On December 14, State Bank of India received Rs38,896 crore from ArcelorMittal-Nippon Steel, an alliance of two of the largest steelmakers in the world that had successfully bid for the insolvent Essar Steel, as part of the resolution plan. SBI, the leader of a bunch of lenders Essar had borrowed money from, would distribute the amount among them. The operational and other creditors would get the remaining Rs3,104 crore of the Rs42,000 crore bid.

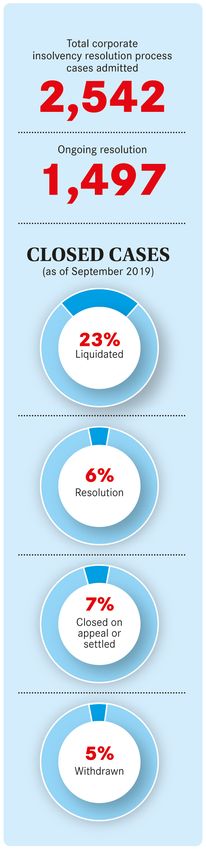

It was the single largest recovery made by lenders under a corporate insolvency resolution process (CIRP), and probably the most emphatic evidence so far of the efficacy of the Insolvency and Bankruptcy Code (IBC) since it came into effect in 2016. Over the past 10 quarters, the number of cases submitted for CIRP has gone up significantly. While there were just 37 in the January-March quarter of 2017, there were 2,542 at the end of the July-September quarter of 2019, according to an analysis by the rating agency CARE.

“The system is evolving, the palpable benefit is the improved credit behaviour and timely recognition of stress while the tangible benefit is the flow back of about Rs1 lakh crore (of stressed debt of Rs2.5 lakh crore) with the resolutions thus far. Litigations have been the unintended consequences. However, the regulatory as well as the court responses have been commendable,” said Mahaveer Shankarlal Jain, associate director at India Ratings and Research.

A study by SBI’s research team says the success rate of companies in terms of closure under pre-2016 regulations varied from 16 per cent to 25 per cent. In contrast, the success rate under IBC is already 41 per cent. “It is among the best resolution outcomes and sends an unambiguous signal to promoters. Before IBC, the average time taken for resolutions was around six years, it has now come down significantly. Also, earlier for every one rupee, the recovery rate was around 25 paise, which has now increased to around 44 paise,” said Ajay Bodke, CEO and chief portfolio manager at broking firm Prabhudas Lilladher.

Despite this, delays caused by various parties going to court remain one of the key challenges of IBC. As of March 2019, the average resolution time for the resolved 94 cases was 324 days, while the stipulated insolvency resolution timeline is 270 days. Of the 1,497 ongoing CIRPs, 36 per cent cases are pending for more than 270 days from the date of admission. “The delays are mostly on account of pending litigations motivated by competing interests and the time taken for deciding disputed claims,” said Charanya Lakshmikumaran, partner, Lakshmikumaran and Sridharan Attorneys.

The Essar Steel case was also taken to the Supreme Court. In a verdict hailed by bankers and lawyers as a landmark judgment, the apex court said that the committee of creditors (CoC) would have a final say in the resolution plans under IBC. “This much awaited judgment settles to rest numerous points of law under the insolvency and bankruptcy code, which were tested in various courts. This should significantly reduce the scope for long drawn litigations under IBC and would eventually lead to faster resolutions of stressed assets,” said Rajnish Kumar, chairman of SBI.

Bankruptcy had always been a messy affair in India, and lenders rarely got their money recovered. With meaningful amendments and encouraging court verdicts, IBC may change that. In November 2019, the government notified fresh rules that would pave the way for insolvency process being initiated against distressed non-banking finance companies and mortgage lenders. In what would be a test case, the RBI on November 29 filed an application for the initiation of insolvency proceedings against mortgage lender Dewan Housing Finance (DHFL). “Until this notification, there were no provisions for resolution and revival of NBFCs acting as financial service providers. Since no resolution and takeover was possible, the alternative banking sector was deteriorating and led to the devaluation of the entire financial sector,” said Lakshmikumaran.

Bodke said the balance sheets of banks were being “repaired” thanks to IBC, and as recoveries happen, provisioning for bad loans would come down, credit costs would fall and profits would increase. In the financial year ended in March 2018, the gross non-performing assets of banks were around Rs10 lakh crore. By the end of June 2019, it went down by around Rs1 lakh crore.

However, as the larger NPAs are getting resolved, analysts now flag risk of NPAs from the small and medium enterprises. “The smaller private banks clearly have a challenge,” said Shibani Kurian, head of equity research at Kotak Mahindra Asset Management. “Because this time around the stress has happened in the mid-corporate segment.”

THE BIG DEALS

Some resolutions under IBC

◆ Essar Steel

Acquired by ArcelorMittal for Rs42,000 crore

◆ Electrosteel Steels

Acquired by Vedanta for Rs5,320 crore

◆ Bhushan Steel

Acquired by Bamnipal Steel for Rs35,200 crore

◆ Monnet Ispat and Energy

Acquired by a consortium of JSW Steel and Aion Investments for around Rs2,875 crore

◆ Bhushan Power and Steel

To be acquired by JSW Steel for around Rs19,700 crore

◆ Jyoti Structures

To be acquired by a group of investors led by Sharad Sanghi for Rs3,695 crore

◆ Alok Industries

To be acquired by Reliance Industries and JM Financial ARC for Rs5,000 crore