Digital payments have surged in India in the last few years, and the key architect behind this has been unified payments interface (UPI), a home grown real-time payment system developed by the National Payments Corporation of India.

UPI payments crossed a milestone in October, with the number of transactions touching 2.07 billion, and total transaction value at Rs 3.86 trillion.

Google Pay and PhonePe have been the leaders in the UPI payments ecosystem, followed by others like Paytm and Mobikwik. Last month, PhonePe beat Google Pay to become the largest UPI player with a market share of 40 per cent.

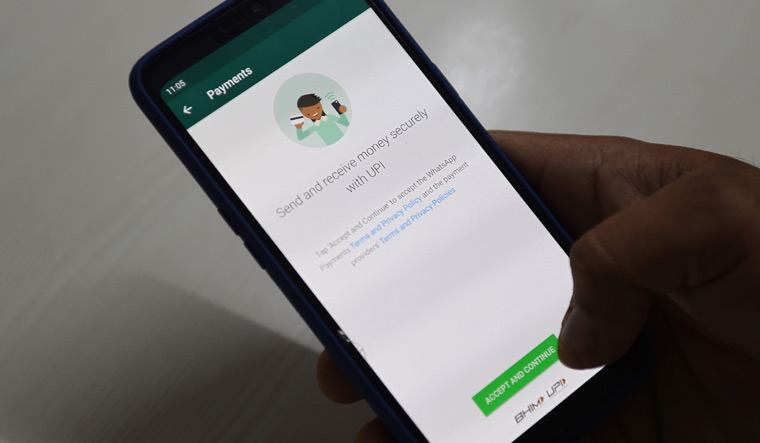

But, now, a formidable new entrant in WhatsApp could shake up the UPI ecosystem.

Facebook-owned WhatsApp has over 400 million users in India and the messaging app was given the go-ahead by NPCI late on Thursday to launch payments services in a graded manner.

“NPCI has given approval for WhatsApp to ‘go live’ on UPI in the multi-bank model. WhatsApp can expand its UPI user base in a graded manner starting with a maximum registered user base of 20 million in UPI,” it had said.

WhatsApp is the most widely used messaging service in the country. So, it's a matter of time that payments over WhatsApp will also catch up.

Facebook CEO Mark Zuckerberg said in a video message that sending money through WhatsApp to friends and family would be as easy as sending a message.

“There is no fee and its supported by more than 140 banks. And, because its WhatsApp, you know its secure and private too,” he said.

Payment is available in 10 Indian regional language versions of WhatsApp.

To send money over WhatsApp, you will need a debit card with a bank that supports UPI.

To enable payment, WhatsApp sends regulations to banks, known as payment service providers. These payment service providers start the process of transferring money through UPI between the bank accounts of the sender and the recipient.

Once the payments are set up on WhatsApp, it will be possible to send and receive money from any UPI app, the company said. Users have to enter their UPI PIN for each payment.

This service will be available in India on the latest version of WhatsApp for iPhone as well as Android smartphones.

How do you set up WhatsApp payments?

Tap on settings, then payments and then add new account.

Accept the payments terms and privacy policy.

You will then see a list of banks, from which you can select your bank.

Verify via SMS.

Once the process is complete, a user can then complete setting up payments.

You will also need to verify the last six digits of the debit card number and the expiry date to send money.

Making payments

Go to the chat box of the person you want to transfer the money to. Then click on the attach button and go to payments option and add the money you want to send to the person. You will have to enter the UPI pin number to complete the transaction.

WhatsApp has partnered with leading banks including ICICI Bank, HDFC Bank, State Bank of India, and Axis Bank for the service.

NPCI cap on volumes

On Thursday, NPCI issued a cap of 30 per cent of total volume of transactions processed in UPI, applicable on all third party app providers.

This move will be effective from January 1, 2021 and the existing third party app providers who are exceeding the specified cap, will have a period of two years from January 2021 to comply with the same in a phased manner, NPCI said.

The cap of 30 per cent will be calculated on basis of the total volume of transactions processed in UPI during the preceding three months on a rolling basis. NPCI said the move “will help to address the risks and protect the UPI ecosystem as it further scales up”.

This is likely to affect larger players like Google Pay and PhonePe, while presenting opportunities for other smaller players to scale up.