Press Release

NFO Period: May 6, 2025 – May 20, 2025

Highlights:

The scheme seeks to tap into the long-term growth opportunities by investing in businesses with higher ROE and ROIC, lower financial leverage, sound net cash balances, and efficient capital allocation - all while ensuring investments are made at reasonable valuations

The scheme will adopt a flexible investment approach across market capitalizations and sectors, following a blend of top-down and bottom-up strategies

The scheme offers investors an opportunity to power their portfolios with quality picks at a time when valuations are reasonable, aiming for long-term wealth creation

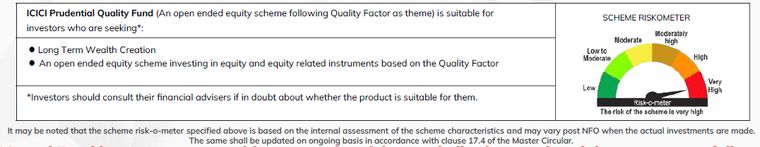

Mumbai, May 02, 2025: ICICI Prudential Mutual Fund has announced the launch of the ICICI Prudential Quality Fund, an open-ended equity scheme following the Quality Factor as theme. This New Fund Offer (NFO) opens on May 6, 2025 and closes on May 20, 2025.

The scheme aims to invest in companies that exhibit stronger fundamentals such as high return on equity (ROE), robust cash flows, low financial leverage, and a history of sound capital allocation. These factors, combined with a reasonable valuation approach, can form the backbone of the scheme’s stock selection strategy.

Speaking on the scheme launch, Mr. Sankaran Naren, ED & CIO of ICICI Prudential AMC, said, “In today’s environment of economic uncertainty and moderating growth, business with sound financials and sustainable profitability stand out. ICICI Prudential Quality Fund aims to tap into this potential by selecting high quality* companies available at reasonable valuations, thereby aiming to build a resilient portfolio designed to perform across market cycles. With attractive valuations in the quality segment, we believe this is an opportune time for investors to adopt a quality-focused strategy.”

Why Invest in Quality Now?

Amid growing global economic uncertainties, including geopolitical tensions, elevated interest burdens, and a moderating domestic earnings cycle, the AMC believes that quality stocks can weather the storm. These companies generally outperform in periods of volatility due to their sound balance sheets and growth records.

While the quality theme had underperformed broader markets and other styles like momentum, value and alpha in recent years, this has resulted in more attractive entry valuations today.

*The word quality has to be understood in line with the Investment Strategy of the Scheme.

Data as on March 31,2025. Returns are on absolute basis Past performance may or may not be sustained in the future. FY: Financial Year. For Quality: Nifty 200 Quality 30 TRI, for Value: Nifty 200 Value 30 TRI, for Momentum: Nifty 200 Momentum 30 TRI, for Alpha: Nifty 200 Alpha 30 TRI and for Broader Market: Nifty 200 TRI is used

Flexible & Research-Driven Approach

The ICICI Prudential Quality Fund will follow a flexible investment strategy, drawing from both top-down (macro and sector-level) and bottom-up (company-specific) research. It will help maintain the flexibility to invest across sectors and market caps.

The asset allocation and investment strategy will be as per Scheme Information Document

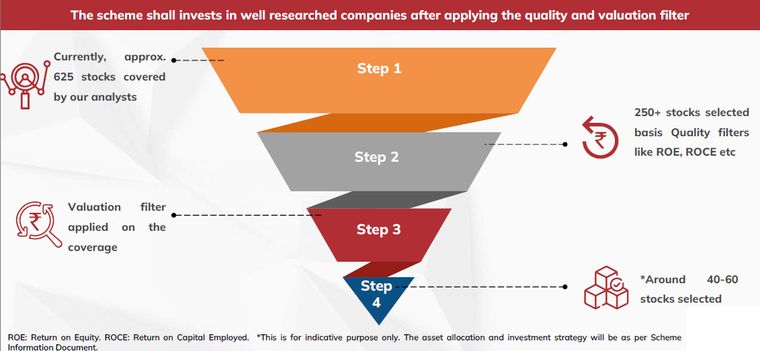

The fund's portfolio construction process involves narrowing down a universe of approx 625 companies to around 40–60 names, based on stringent quality and valuation filters.

Performance of Quality Strategy

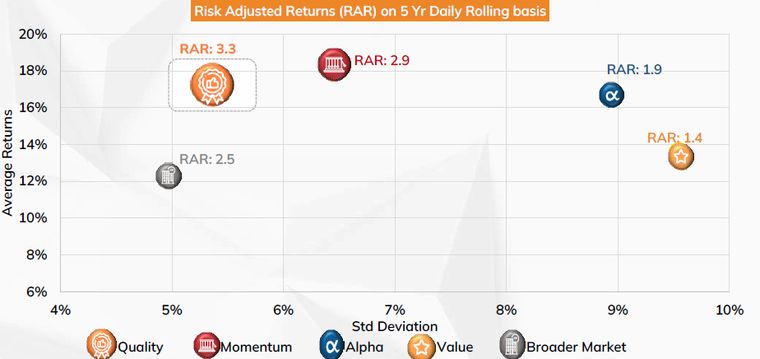

Historical data shows that the quality style has demonstrated good risk-adjusted returns and greater return predictability compared to value, momentum, and alpha strategies:

On a 5-year daily rolling return basis, the quality strategy delivered an average return of 17.4% with the risk-adjusted return ratio (RAR) of 3.3

Source: NSE Indices Ltd. Data as on March 31, 2025. The Investment Period is considered from April 2005 to April 2020. Returns are considered from April 2010 to March 2025. Past performance may or may not be sustained in the future. RAR: Risk Adjusted Returns. For Quality: Nifty 200 Quality 30 TRI, for Value: Nifty 200 Value 30 TRI, for Momentum: Nifty 200 Momentum 30 TRI, for Alpha: Nifty 200 Alpha 30 TRI and for Broader Market: Nifty 200 TRI is used.

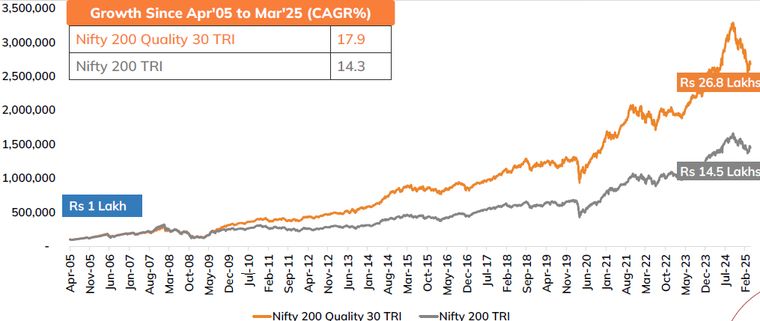

Since April 2005, an investment of ₹1 lakh in the quality index would have grown to ₹26.8 lakh, compared to ₹14.5 lakh for the broader Nifty 200 TRI.

Source: NSE Indices Ltd. Data as on March 31,2025. Past performance may or may not be sustained in the future. For indices TRI value is used

Scheme Details:

Fund Managers: Ihab Dalwai & Masoomi Jhurmarvala

Benchmark: Nifty 200 Quality 30 TRI

Exit Load: 1% if redeemed within 12 months of allotment, nil thereafter

Plans: Regular & Direct; Options: Growth & IDCW

SIP / SWP / STP: Available

For media queries, please contact:

Adil Bakhshi

Principal PR & Corporate Communication

Email: PR@icicipruamc.com

Phone: 91-22-66470274

Riskometer & Disclaimers:

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

All figures and other data given in this document are dated. The same may or may not be relevant at a future date. The AMC takes no responsibility of updating any data/information in this material from time to time. The information shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Prudential Asset Management Company Limited. Prospective investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICI Prudential Mutual Fund.

Disclaimer: In the preparation of the material contained in this document, ICICI Prudential Asset Management Company Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Some of the material used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other coun- tries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. ICICI Prudential Asset Management Company Limited (including its affiliates), the Mutual Fund, The Trust and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Further, the information contained herein should not be construed as forecast or promise. The recipient alone shall be fully responsible/are liable for any decision taken on this material