The Reserve Bank of India, in-line with market expectations, left interest rates unchanged and also continued with its accommodative stance, at least during the current financial year and into the next financial year, as retail inflation has come down to comfortable levels, while at the same time focusing on the need to lift the economy hit by the COVID-19 pandemic.

The status quo decision means the benchmark repo rate remains at 4 per cent. Consequently, the reverse repo rate will remain at 3.35 per cent and the marginal standing facility rate and bank rate at 4.25 per cent. Since February 2020, the RBI has reduced the repo rate by 115 basis points, this was on top of the 135 bps reduction in 2019.

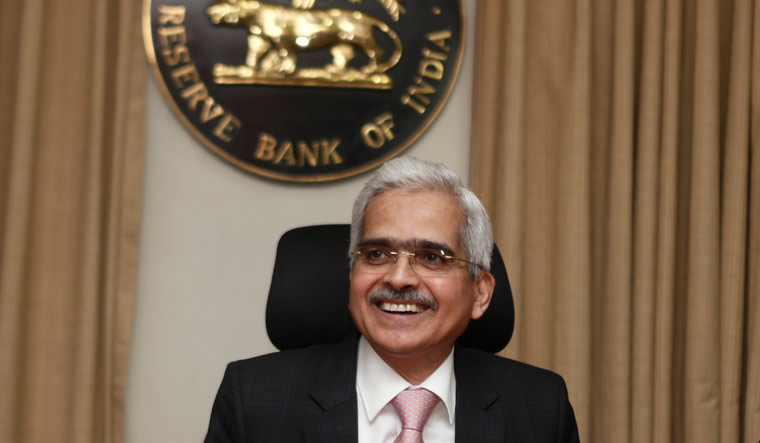

“Given that inflation has returned within the tolerance band, the MPC (monetary policy committee) judged that the need of the hour is to continue to support growth, assuage the impact of COVID-19 and return the economy to a higher growth trajectory,” said Shaktikanta Das, Governor, RBI.

RBI’s objective is to achieve a medium-term consumer price index (CPI) inflation target of 4 per cent within a band of 2 per cent to 6 per cent, while supporting growth.

After trending higher than the comfort level for some time, retail inflation in December declined to 4.59 per cent. The central bank expects inflation in the current January-March quarter to be around 5.2 per cent, and sees it in the 5.2 per cent to 5.0 per cent range in the first half of the next financial year. It has also projected inflation at 4.3 per cent for the third quarter of 2021-22.

At the same time, the central bank is hopeful of the economic growth picking up next year and expects the GDP to grow 10.5 per cent in the year ending March 2022.

“The outlook on growth has improved significantly with positive growth impulses becoming more broad-based and the rollout of the vaccination programme in the country auguring well for the end of the pandemic,” Das said.

In the Union budget on February 1, Finance Minister Nirmala Sitharaman focused on boosting spending on capital expenditure, healthcare and infrastructure, even if that meant a much higher-than-expected fiscal deficit this year as well as the next.

Even as the rates were left unchanged, the Reserve Bank MPC has signalled that it will gradually normalise the excess liquidity in the system (restoring the cash reserve ratio, for instance), now that the GDP growth is expected to rebound and the government will be doing much of the heavy lifting to drive economic growth.

Last year, amid the disruption caused by COVID-19, the CRR of all banks was reduced by 100 basis points to 3 per cent. CRR is the amount of cash that banks have to maintain with RBI. It will be restored in phases; banks will now be required to maintain a CRR of 3.5 per cent from the reporting fortnight beginning March 27 and 4 per cent effective from fortnight beginning May 22, 2021.

“Though there were no major immediate announcements on liquidity reversal, increasing the CRR to 4 per cent in phases indicates the beginning of reining in liquidity measures, announced during the lockdown. We expect RBI to continue with its current policy stance for first quarter of FY22 and may gradually start withdrawal of liquidity to rein in surplus liquidity,” said M. Govinda Rao, chief economic advisor, Brickwork Ratings and member of the fourteenth finance commission.

The MPC in its outlook has warned broad-based escalation in cost-push pressures in services and manufacturing prices due to increase in industrial raw material prices could impart upward inflationary pressure.

So, while the general feeling is that the RBI may continue to stay accommodative for some more time, rate cuts, if any, will depend on how the inflation trends.

“Today’s upbeat policy statements on growth and inflation restates our view that the rate cut cycle is over. Even as headline inflation trends lower, with economic recovery being underway, services gradually starting to open up, and pricing power coming back in some segments, core inflation will likely see some upside pressure through the year,” said Suvodeep Rakshit, vice-president and senior economist at Kotak Institutional Equities.

Anagha Deodhar, chief economist at ICICI Securities, on the other hand, expects “inflation to ease further in coming months, possibly opening up room for rate cuts.”

"We see policy rates on status quo in FY22. The liquidity stance is unlikely to diverge from the accommodative policy stance in the near term," said Madhavi Arora, lead economist at Emkay Global Financial Services.

Meanwhile, the RBI’s announcement to also include NBFCs in its targeted long-term repo operations has been welcomed by market experts.

“Given that NBFCs are well recognised conduits for reaching out last mile credit and act as a force multiplier in expanding credit to various sectors, it is now proposed to provide funds from banks under the TLTRO on tap scheme to NBFCs for incremental lending to these sectors,” RBI said.

This will give a much needed fillip to the NBFC sector, after it had been reeling from a liquidity crunch since the IL&FS default in 2018, which was exacerbated by the pandemic, said Tirthankar Datta, partner, J. Sagar Associates.

“The TLTRO on tap scheme to NBFCs for incremental lending will usher in effective liquidity for NBFCs. The positive impact is that it would enhance the NBFCs’ ability to provide a credit lifeline to capital-starved MSMEs (micro, small and medium enterprises),” said Shachindra Nath, executive chairman and MD of U Gro Capital.