On November 19, when the Reserve Bank board meets, the central bank and government could well be finding some common ground. The ball for the Monday meeting with all 21 board members of the RBI, would be set rolling over Friday and Saturday, prior to a meeting of the full board.

On Friday, government-nominated board members of RBI, financial services secretary Rajiv Kumar, economic affairs secretary Subhash Chandra Garg, Swadeshi Jagaran Manch convenor S. Gurumurthy, economist Ashok Gulati and RBI officials from Delhi met at North Block.

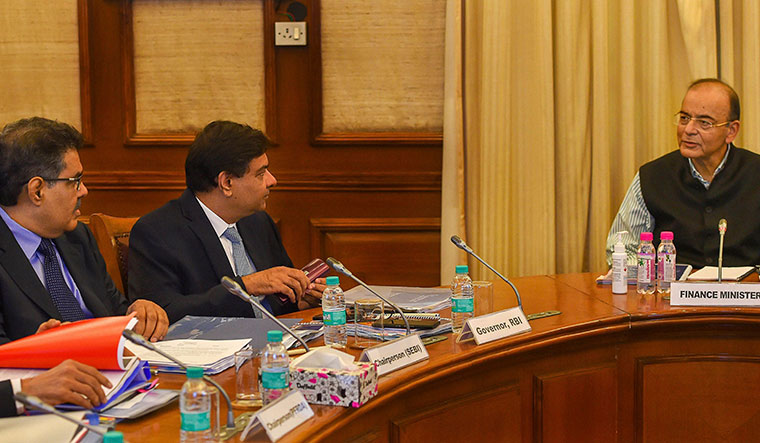

The closed-door meeting went on for more than three hours at finance minister Arun Jaitley's chamber. Officials from other departments were also called to make their presentations in this meeting with RBI board members and officials.

"So far nothing can be said, but it seems that some common ground could be reached on the subject of providing additional liquidity to the micro, small and medium enterprise sector," said Garg, speaking to reporters during a break from the meeting.

According to him, at the board meeting, Urjit Patel, RBI governor is likely to announce a decision to ease liquidity for the sector. The government is aiming to launch a big ticket scheme for the MSME sector, whom it believes to have suffered the most after demonetisation and the introduction of GST.

Among other issues which remain pain points for both the RBI and government are issues like the contentious economic capital framework's acceptance by the RBI governor, plans to provide capital adequacy to banks and relaxation of Prompt Corrective Action (PCA) norms.

Garg and other finance ministry officials refused to comment on the resolution of these issues. "Nothing could be said at this moment," said Rajiv Kumar, financial affairs secretary, indicating that any final solution to these issues is yet to be reached.

The RBI's Board for Financial Stability (BFS), a sub-committee of the RBI board that looks at funding issues of banks, financial institutions, and non-banking financial institutions, also met on Friday at North Block, ahead of the board meeting.

"The issue on the table was the liquidity crisis being faced by some of the NBFCs. We were assured by the RBI deputy governor (N.S. Vishwanathan) that the crisis is being addressed and the situation is improving steadily," said Kumar after attending the meeting on Friday.

Finance Minister Arun Jaitley also attended the meeting but left mid-way to attend a function organised by the Press Council of India. Before leaving, the finance minister was learned to have expressed satisfaction at the steps taken by RBI to diffuse the liquidity crisis being faced by NBFCs.

Sources in the finance ministry said that the present crisis between the RBI and government had not impacted investment ratings of India adversely. Earlier, an internal report of the ministry had cast apprehensions that the ongoing tiff would impact India's ratings.

However, on Friday, global rating agency Fitch Ratings maintained its investment grade ratings for Indian sovereign bonds at BBB-. The rating agency also said that the NBFC crisis could delay the bank's NPA cleanup operation embarked upon by the RBI. All eyes would now be on the Monday meeting of the RBI board.