The Reserve Bank of India's monetary policy committee (MPC) expectedly left the repo rate unchanged on Friday. While the decision to maintain a status quo was unanimous, five out of the six members of the MPC also voted in favor of maintaining the "withdrawal of accommodation" stance.

The RBI MPC last raised the benchmark rate at which it lends money to commercial banks in February 2023 by 25 basis points. In all the subsequent MPC meetings since, the repo rate has been left unchanged at 6.50 per cent.

In the 2022-23 financial year, the MPC raised the repo rate by 250 basis points (2.50 per ent), in a bid to bring CPI (consumer price index) inflation under control. In the last couple of months, the retail inflation has declined as has core inflation, which had earlier been sticky. At the same time, economic growth has been resilient.

Retail inflation declined to a five month low of 4.87 per cent in October, bringing it closer to the RBI target of 4 per cent. India's GDP also remained robust, growing at a better-than-expected 7.6 per cent in the July-September quarter.

However, uncertainties around food prices remain. A spike in vegetable prices in the wake of a below normal south west monsoon season and unseasonal rains in a few parts, could well play a spoilsport and push the inflation back higher again. This warrants RBI to be vigilant and therefore maintain a status quo.

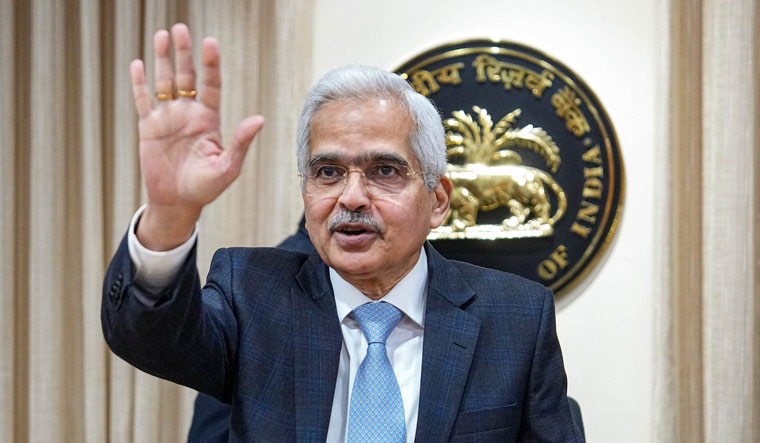

"There has been broad-based easing in core inflation, which is indicative of successful disinflation through monetary policy actions. The near-term outlook, however, is masked by risks to food inflation, which might lead to an inflation uptick in November and December. This needs to be watched for second round effects, if any," said RBI Governor Shaktikanta Das.

While the RBI MPC may have decided to maintain a status quo yet again, it remains "highly alert" and prepared to take actions as warranted, he stressed.

"Monetary policy must continue to be actively disinflationary to ensure fuller transmission and anchoring of inflation expectations," said Das.

The central bank has projected CPI inflation at 5.4 per cent in the current financial year ending March 2024. Inflation in the October-December quarter is expected at 5.6 per cent, declining to 5.2 per cent in the January-March quarter.

In the first three quarters of the next (2024-25) financial year, RBI sees inflation trending at 5.2 per cent, 4.0 per cent and 4.7 per cent respectively.

Das said that the inflation outlook going ahead would be "considerably influenced" by uncertain food prices.

"High frequency food price indicators point to an increase in prices of key vegetables which may push CPI inflation higher in the near-term. The ongoing rabi sowing progress for key crops like wheat, spices and pulses needs to be closely monitored. Elevated global sugar prices is also a matter of concern," he said.

On the growth front, the global economy remains "fragile," warned Das. Easing of inflation in advanced economies has led to expectations of an early end to the monetary tightening cycle, shoring up market sentiments, he noted.

Against an "unsettled global economic backdrop," the Indian economy presents a picture of resilience and momentum, according to Das.

"The fundamentals of the Indian economy remain strong with banks and corporates showing healthier balance sheets; fiscal consolidation on course; external balance remaining eminently manageable; and forex reserves providing cushion against external shocks," he pointed.

India's foreign exchange reserves stood at $604 billion as on December 1, 2023.

In the backdrop of the strong economic growth, the RBI has raised its real GDP growth forecasts for the 2023-24 financial year to 7.0 per cent from earlier projection of 6.5 per cent. It sees the GDP in the December quarter growing at 6.5 per cent and 6.0 per cent in the fourth quarter. In the first three quarters of 2024-25, real GDP is expected to grow at 6.7 per cent, 6.5 per cent and 6.4 per cent respectively.

Private consumption should gain support from gradual improvement in rural demand, strengthening of manufacturing activity and continued buoyancy in services, noted Das. The healthy twin balance sheets of banks and corporates, high capacity utilisation, continuing business optimism and government’s thrust on infrastructure spending should propel private sector capex, he added.

The drag from external demand is also expected to moderate with a turnaround in merchandise and services exports. However, protracted geopolitical turmoil, volatility in global financial markets and growing geo-economic fragmentations pose risks to the growth outlook, said Das.

Economists were keenly watching out for RBI's views on the liquidity front. Here, Das pointed that deficit liquidity conditions persisted in October and November, prompting large recourse by banks to the marginal standing facility (MSF). Due to factors like higher currency "leakage" in the festive season, government cash balances and RBI's market operations, he said the need to undertake auction of OMO (open market operation) sales had not arisen so far.

He also pointed that more recently, as government spending had picked up and system liquidity had got more evenly balanced among market participants, pressures had eased. Going forward government spending was likely to further ease liquidity conditions, he felt.

"The Reserve Bank will remain nimble in liquidity management," said Das.

In a move that is expected to facilitate better fund management by banks, the RBI said it will allow reversal of liquidity facilities under SDF (standing deposit facility) and MSF even during weekends and holidays from December 30. This measure is likely to be reviewed after six months or earlier.

Summing up the policy, Das said India was better prepared to withstand the uncertainties compared to many other countries, but one would have to remain vigilant and ready to act as per evolving outlook.

"We have now reached a stage when every action has to be thought through even more carefully to ensure overall macroeconomic and financial stability; more so, because the conditions ahead could be fickle," he noted.