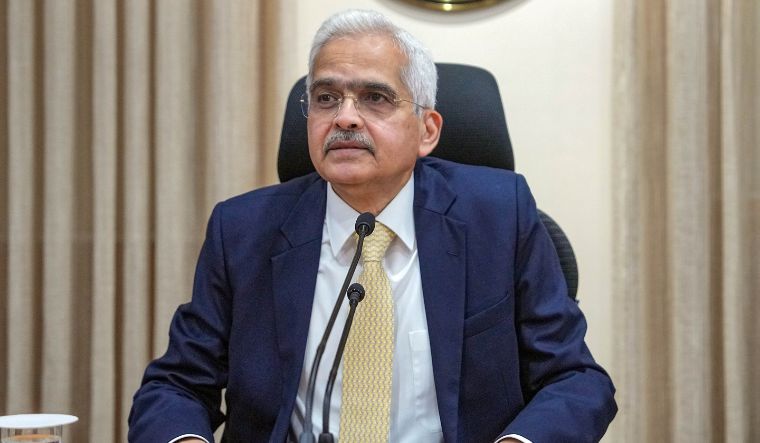

Two years ago the elephant in the room was inflation. The elephant has now gone out for a walk and appears to be returning to the forest. This statement from RBI Governor Shaktikanta Das sends a signal that the central bank's biggest pain point may be healing. With GDP growth remaining robust, there is now policy space to remain focused on reining in inflation closer to its 4 per cent target.

"We would like the elephant to return to the forest and remain there on a durable basis," said Das.

In other words, it is essential, in the best interest of the economy, that CPI inflation continues to moderate and align, and till then the task remains unfinished, he stressed.

The inflation targeting framework has set an inflation target for RBI of 4 per cent, within a tolerance band of plus or minus 2 per cent, while also keeping in mind the growth objective.

The RBI MPC expects India's GDP to grow at 7 per cent in the current financial year ending March 2025. Industrial activity, led by manufacturing, has continued its momentum. Rural demand has been slow for some time now. The MPC noted that rural demand too is catching up and should support economic growth this year. Exports registered double-digit expansion in February. So, on the growth front, there don't seem to be any speed bumps as of now.

On the inflation front, the MPC sees the consumer price index averaging 4.5 per cent in the current financial year. It is expected to average at 4.9 per cent in the April-June quarter, decline to 3.8 per cent in July-September, but then rise to 4.6 per cent and 4.5 per cent in the third and fourth quarters of the year.

But, the inflation forecast considers a normal monsoon season this year. How it actually pans out will have to be watched closely. A lower-than-expected monsoon in 2023, and lower reservoir levels led to volatile food prices. Even as core inflation has come down, food inflation still remains well above comfort levels; it rose to 8.66 per cent in February.

Uncertain or harsh weather conditions could well play a spoilsport over the next few months. The India Meteorological Department has already warned that most parts of the country will see above-normal temperature from April to June this year. For now, the expectation is that monsoon is likely to be good this year, with El Nino conditions set to weaken.

"Frequent and overlapping adverse climate shocks pose key upside risks to the outlook on international and domestic food prices," warned Das.

There is another factor to watch out for. Globally, US Federal Reserve and other major central banks are expected to start cutting interest rates this year. But, in recent weeks, hopes of rate cut as early as June have receded, especially after US consumer inflation unexpectedly rose in February.

In recent days, crude oil prices have spiked again, amid continued geo-political tensions in West Asia. There are risks if things blow up here.

"The continuation of geo-political rifts and supply side risks of the same on commodity prices requires monitoring," said Rajani Sinha, chief economist at CareEdge Ratings.

Most experts back home are penciling in the RBI to cut repo rate from the current 6.50 per cent in the second half of the financial year. Also, the rate cuts aren't likely to be too many, at best 50-100 bps, they feel.

"Given the recent global resilience in economic activity, there has been a tendency to keep monetary policy tight to take on the last mile challenge on inflation by global central banks. The RBI seems to be moving in lock step with that," noted Abheek Barua, chief economist and executive vice-president at HDFC Bank, who feels chances of a rate cut have been pushed into the second half of 2024-25.

As inflation moderates and the Fed starts cutting rates, Sinha expects the RBI going for a "shallow" rate cut of around 50 basis points in two tranches starting from the October-December 2024 quarter.

"Space for rate cut likely has opened up though RBI seems in no hurry to cut rates presently but use its pole position to align inflation structurally to its long term target of 4 per cent. As such, markets may find confidence in projecting rate cuts in later part of the year and interest rates may remain stable with a downward bias," said Mahendra Kumar Jajoo, CIO - Fixed Income, Mirae Asset Investment Managers (India).

Indranil Pan, chief economist at Yes Bank also feels RBI's rate cut cycle will be shallow.

"With an unchanged inflation projection for FY25 at 4.5 per cent, with growth conditions improving and with US Fed also pushing out its rate cut cycle, we think that the RBI might only be in a position to cut rates either in the August policy or even later," said Pan.

Sunil Kumar Sinha, senior director and principal economist at India Ratings and Research, and Paras Jasrai, senior analyst, say RBI's guidance on inflation and its trajectory through this year suggests it will remain cautious and watchful and is unlikely to change the rate or stance anytime soon.

"The macro environment provides the headroom for RBI to stay put on both policy rate and stance in the near term and look at policy rate easing only during the second half of FY25 in the range of 50-75 bps," they said.

Suman Chowdhury, chief economist and head of research at Acuite Ratings and Research, also feels that given the tone of the MPC statement and the expectation of strong domestic growth, there is "low likelihood" of any rate cut by RBI before October this year.

With inflation likely to cool and growth strong, shallow rate cuts likely in the second half of FY25

RBI MPC expects India's GDP to grow at 7 per cent in the current financial year

Join our WhatsApp Channel to get the latest news, exclusives and videos on WhatsApp

read more

-

Who are Mexican drug cartel kingpins 'El Mayo' Zambada and Joaquin Guzman Lopez arrested by US?

-

‘Will protest against discriminatory budget proposals in Niti Aayog meeting', says Mamata confirming attendance

-

'Bride of Dance' review: A dancer's journey

-

India at Paris Olympics 2024: All events today, July 27, Saturday | Hockey, table tennis and more

-

'It is very important to defend the Earth from asteroids': ISRO Chairman Somanath

*Articles appearing as INFOCUS/THE WEEK FOCUS are marketing initiatives