IT IS A KNOWN fact that while financial freedom remains an elusive goal for most of investors, they miss their goals by a wide margin often due to lack of planning and sometimes discipline. This is where products which automate savings and withdrawal at a time when it is required gain precedence.

Freedom SIP and Freedom SWP (Systematic Withdrawal Plan), both by ICICI Prudential Mutual Fund, are notable products in this regard. Freedom SIP encourages an investor to invest regularly in a disciplined manner via SIP and enjoy the benefits of regular cash flows post completion of SIP period. On the other hand, through Freedom SWP, an investor, say during retirement days, can generate a cash flow stream through withdrawals in a systematic manner.

Freedom SIP

The journey to financial freedom through Freedom SIP comprises of three steps. First, an investor should decide a monthly SIP amount and choose a pre-defined tenure of 8 years, 10 years, 12 years or 15 years. Second, on completion of the SIP tenure, units accumulated are transferred to a pre-selected scheme which is mostly a hybrid fund. This step ensures that the corpus generated over the years is not exposed to undue risk which the equity market presents.

Third, a systematic withdrawal plan is activated after the transfer. If a SIP is registered for eight years, then the monthly SWP installment is 1x monthly SIP Installment. In case of 10, 12 and 15 years, the withdrawal is 1.5x, 2x and 3x respectively. For example: If initial SIP registered for tenure of 12 years is 010,000 per month, then SWP will be 020,000 (2x 010,000). In this manner, a disciplined investor can create a sizeable corpus over the years and meet one’s long-term financial goals comfortably.

Freedom SWP

One has to prepare for retirement during the working years itself. Through Freedom SWP feature, an investor can manage his/her future growing expenses in a very simplified manner. This feature is an innovation over the traditional SWP and helps overcome the shortcomings of traditional SWP.

In case of a traditional SWP, while expenses increase over the years due to inflation, the cash-flow from SWP remains constant, thereby resulting in a huge gap between expenses vs cash flow as the time progresses. However, when it comes to Freedom SWP, the cash flow gradually increases with time to meet one’s increasing expenses.

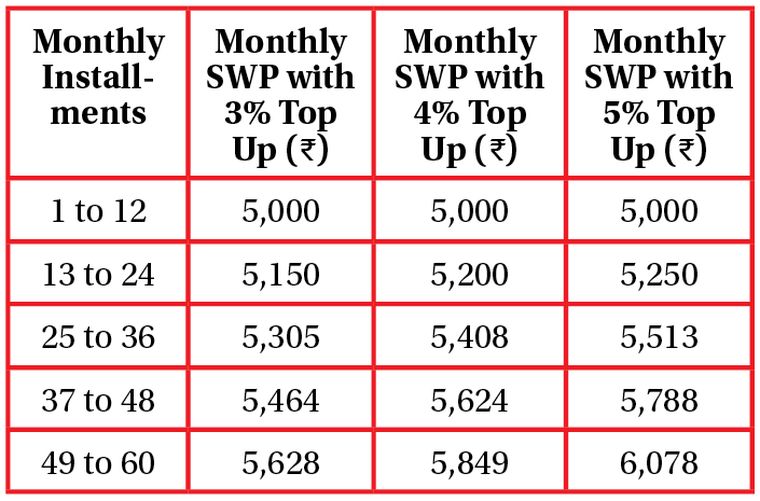

Through this feature, investors can withdraw a fixed amount ie 6 per cent per annum from the investment corpus along with an option of annual top up of either 3 per cent, 4 per cent or 5 per cent. The point to note here is that through this feature, investors can register for monthly withdrawals only. So, how does this feature work?

Under Freedom SWP feature, investors make a lump sum investment into any of the eligible schemes, which are mostly from the hybrid category. These schemes aim to benefit from volatility and manage equity exposure based on valuations. Thereafter, one has to make two choices—top up percentage and SWP start date.

The SWP of 6 per cent per annum will be calculated on the basis of the lump sum invested. Through this arrangement an investor can ensure that he/she can maintain a certain lifestyle in future.

For example: For an initial investment of Rs10 lakh and an initial SWP of 6 per vent per annum, the withdrawals over the next 5 years will be as follows:

To conclude, financial freedom need not be an elusive dream. It can be a reality if one is ready to invest patiently over the longer time frames.

Sivasankar is the chief consultant at Samish Financial Services