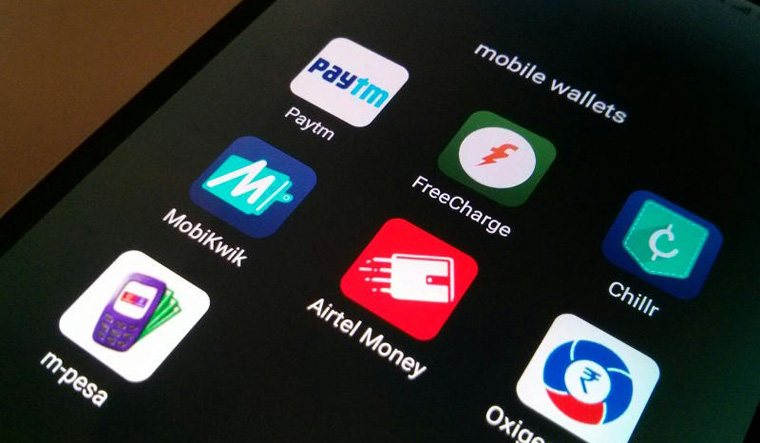

Digital payments in India have surged in recent years, more so since the COVID-19 pandemic hit. The Reserve Bank of India announced various measures on Wednesday, which will give a further boost to the digital fintech ecosystem, including payment banks and prepaid payment instruments.

Prepaid payment instruments (PPI) like mobile wallets and prepaid cards have been used in India, too. The Reserve Bank has proposed to enable payment system operators like PPIs, card networks, white label ATM operators and trade receivable discounting system (TReDS) platforms regulated by the central bank to take direct memberships in centralised payment systems (CPS)—RTGS (real-time gross settlement) and NEFT (national electronic fund transfer).

The membership to these RBI operated CPS was so far limited to banks, with a few exceptions. “This facility is expected to minimise settlement risk in the financial system and enhance the reach of digital financial services to all user segments,” said RBI Governor Shaktikanta Das.

Opening up NEFT and RTGS facilities to digital payment intermediaries is a big move by the RBI and aligned with its policy push for digital payments, said Shilpa Mankar Ahluwalia, partner and head of fintech at Shardul Amarchand Mangaldas and Co.

“Given the exponential growth in digital payments, dominated by the UPI infrastructure, this move will allow better product innovation and integration,” added Ahluwalia.

Furthermore, the RBI has also proposed to make interoperability mandatory for full-KYC PPIs and for all payment acceptance infrastructure. Guidelines for adoption of interoperability on a voluntary basis for full-KYC PPIs were issued back in October 2018. However, according to the central bank, the migration towards interoperability has not been significant and therefore, the proposal to make it mandatory.

“To incentivise the migration of PPIs to full-KYC, it is proposed to increase the current limit on outstanding balance in such PPIs from Rs 1 lakh to Rs 2 lakh,” said Das.

As per the earlier guidelines on interoperability, where PPIs are issued in the form of wallets, interoperability across PPIs shall be enabled through unified payments interface (UPI). Card networks are allowed to onboard PPI issuers to join their network. Non-bank PPI issuers can also issue interoperable cards in association with card networks.

Additionally, in a bid to bring uniformity across PPI issuers, the central bank on Wednesday proposed to allow cash withdrawals for full-KYC PPIs of even non-bank PPI issuers.

“This measure, in conjunction with the mandate for interoperability, will boost migration to full-KYC PPIs and would also complement the acceptance infrastructure in tier III to VI centres,” the governor added.

also read

- Kotak Bank's growth plans to take a hit post RBI restrictions on digital channels; shares plunge 11 pc

- RBI bars Kotak Mahindra Bank from onboarding customers online, issuing fresh credit cards

- Extreme weather may pose risk to inflation, says RBI Bulletin

- Normal monsoon predicted for 2024. Is it enough to bring down inflation?

Meanwhile, payment banks can also now hold a maximum balance of Rs 2 lakh per customer from Rs 1 lakh earlier. The central bank issued guidelines for licensing of payment banks back in November, 2014. In principle approval was given to payment banks in 2015. Paytm, Airtel, India Post and Fino Payments Bank are some of the leading players in this segment.

This is the first time that the maximum balance requirement has been revised, a move RBI feels will further drive financial inclusion.

“Based on a review of performance of payments banks and with a view to encourage their efforts for financial inclusion and to expand their ability to cater to the needs of their customers, including MSMEs, small traders and merchants, it has been decided to enhance the limit of maximum balance at end of the day from Rs 1 lakh to Rs 2 lakh per individual customer,” RBI said.

The enhanced limit aligns with the customers needs and gives them the flexibility to park more money in the savings account, said Rishi Gupta, MD and CEO of Fino Payments Bank. “The raise in limit also enhances the cause of financial inclusion and in the long run will benefit payments bank model with incremental revenue expected from increased deposit base,” he added.