commitments, too. Therefore, there is not enough scope for a big time rise in capex. Maybe it can go up from Rs5.5 lakh crore to Rs6 lakh crore, but nothing substantially higher than that.”