The rise in populist politics in India as it battles the world's third-highest number of coronavirus cases is posing a key risk for companies whose fortunes are closely tied to the economy, said a report by JPMorgan Chase & Co. "Rising populism could impact market valuations, at least in part due to protectionist trade and foreign direct investment policies inhibiting growth," analysts led by James R. Sullivan in Singapore, wrote in a note, reported Bloomberg.

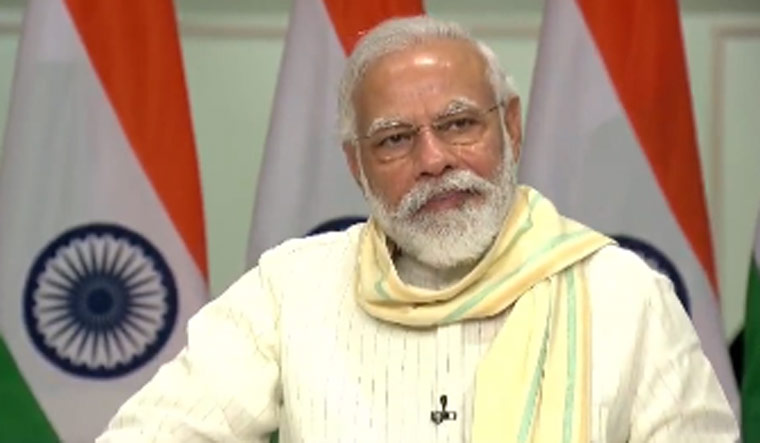

The report comes in the backdrop of India tightening its FDI rules, especially for China and other neighbouring countries, in the aftermath of the Galwan Valley clash. Soon after the pandemic struck, Prime Minister Narendra Modi gave the call for 'Atma Nirbhar Bharat', or self-reliant India, in an attempt to instill confidence and optimism among Indians bogged down by the COVID-induced economic strain.

However, the Central government soon followed with the "vocal for local" call with a ban on Chinese apps and increased scrutiny on companies with Chinese investors, amid the rising friction between Beijing and New Delhi.

The JPMorgan report, without naming the Indian policies, opines that "populism is a justifiable concern for investors." "Populism is linked with weaker economic growth in the long-term, which could weigh on India's rich equity valuations," the note said.

In addition, the devastation from the pandemic is fostering conditions in which populist rhetoric thrives, while the falling share of income going to the lower and middle-income groups will likely worsen this trend, the analysts said in the note.

The report added that Thailand and the Philippines are among other Asian economies facing a greater risk of populist policies. "We advise minimal or reducing exposure to sectors linked to growth and investment cyclicals like financials, materials and energy, except Reliance Industries," Sullivan said. The analysts recommend focusing on consumer, services and healthcare-oriented companies instead.

Interestingly, more than a year ago, former RBI governor Raghuram Rajan had also warned about the economic fallout of populist policies. "Populism done right can make capitalism work better for people, but that’s not always the outcome. They can go the right way, which is create more competition, more opportunity for people, prevent the closing of economies into crony capitalism. They can also go the wrong way, that is, elect strong leaders who promise they will curtail markets, create a nirvana for the people. That is the road to serfdom. We need populist movements to work the right way, which they’ve done in the past,” he had said.